Bitcoin (BTC) is currently in red regarding price performance, dragging the rest of the crypto market along with it. Amid the continuous bearish price action, the latest data has revealed that Bitcoin short-term holders now face losses compared to their initial purchase prices.

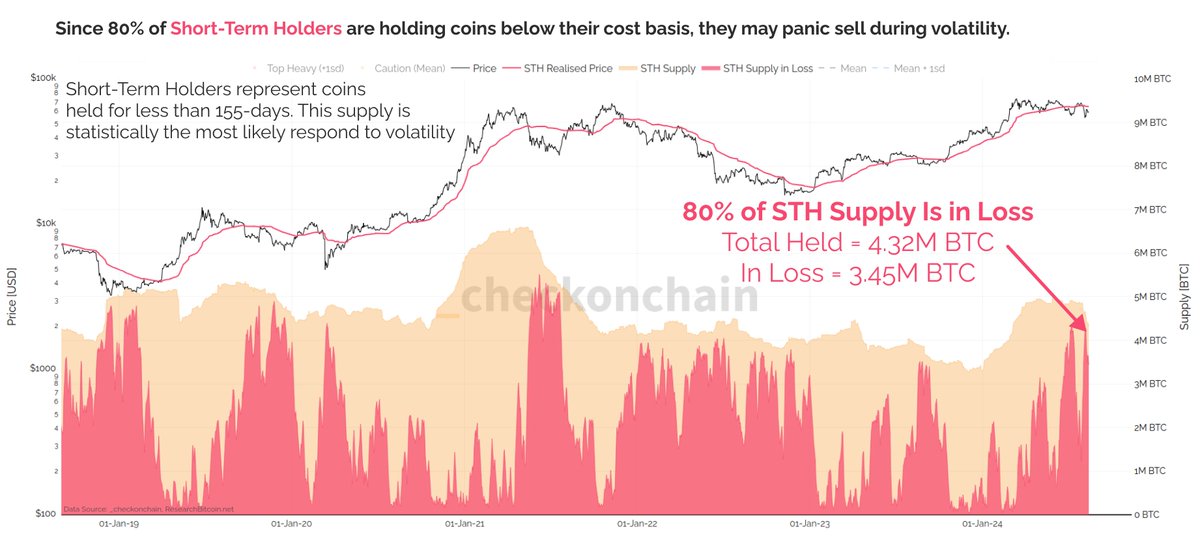

Onchain data expert James Check highlighted this in a recent post on X, disclosing that over 80% of Bitcoin’s short-term holders, those holding their BTC for less than 155 days, have bought their tokens at prices higher than the current market rate.

Underwater Investors, Implication For Bitcoin

This situation of the majority of short-term holders being in the red (at a loss), as pointed out by Check, is quite similar to the scenario that took place in “2018, 2019, and mid-2021, which signaled many investors were at risk of panicking and precipitating a bearish trend.”

Right now, over 80% of #Bitcoin Short-Term Holders are underwater, meaning their coin was acquired at a price above the current spot price.

This is similar to 2018, 2019, and mid-2021 which signalled many investors were at risk of panicking, and precipitating a bearish trend. pic.twitter.com/8jM7PBqh5z

— _Checkmate 🟠🔑⚡☢️🛢️ (@_Checkmatey_) August 19, 2024

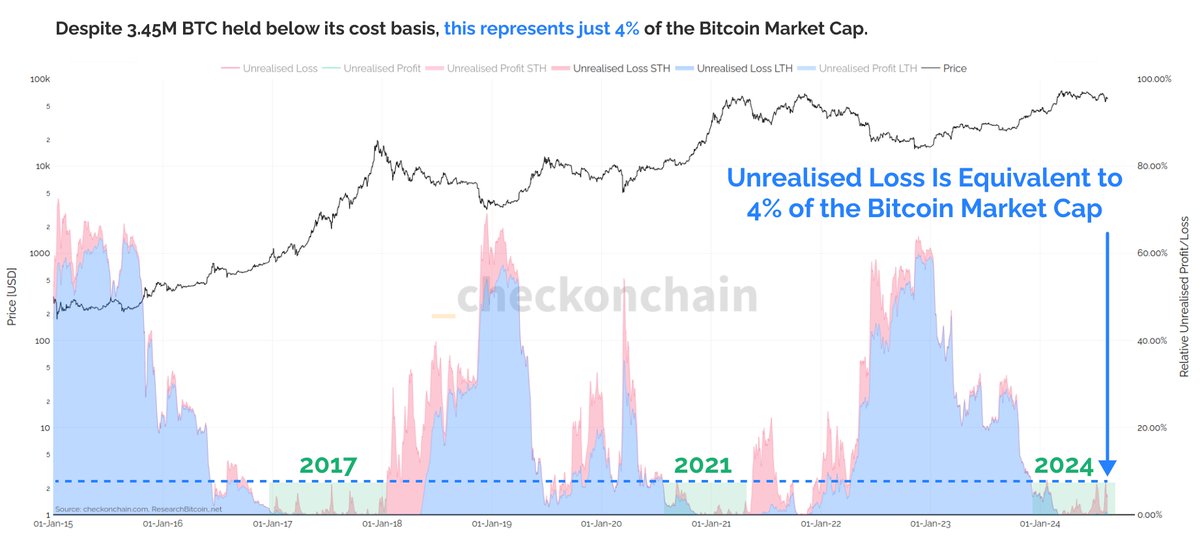

Despite the bleak outlook suggested by the high percentage of underwater short-term holders, the implications for the market are nuanced.

Check highlighted that the psychological impact on holders varies greatly depending on the extent of their losses. He elaborates that a minor unrealized loss, such as 1%, has a significantly different psychological effect on an investor than a more substantial loss of 20%.

Despite the high percentage of holders facing losses, the total unrealized loss across the market equates to only 4% of Bitcoin’s total market capitalization. This indicates that while the sentiment may be bearish, the financial impact might not be as severe as expected.

BTC Market Performance And Outlook

Bitcoin has continued to gradually plunge towards the downsides, breaking multiple supports. Over the past week, the asset has declined by 1.7% and further down by 2.7% in the past day.

This bearish performance has brought the asset to trade as low as $57,918 earlier today before now, retracing slightly to trade at $58,339 at the time of writing. Interestingly, despite the decline, BTC’s daily trading volume has seen quite the opposite performance.

According to data from CoinGecko, this metric has increased from below $17 billion at the start of today to roughly $22.6 billion.

Regardless, several analysts remain bullish on BTC, anticipating a rebound soon. Renowned crypto analyst Elsa on X has revealed that Bitcoin’s daily MACD indicator has switched bullish. However, it appears BTC is “lacking” the liquidity needed to make that push to the upside.

$BTC daily MACD has turned bullish

But still, liquidity is lacking which is needed for a big #Bitcoin pump! pic.twitter.com/snUqfPdFGU

— Elja (@Eljaboom) August 19, 2024

Featured image created with DALL-E, Chart from TradingView