The Fed will deliver its first rate cut in 4.5 years on Wednesday, marking a significant shift in monetary policy.

Key Takeaways

- Expected rate cuts could drive Bitcoin prices higher as investors seek riskier assets.

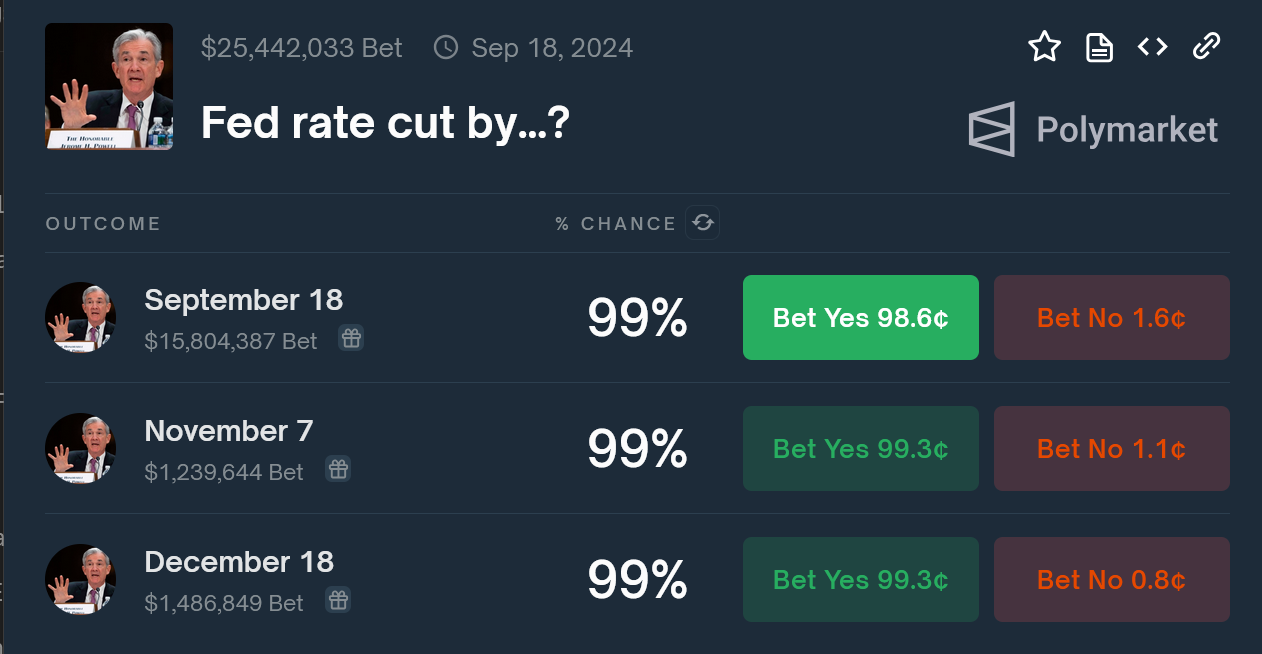

Polymarket traders are overwhelmingly betting on a Federal Reserve rate cut this week, with odds at 99% for a reduction at the upcoming September 18, 2024 meeting. Traders are anticipating a 25 basis point cut, which would reduce the federal funds rate to a range of 5.00% to 5.25%.

While some economists speculate a more aggressive cut of 50 basis points, the general consensus anticipates two cuts this year, aiming for a year-end target of 4.75%-5.00%.

According to the CME FedWatch tool, the probability of a 50 basis-point reduction has risen to 65%, surpassing the earlier 35% likelihood of a 25 basis-point cut.

This shift in interest rates is expected to significantly impact risk assets like Bitcoin. Lower rates typically increase market liquidity, pushing investors towards higher-yield, riskier assets. Analysts predict a surge in Bitcoin prices as a result, although this could also introduce short-term market volatility.

A Bitfinex analyst predicts a 15-20% drop in Bitcoin prices following the rate cut, with a potential low between $40,000 and $50,000. This forecast is based on historical data showing a decrease in cycle peak returns and a reduction in average bull market corrections. However, these predictions could be impacted by changing macroeconomic conditions.

The last time the Fed implemented a rate cut was in March 2020, in response to the COVID-19 pandemic.

Earlier this week, an economist predicted that the anticipated 25-basis-point rate cut by the Federal Reserve could trigger a ‘sell-the-news’ event affecting risk assets.