MicroStrategy's stock aligns with Bitcoin trends, NAV premium hits new high.

Key Takeaways

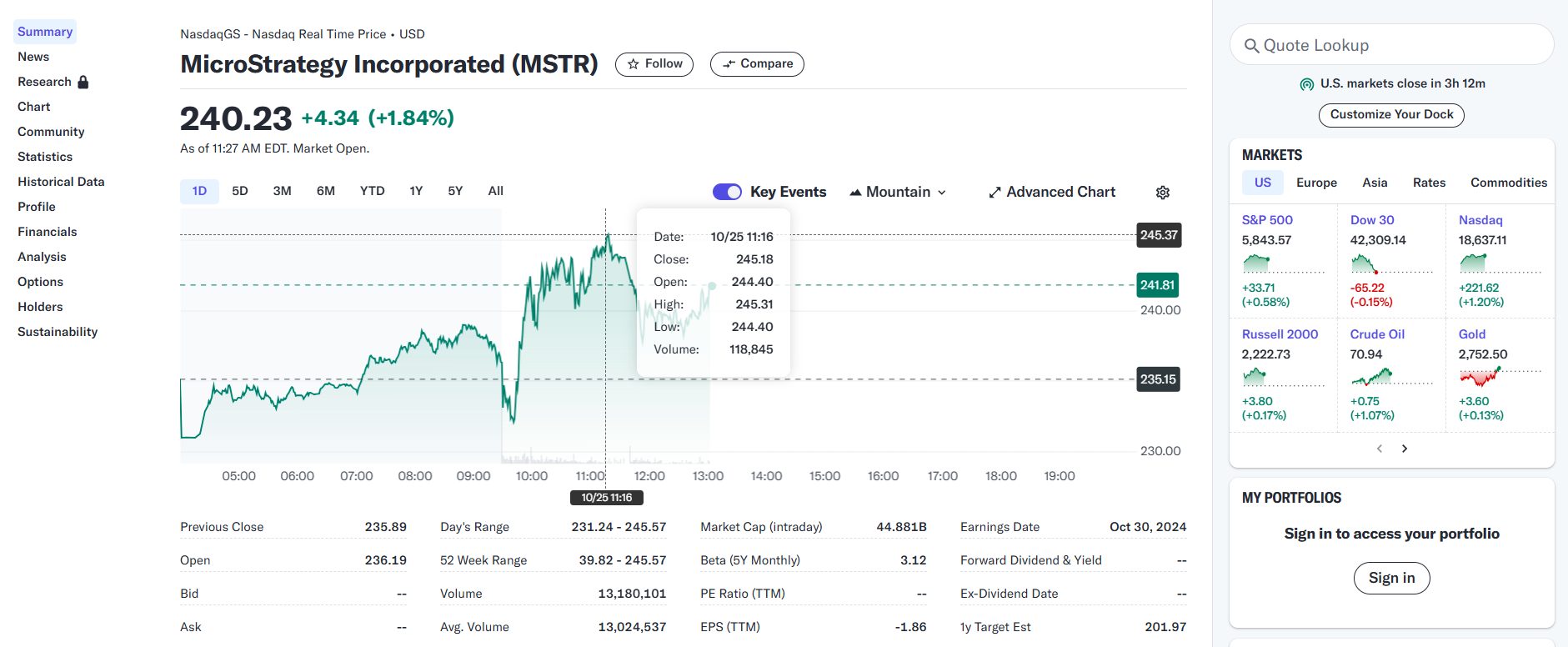

- MicroStrategy's stock reached a 25-year high of $245 ahead of its Q3 earnings report.

