Metaplanet just added ¥500 million worth of Bitcoin to its holdings.

Key Takeaways

- Metaplanet now holds 360.368 BTC after recent purchase.

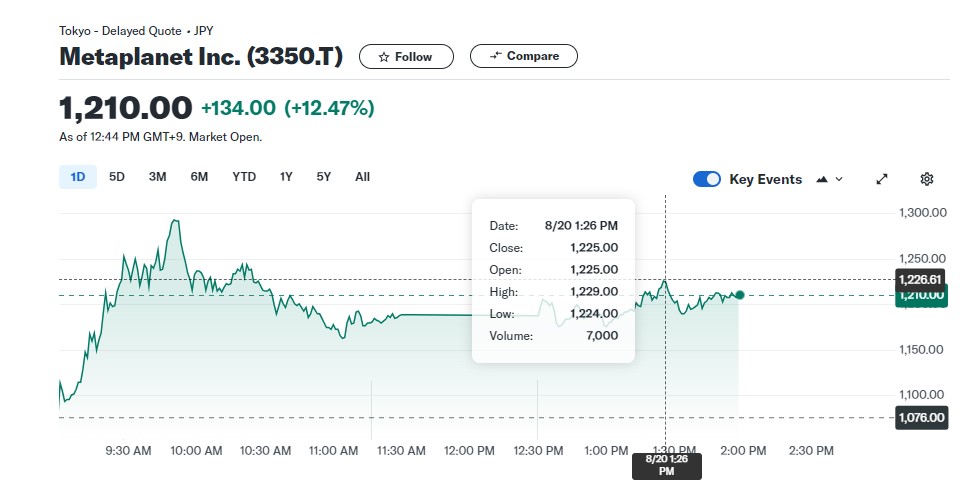

- The firm's stock increased by 14% post-announcement.

Shares of Metaplanet, a Japanese public company known for adopting Bitcoin as its primary treasury reserve asset, surged 14% after the company announced it completed its ¥1 billion Bitcoin (BTC) acquisition, according to data from Yahoo Finance.

According to a statement shared by Simon Gerovich, CEO of Metaplanet, the firm purchased 57.273 BTC, valued at ¥500 million (approximately $3.4 million) on August 20. The new purchase boosts Metaplanet’s holdings to 360.368 BTC.

The acquisition is part of Metaplanet’s strategy to expand its BTC reserves using a ¥1 billion loan from MMXX Ventures. The move came after a ¥500 million purchase last week.

“As disclosed in our announcement dated August 8, 2024, regarding the loan and purchase of Bitcoins worth 1 billion yen, we hereby announce that we have purchased additional 500 million yen worth of Bitcoins as below. With this purchase, we have completed the purchase of 1 billion yen worth of Bitcoins,” the statement read.

Originally involved in hotel development and operations, Metaplanet has diversified its business to include consulting services in Bitcoin adoption, real estate development, and investments.

The company, listed on the Tokyo Stock Exchange under the ticker 3350, has seen its stock grow since announcing its focus on Bitcoin as a principal treasury reserve asset in response to Japan’s economic challenges, including high government debt and prolonged negative real interest rates.

Metaplanet’s pivot to Bitcoin appears to have paid off. At the Bitcoin Conference in Nashville last month, Gerovich said that his firm was beginning to exhibit traits associated with zombie companies before shifting its strategy to Bitcoin.

The strategy has transformed the company’s outlook. Gerovich stated that it eventually “realized that Bitcoin is the apex monetary asset” and would make a “great” element of Metaplanet’s treasury.