The chief crypto analyst at Real Vision says the global money supply (M2) metric is showing a “perfect” scenario for Bitcoin (BTC).

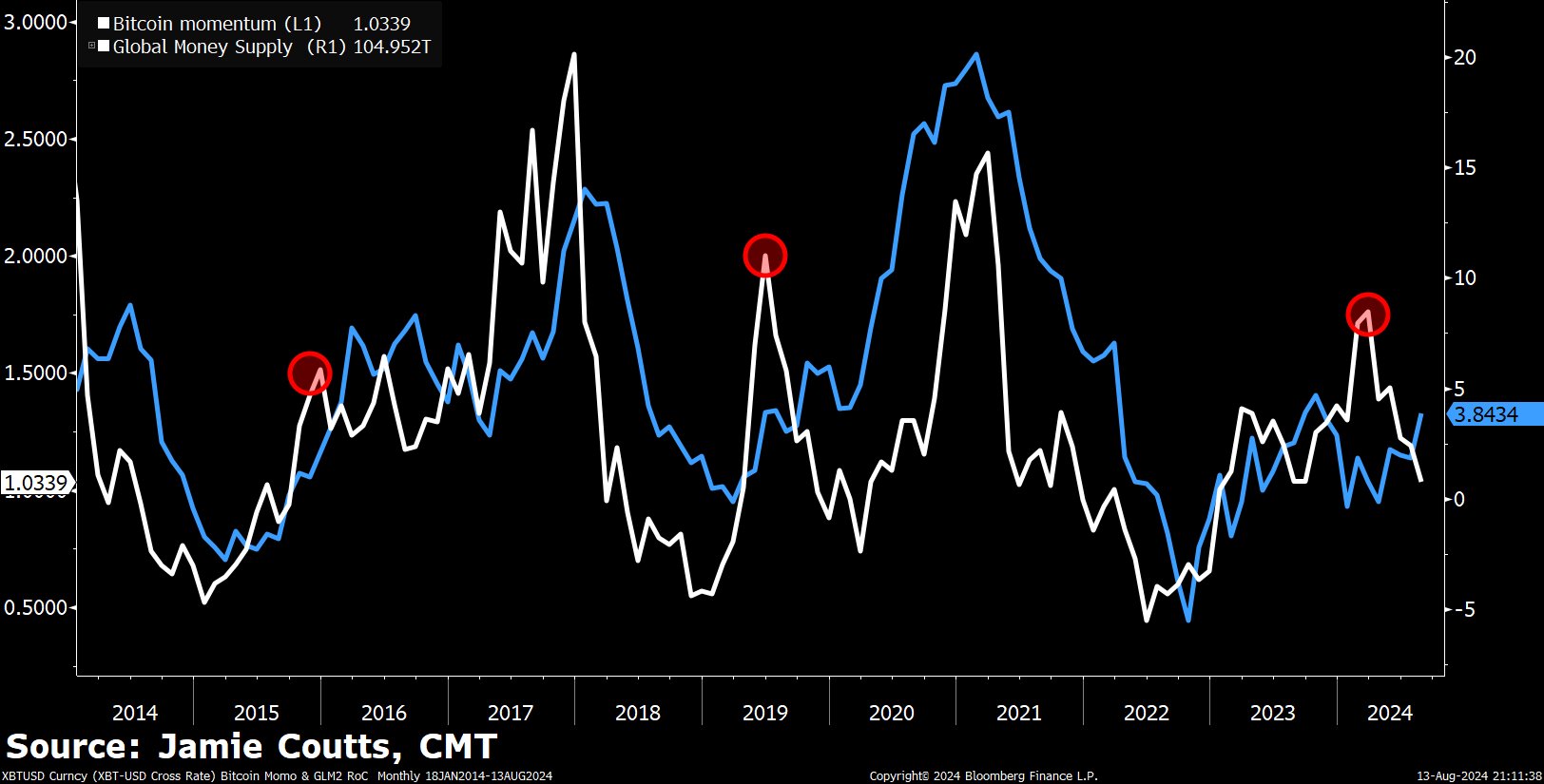

Jamie Coutts says on the social media platform X that a historical relationship between Bitcoin and M2 suggests that the flagship cryptocurrency is in the midst of a consolidation phase while an increase in the money supply sets the stage for BTC’s next leg up.

“Over the past decade, Bitcoin has had a tendency to trough several months before the bottom in global M2. Then it rips, gets way ahead of the move in liquidity, and has a mid-cycle correction.

Now, momentum in global liquidity is starting to accelerate higher while all the froth from ETF launches and excess leverage has left the Bitcoin market.

The perfect set up.”

Coutts reiterates the link between Bitcoin and the money supply, sharing a chart suggesting that BTC rises with M2, and then corrects once M2 reaches a short-term top.

“In a debt-based fractional reserve financial system, the money supply must continually expand to support the outstanding debt. Otherwise, everything will collapse. This is the natural state.”

BTC is worth $61,323 at time of writing, up 7% on the week.

Last month, Coutts’ boss at Real Vision, Raoul Pal, made similar suggestions about liquidity flooding the markets.

“We also think that globally, the Japanese might intervene in their currency selling dollars which adds dollars into the global system. We also think that most countries will be adding liquidity as well. We think China needs to increase its liquidity.”