Retail investing is still driving spot Bitcoin (BTC) exchange-traded funds (ETFs), but more institutions are sinking capital into the new products each quarter, according to a senior analyst with crypto intelligence platform K33 Research.

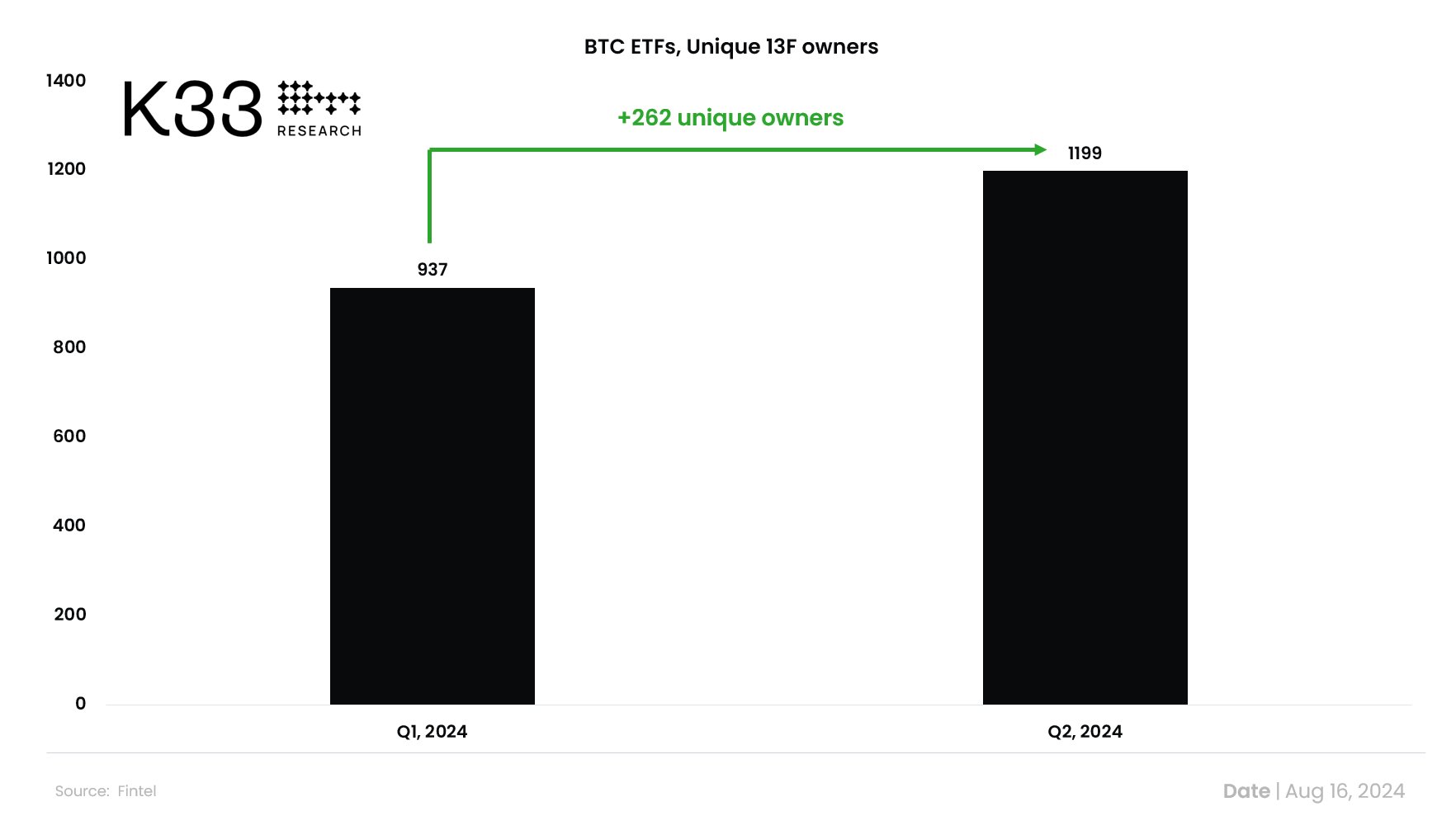

K33’s Vetle Lunde notes on the social media platform X that 262 additional professional firms purchased investments in spot BTC ETFs, bringing the total number of firms with investments to 1,199.

“While retail investors still hold the majority of the float, institutional investors increased their share of total AUM (asset under management) by 2.41 percentage points, now accounting for 21.15% in Q2.

GBTC (Grayscale Bitcoin Trust) saw a substantial reduction in their institutional capital, whereas IBIT and FBTC saw a pronounced growth in professional investor dominance.”

