Michael Saylor encourages Microsoft to consider Bitcoin investment to drive shareholder gains.

Key Takeaways

- Microsoft shareholders to vote on Bitcoin proposal as Michael Saylor pitches trillion-dollar opportunity.

- Microsoft board pushes back on Bitcoin investment proposal, urging shareholders to vote against it

Michael Saylor, CEO of MicroStrategy, earlier today directed a post on X to Microsoft CEO Satya Nadella, suggesting that if Microsoft wants to add another trillion dollars in value for its shareholders, it should consider adding Bitcoin to its treasury.

Hey @SatyaNadella, if you want to make the next trillion dollars for $MSFT shareholders, call me. pic.twitter.com/NPnVvL7Wmj

— Michael Saylor⚡️ (@saylor) October 25, 2024

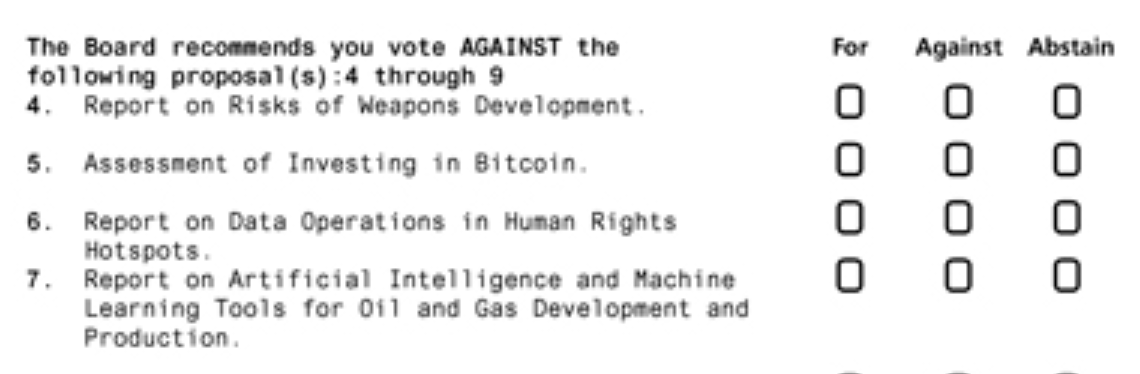

Saylor’s comment follows Microsoft’s latest SEC filing, which outlines a shareholder proposal titled “Assessment of Investing in Bitcoin” set to be voted on during the company’s annual meeting in December.

Building on recent performance, MicroStrategy’s Bitcoin-heavy portfolio has led its stock to outperform Microsoft’s by 313% this year, despite the company’s relatively smaller scale in the tech industry.

Microsoft acknowledged this in their report, noting the significant gains some companies have made by holding Bitcoin.

Although they acknowledge Bitcoin’s recent outperformance, Microsoft’s board has advocated that shareholders vote against this proposal.

In the filing, the board stated that conducting a Bitcoin investment assessment was unnecessary, emphasizing that Microsoft’s management “already carefully considers this topic.”

The board emphasized that Microsoft’s Global Treasury and Investment Services team regularly evaluates diverse assets, focusing on maintaining liquidity and minimizing economic risk while ensuring long-term shareholder gains.

While Microsoft acknowledges that Bitcoin has been considered in past assessments, its portfolio is currently dominated by US government securities and corporate bonds—a strategy aimed at stability and steady returns.

Microsoft’s caution aligns with the volatility associated with Bitcoin, a point they highlighted in the filing. They noted that assets for corporate treasury applications should be predictable and stable to support operations effectively.