Nvidia is on track to hit a $10 trillion valuation, analyst Beth Kindig says.

Kindig is forecasting strong growth and "fireworks" for the stock after its Blackwell launch.

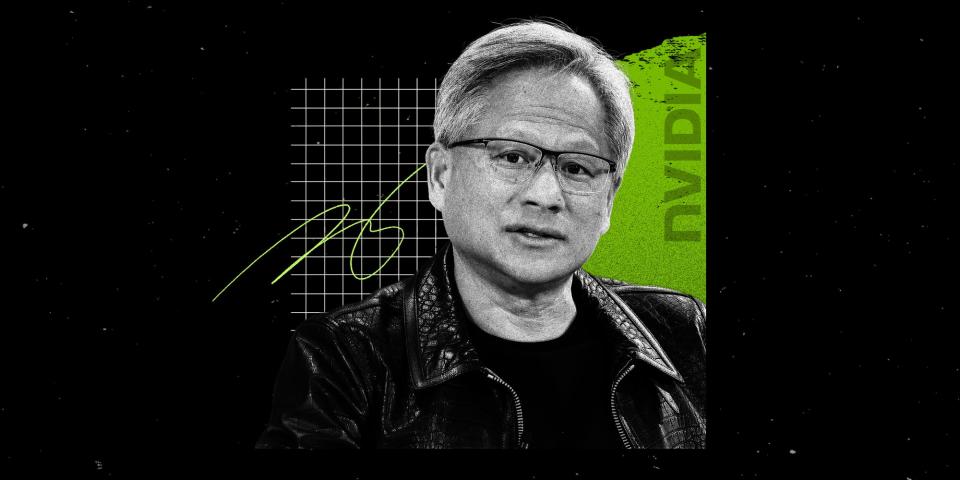

Jensen Huang assured investors on Nvidia's next-gen AI chip, promising "billions" in revenue.

Nvidia is on track to more than triple in value, according to Beth Kindig, the lead tech analyst at I/O Fund.

Speaking to Yahoo Finance on Thursday, Kindig said she foresees Nvidia notching a $10 trillion valuation over the long term. That implies monster gains for the $2.9 trillion AI titan, largely due to strong expected growth and gains from its next-generation AI chip, dubbed Blackwell, Kindig said.

Investors on Wall Street have grown concerned that Nvidia is becoming overvalued, given its massive run-up over the past year and investors' enormous expectations for earnings growth. Nvidia shares fell as much more than 6% Thursday after the company beat earnings for the second quarter, albeit more narrowly than previous quarters.

Investors also have concerns about Nvidia's Blackwell chip after industry analysts reported that the chip's launch would be postponed by two to three months due to "major issues in reaching high production volume."

Kindig argues that Nvidia's results were still "great," and enough to brush off investors' concerns heading into the results.

Nvidia CEO Jensen Huang defended the progress on Blackwell in a recent interview with Bloomberg, revealing that the company made a "mass change to improve yield" and was looking to pull in "billions of dollars" in revenue from the next-gen chip.

"That's why things are being revised up and they were never revised down," Kindig said of Nvidia estimates, adding that she remained positive on Blackwell's upcoming release. "They're saying Blackwell is basically on time. Blackwell is not a concern. If anything, it's extremely bullish."

Kindig predicted that Nvidia's growth trajectory should become more apparent once Wall Street analysts upwardly revise fiscal estimates for the following year. That should be a "big moment" for Nvidia, followed by the release of shipping volume figures for Blackwell in 2025.

"That's going to be fireworks, is how I would put it. Absolute, ultimate fireworks for Blackwell will come in Q1, with that Q2 guide," Kindig said. "Early next year will be fireworks again for Nvidia, and we will be on track for that $10 trillion."

Kindig's forecast for the chip company is among the most bullish, though Wall Street is still feeling optimistic about the chipmaker. Analysts have issued an average price target of $151 per share, per Nasdaq data, implying another 27% upside for the stock over the next 12 months.

Read the original article on Business Insider