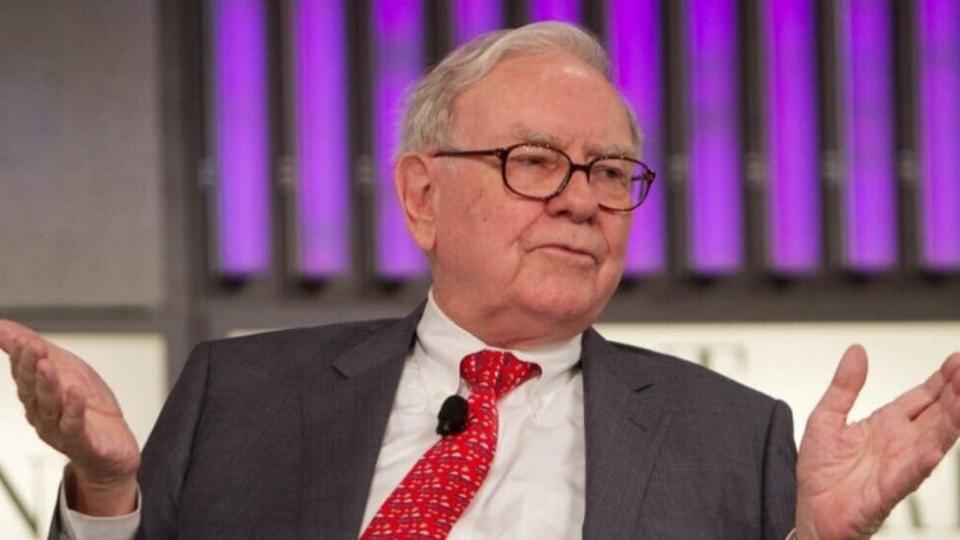

Warren Buffett, the “Oracle of Omaha,” is at it again and people are starting to talk. He's been selling off Bank of America (BAC) stock aggressively. Almost $7.2 billion worth of shares have been sold in the last couple of months – 174 million shares in 27 of the last 39 trading sessions. Strange, right?

Buffett's known for his long-term, patient approach: Buy good companies, hold forever – that's his thing. But now, he's ditching BAC, one of his favorite stocks for years. So what's going on?

Don't Miss:

General Motors and other leaders revealed to be investing in this revolutionary lithium start-up — allowing easy entry by launching at just $9.50/share with a $1,000 minimum.

A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

Some think it's about taxes. Earlier this year, Buffett mentioned corporate tax rates might be going up soon. So, maybe he's locking in some profits while taxes are still lower. Makes sense, right? But here's the thing – it's not like he's trimming a little here and there. This is a big-time sell-off. Feels like something more is happening.

There's another theory floating around. Maybe Buffett's preparing for a big shift in the Fed's policy. Everyone's expecting the Fed to start cutting interest rates and Bank of America doesn't do well when rates drop. They're super sensitive to changes like that. Buffett knows this. He's a smart guy. Maybe he's just getting ahead of the game.

Trending: Warren Buffett once said, "If you don't find a way to make money while you sleep, you will work until you die." These high-yield real estate notes that pay 7.5% – 9% make earning passive income easier than ever.

But here's where it gets more interesting. Buffett's been grumbling about Wall Street's “casino-like behavior” for a while now – the meme stocks, the wild retail investor moves and the general craziness in the markets. He's not a fan. And the timing of this BAC sell-off? Feels like he's making a statement. Maybe he's tired of the roller coaster and wants to hold onto more cash until things calm down.

See Also: This billion-dollar fund has invested in the next big real estate boom, here's how you can join for $10.

The stock market is expensive right now, too. The Shiller P/E ratio is at 36. Only two times since 1871 has it been higher. And both times? Huge crashes followed. So, maybe Buffett's just playing it safe. Cash is king, after all, especially if he thinks the market's about to take a nose-dive.

Whatever the reason, people are watching. Buffett doesn't make moves like this for no reason. Whether it's about taxes, interest rates, or just not liking the current market vibe, the Oracle of Omaha is up to something. And when Buffett's up to something, everyone else better pay attention.

Read Next:

During market downturns, investors are learning that unlike equities, these high-yield real estate notes that pay 7.5% – 9% are protected by resilient assets, buffering against losses.

Unlock a $400 billion opportunity by investing in the future of EV infrastructure on this startup already valued at $50 million.

Up Next: Transform your trading with Benzinga Edge's one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today's competitive market.

Get the latest stock analysis from Benzinga?

This article Oracle Of Omaha Sends A Warning? Buffett's Aggressive Bank Of America Stock Sales Raise Eyebrows originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.