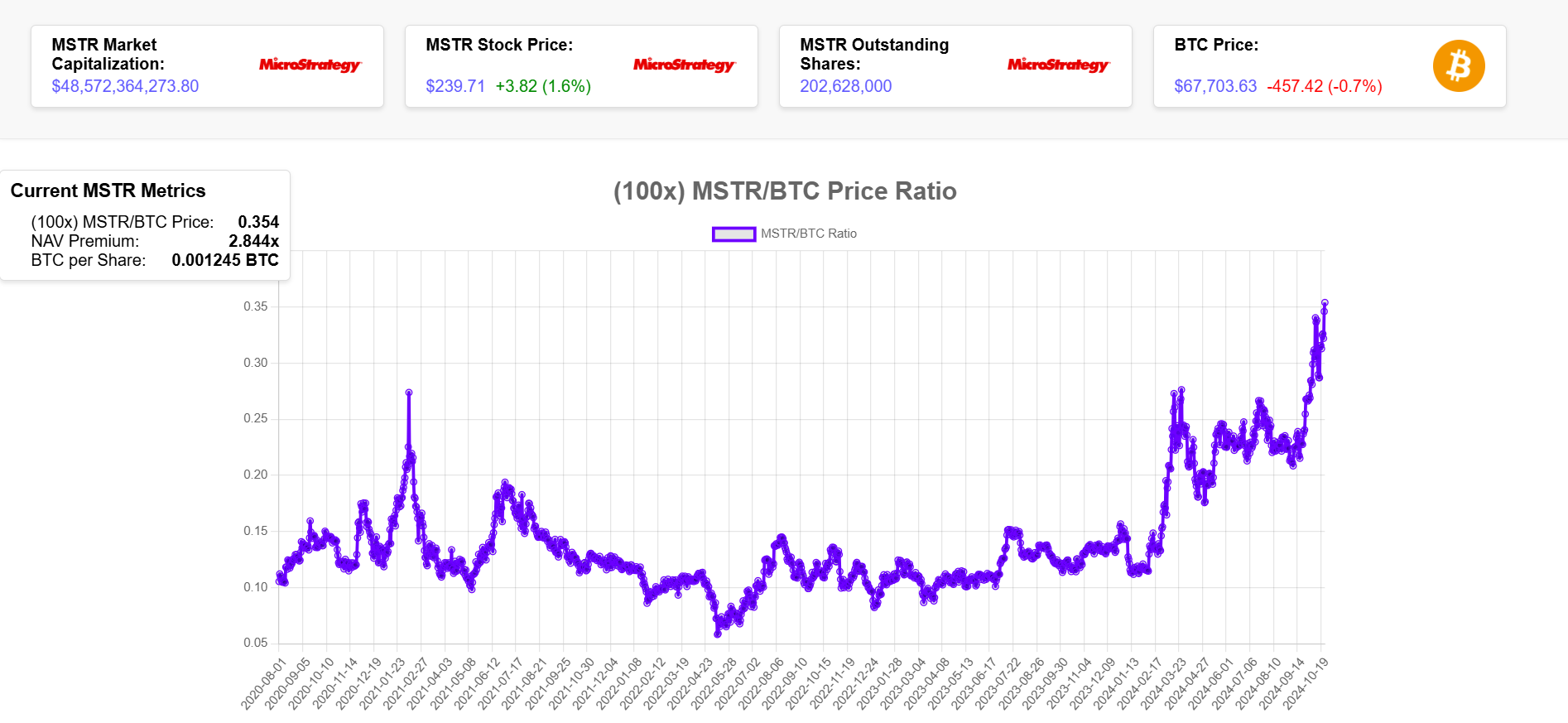

- The MSTR/BTC Ratio hits a record high, reflecting strong performance relative to Bitcoin.

MicroStrategy (MSTR) stock surged after the US markets opened Friday, rising from around $235 to $245, its highest level over the past 25 years, data from Google Finance shows. The jump comes ahead of the company’s third-quarter earnings report, which is set to be released next Wednesday.

At the time of reporting, MSTR cooled off to around $242, but it still outperforms the S&P 500. Data shows that MicroStrategy’s stock has increased by 286% year-to-date while the S&P 500 has gained around 37% during the stretch.

Over the past five years, MicroStrategy has experienced a staggering 1,588% increase in its stock price, surpassing the S&P 500’s 94.18% return.

MicroStrategy’s stock tends to perform in tandem with the broader crypto market, particularly Bitcoin, due to the company’s close ties to the largest crypto asset.

According to the MSTR tracker, the MSTR/BTC Ratio, which provides insights into how MicroStrategy’s stock value trends in relation to Bitcoin’s market movements, hit an all-time high of 0.354. This indicates that the stock has been performing well relative to Bitcoin.

The company’s net asset value (NAV) has also seen growth, with the NAV premium approaching 3, the highest since early 2021.

According to CoinGecko data, Bitcoin edged closer to the $69,000 level after resurging above $68,000 in the early hours of Friday. It has since corrected below $68,000, but still outperformed the broader market.

MSTR is about 23% away from its previous all-time high of $313 in March 2020. Its market cap now sits at around $44 billion. If MicroStrategy’s Bitcoin playbook proves successful, its stock price may hit new highs in the future.

Since adopting the strategy, MicroStrategy has seen its stock outperform Bitcoin itself. It is currently the world’s largest corporate holder of BTC, owning over 252,000 BTC, valued at around $17 billion at current prices.

The company shows no intention of selling its Bitcoin holdings. Instead, it plans to accumulate more coins using diverse funding methods.

As the company’s Bitcoin stash grows over time, so does its ambition. MicroStrategy’s CEO Michael Saylor projected a vision for the company to become a leading Bitcoin bank with a possible trillion-dollar valuation through strategic US capital market maneuvers.