Chevron (NYSE: CVX) made a very bold move last fall, agreeing to buy Hess (NYSE: HES) in a nearly $60 billion deal. The needle-moving acquisition would enhance the company's portfolio and extend its growth profile. That's why it is working hard to close the transaction despite several delays.

ExxonMobil (NYSE: XOM) is causing the biggest delay. The big oil giant launched a dispute over contractual language related to the deal. As a result, the companies are seeking arbitration to resolve the matter. I predict that Chevron will emerge victorious and eventually close its purchase of Hess. Here's why.

Drilling down into the deal

Chevron unveiled its merger agreement with Hess last October, less than two weeks after Exxon revealed its more than $60 billion megamerger with Pioneer Natural Resources. While the timing might suggest the acquisition was in response to Exxon's merger, Chevron wasn't doing a deal just to keep up with its rival. Hess is a very strategic transaction for the oil giant.

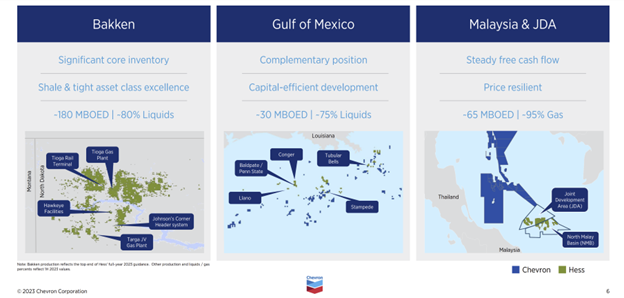

Acquiring Hess will upgrade and diversify Chevron's already advantaged global resources portfolio. It will add the Stabroek block in Guyana, which Chevron noted is an "extraordinary asset with industry-leading cash margins and low carbon intensity that is expected to deliver production growth into the next decade." It will also add Bakken assets to its U.S. shale position and complementary assets in the Gulf of Mexico and Southeast Asia.

The deal would enhance and extend Chevron's free cash flow and production growth outlooks into the 2030s. It positions the oil giant to more than double its free cash flow by 2027, assuming $70 oil (crude oil is currently over $80 a barrel). That would enable the company to return more cash to shareholders via dividends and buybacks.

A merger or an asset purchase?

Hess' crown jewel is its 30% interest in the Exxon-operated Stabroek block offshore Guyana. The world-class oil reservoir produced 137 million barrels of oil last year and $6.3 billion of profit for its three developers (Exxon has a 45% stake, Hess has a 30% interest, and China's CNOOC owns the remaining 25%). The field is on track to triple its output by 2027 while continuing to grow its production through around 2033.

The operating agreement signed by the three joint venture partners contains a change of control clause. If triggered, it would give the other two operators the right of first refusal to the asset sale. Exxon believes Chevron's acquisition of Hess triggers this contractual right. Chevron disagreed, which led the rivals to seek arbitration in the matter. The three-person panel will make their decision later next year.

The issue is that Exxon believes Chevron's acquisition of Hess is an asset purchase disguised as a merger. That's because most of Hess' value is its stake in the Stabroek block (analysts estimate it makes up 70% of the deal's value).

While it's true that Hess' interest in the Stabroek block is the most important asset Chevron would acquire in the deal, it's not the sole driver of the transaction. The other three assets it would acquire are also excellent strategic fits for Chevron:

While Chevron doesn't currently operate in the Bakken, it fits in with its U.S. shale portfolio, which features positions in the Permian and DJ Basins. The company bulked up on those two basins last year with its $7.6 billion acquisition of PDC Energy. While the Permian Basin gets all the press (it was the driver behind Exxon's deal for Pioneer Natural Resources), Chevron's PDC Energy deal was more focused on the DJ Basin. It liked the complementary nature of the transaction, which is also highly accretive to its financial metrics. Adding the Bakken would have similar benefits.

Meanwhile, Hess' Gulf of Mexico and Southeast Asia gas businesses are highly complementary to Chevron's existing assets in those regions. That will make those assets easy to integrate into its operations, enhancing its free cash flow.

While Chevron does plan to sell $10 billion to $15 billion of assets through 2028 after closing its merger with Hess, it won't flip any of the acquired assets. They fit its current portfolio like a glove. They will enable the energy giant to jettison non-core assets to further high-grade its portfolio and ability to generate free cash flow in the future.

Chevron will emerge victorious

Put everything together, and Hess is the perfect deal for Chevron. It adds a world-class position in offshore Guyana, enhances its strong U.S. shale resource position by adding the Bakken, and complements its existing operations in the Gulf of Mexico and Southeast Asia. That's why I disagree with Exxon's interpretation of the deal as an asset acquisition disguised as a merger. While Guyana is the crown jewel, Hess' other assets are also highly valuable to Chevron, strategically and financially. It's why I expect it to win the arbitration hearing next year and close its merger with Hess.

Should you invest $1,000 in Chevron right now?

Before you buy stock in Chevron, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chevron wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Matt DiLallo has positions in Chevron. The Motley Fool has positions in and recommends Chevron. The Motley Fool has a disclosure policy.

Prediction: Chevron Will Prevail Over ExxonMobil and Close This Needle-Moving Acquisition was originally published by The Motley Fool