Ethereum is flat at press time, moving inside a narrow $400 range with caps at $2,300 on the lower end and $2,800 as the upper limit. Even though investors are upbeat, expecting prices to soar in the coming sessions, uncertainty continues to engulf the market.

Ethereum Finds Support At $2,300: Over 52 Million ETH Bought

The second world’s most valuable coin is bearish, dumping by over 50% from July highs and unable to break the local resistance at $3,500. As traders closely monitor how price action pans out, one analyst has picked an interesting development from market data.

Citing IntoTheBlock data on October 11, the analyst observes that over 52 million ETH has been acquired by traders at around the $2,300 level. Considering the amount of coins in the hands of traders at this price, this zone is the immediate support.

As such, if buyers have the upper hand, lifting prices from this point, this level will anchor the uptrend. If sellers double down, as has been the case in the past few trading months, the probability of ETH dropping below Q3 2024 lows will be elevated.

Presently, the sentiment is bearish, as seen in the CoinMarketCap poll. Over 65% of ETH holders and traders expect prices to struggle in the short term.

Therefore, how prices react at the local support will shape the short to medium-term formation. A surge, lifting ETH above $2,800, will be crucial in driving demand, providing the much-needed tailwinds for optimistic traders.

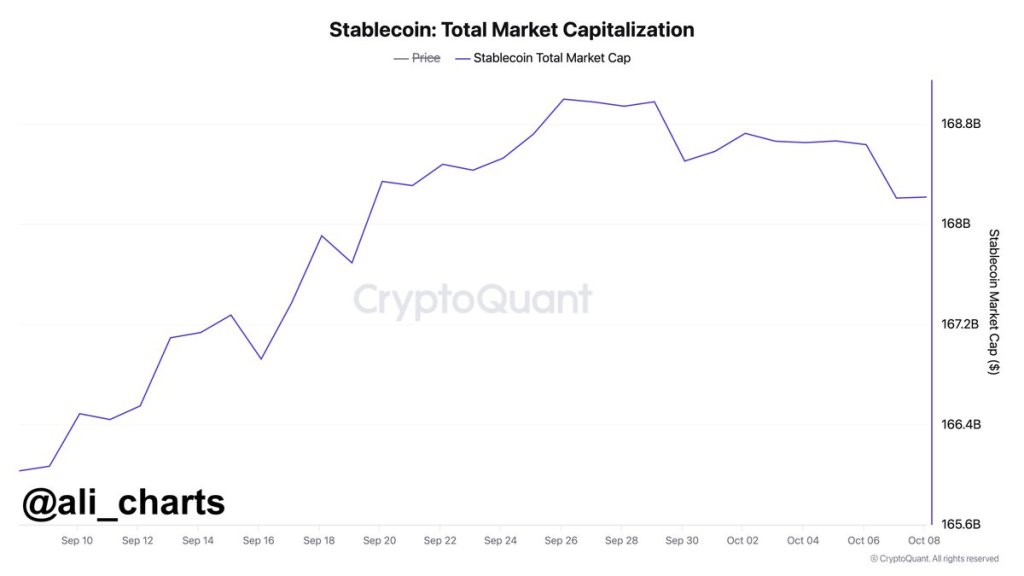

USDT, USDC, And Stablecoin Market Cap Falling: Is Buying Power Dwindling?

Although optimism is high, other related market data points to weakness. Over the past few trading weeks, the market capitalization of stablecoins like USDT and USDC has been falling. As of October 10, the analyst notes it was down $780 million from recent swing highs, pointing to a possible drop in buying power.

Usually, whenever USDC, USDT, and even DAI move to centralized exchanges, more users are keen on buying crypto assets, including ETH and BTC. However, if there is an outflow or its market cap dwindles, it may mean that more users are cautious and closely monitor events before committing.

Typically, more coins, including stablecoins, tend to find their way to centralized exchanges when there are concerns about market prospects. Such inflows tend to precede a market-wide correction.

For now, inflows of ETH to centralized exchanges have not been picked. However, what’s been happening is that more holders have been staking. By mid this week, market data revealed that over 34 million ETH remain locked, earning holders a 3.3% APY.

Feature image from DALLE, chart from TradingView