Bitcoin (BTC) short-term holders have absorbed most of the market’s recent losses, according to the crypto analytics firm Glassnode.

The analytics firm defines short-term holders (STHs) as entities that have held their BTC for less than 155 days.

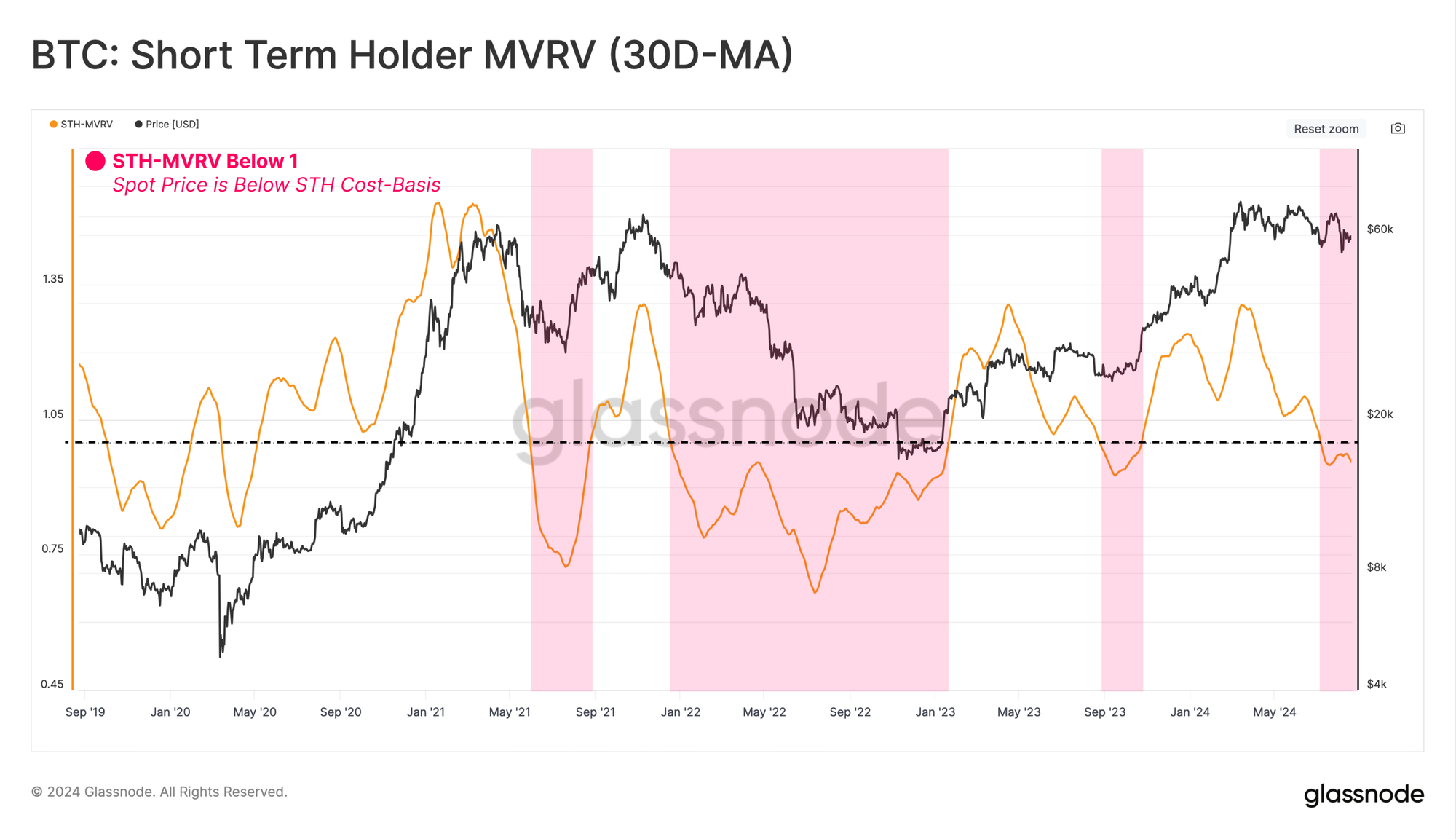

Glassnode looks at the 30-day average of the STH Market Value to Realized Value (MVRV) ratio. The MVRV is the ratio of a crypto asset’s market capitalization relative to its realized capitalization or the value of all the coins at the price they were bought.

The firm notes that the STH-MVRV ratio has fallen below the equilibrium value of 1.0, indicating new investors hold unrealized losses.

“Periods of brief unrealized loss pressure are common during bull markets. However, sustained periods where STH-MVRV trades below 1.0 can lead to a higher likelihood of investor panic and precede a more severe bearish market trend.”

Glassnode also says new investors often overreact to high levels of unrealized profits or losses.

“The chart below compares the spent cost-basis of new investors who decided to transact against the average cost-basis of all investors who still hold. The deviation between these two metrics provides insight into the magnitude of potential overreactions.

The bull market corrections seen throughout our current cycle have experienced only a slight deviation between the spent and holding cost basis. From this, it could be argued a modest overreaction may have occurred as the market sold off below $50,000.”

Despite short-term holder losses, long-term holders remain “steadfast and unfazed, with a clear preference to accumulate and HODL coins,” according to the analytics firm.

Generated Image: Midjourney