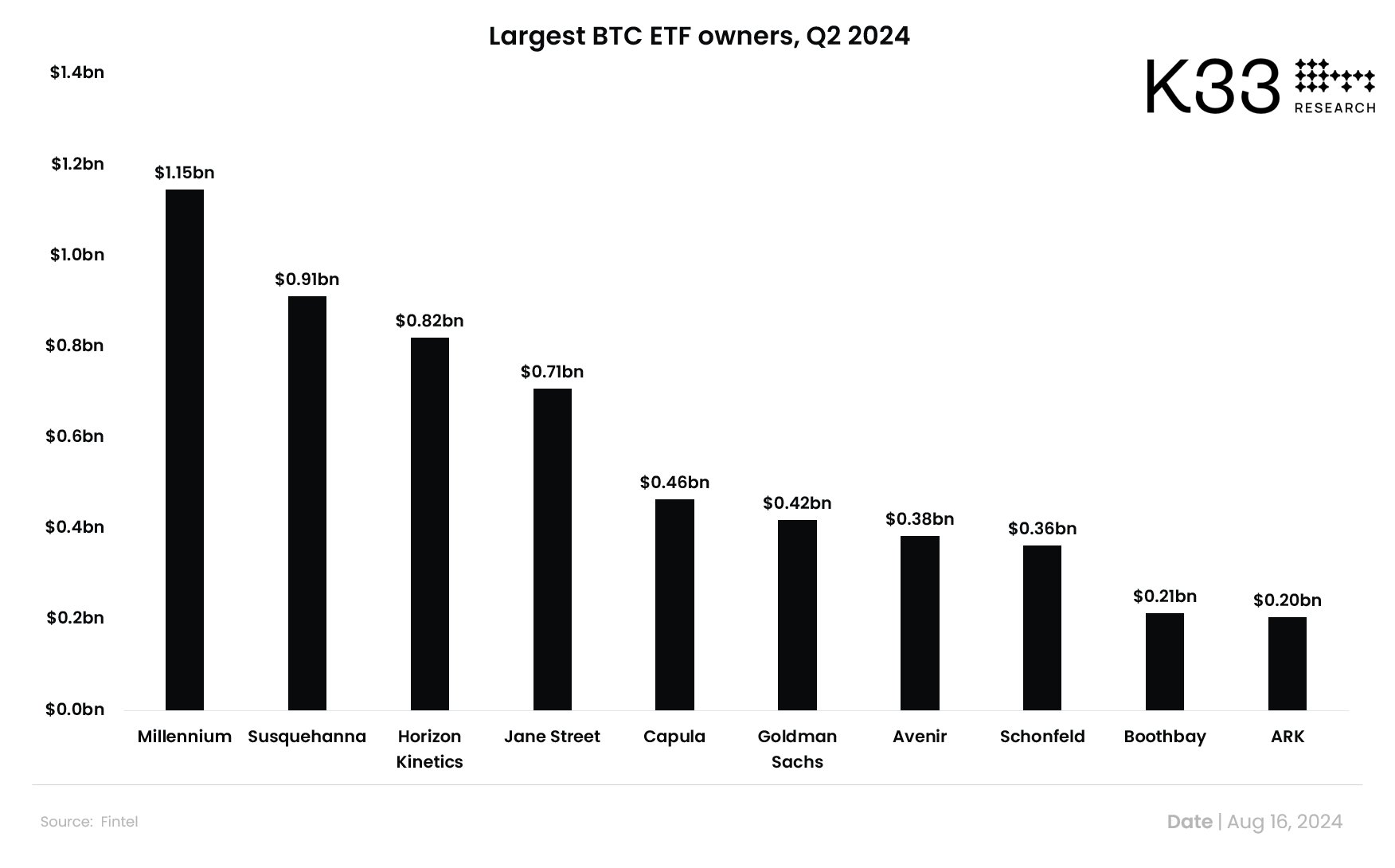

The analyst also notes that the biggest institutional spot BTC ETF owners are market makers.

“Millennium and Susquehanna remain the largest holders but have reduced their exposure compared to Q1. Two factors likely led to this reduction:

1) stiffening competition as Jane Street entered the market in Q2

2) calming market conditions, leading to less juicy yields – annualized CME premiums closed June 30th at 8.6%, compared to March 31st’s 14%.”

Bitcoin is trading at $59,141 at time of writing. The top-ranked crypto asset by market cap is up more than 2.6% in the past 24 hours.

Generated Image: Midjourney