RUNE, the native token of the cross-chain decentralized exchange, THORChain, is under pressure. From the daily chart, the token is down nearly 60% from May highs and remains flat even as the broader crypto market recovers.

Even as RUNE flatlines, there is confidence that prices may rally in the coming days primarily because of fundamental factors and efforts made by the development team.

THORChain Revenue Rising After Swap Fee Increment

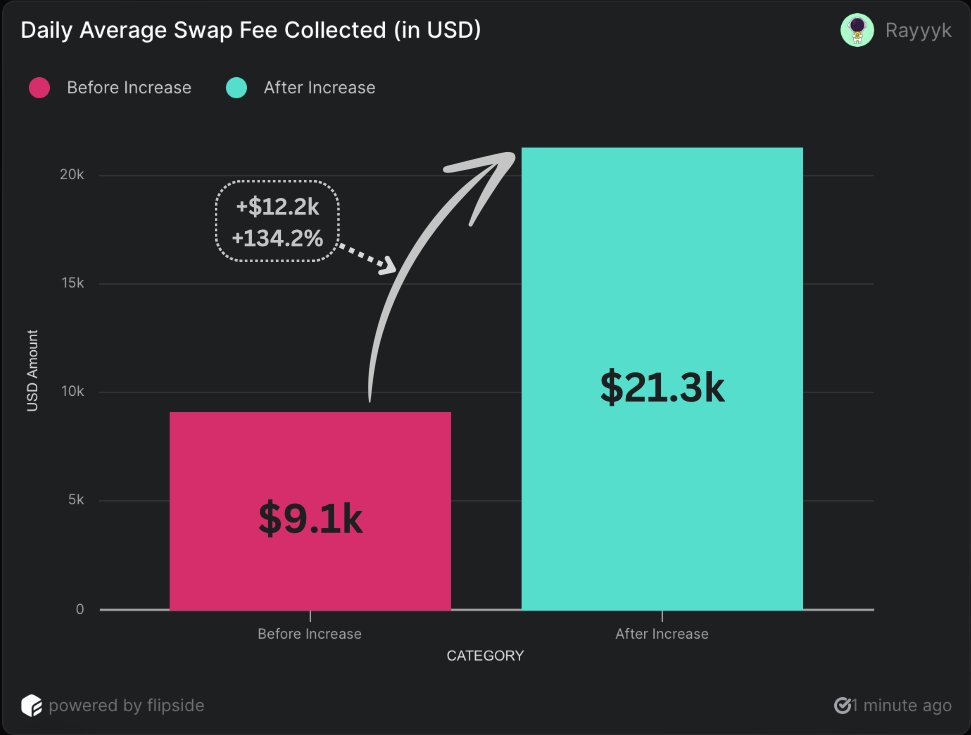

In a post on X, one analyst noted that THORChain has nearly doubled its revenue in the past two days following the community’s decision to increase the minimum swap fee on the DEX.

Recently, THORChain node operators approved and implemented a proposal to increase the swap fee for layer-1 native exchanges to 0.05%. The seemingly minor change, the analyst notes, has profoundly impacted THORChain’s protocol, increasing daily revenue by nearly 100%.

Interestingly, the analyst noted that while fee increments in protocol tend to impact user experience negatively, it had the opposite effect on THORChain. While the swap fee rose, users were not deterred. Instead, swap volume steadied while the average fee from every transaction surged.

As transaction fees rise, weekly liquidity fees on THORChain now exceed block reward, a major milestone for the DEX. Notably, the significant shift in revenue generation would further drive the RUNE burning rate once ADR 17, a community proposal, is implemented in the coming days.

The more RUNE is taken out of circulation, the scarcer the token becomes, lifting prices higher. Once ADR 17 is implemented, the protocol will buy and burn $1 worth of RUNE for every $10,000 revenue generated. For this reason, rising revenue due to the swap fee increase means more RUNE will be torched.

Impact Of RUNEPool On Liquidity: Will RUNE Break $5?

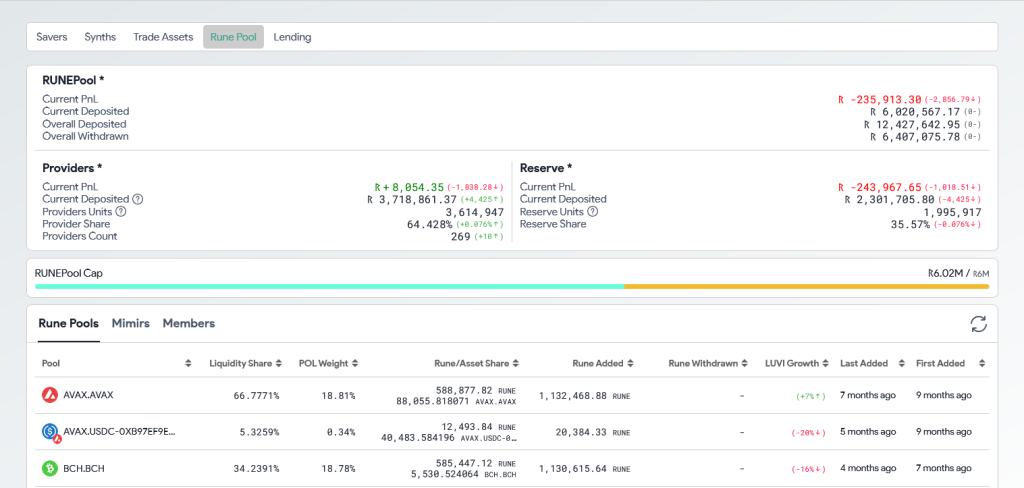

In late July, THORChain also introduced RUNEPool to help further incentivize liquidity provision. Users can freely deposit their RUNE via THORSwap and THORWallet interfaces into a pool of diversified tokens through this feature.

In this way, they help reduce the risks of impermanent loss while increasing liquidity. As of August 9, over 3.7 million RUNE have been deposited by 265 liquidity providers into the RUNEPool.

Despite these changes, RUNE remains under immense selling pressure, although it is steady at press time. Following the bear breakout in early August, pushing prices below July lows, the token has struggled. However, if there is a recovery from spot rates to above July highs of around $5, the coin might surge to over $7.5.

Feature image from iStock, chart from TradingView