by Jason Cohen on August 25, 2024

You’re not profitable if you couldn’t afford someone else to do your job. $1000/mo isn’t profitable. Fix your definition of “profitable,” and build a truly profitable business.

My company is profitable, and has been from day one.

—every high-tech bootstrapped founder

I know what you really mean.

What you really mean is that the only charges on your Business Select PayPal MasterCard this month are:

- AWS “medium” instance for the SaaS with one paying customer: $40

- Stripe fees for the one paying customer: $1.72

- AWS S3 storage to back up your loose “Best of Pat Benatar” mp3s: $0.043

And since your one paying customer is at the $49/mo tier, you’re profitable!

I know that’s what you mean, but when you say “I’m profitable” it’s a turnoff, because it’s actually bullshit, and anyone with a modicum of experience knows it. Which means either you’re coming off as a full-blown bullshit artiste or—more likely, since we’re giving you the benefit of the doubt—you’re coming off as ignorant. Neither is a good look.

Let’s be serious about what “profitable” means:

- If your savings is going down every month, you’re not profitable yet.

- If you’re making less than minimum wage, you’re not profitable yet.

- If you couldn’t afford to pay someone else to do the job that you are doing, you’re not profitable yet.

- If someone bought your company, and hired people to do the work (even at below-market rates), and each month they’d have less money in the bank than the previous month, you’re not profitable yet.

- If you have to work another job to pay the bills, you’re not profitable yet.

Yet!

The key word is “yet.” You’re not a failure. You’re not doing anything wrong. It’s just that businesses aren’t profitable on day one. They’re profitable later (if ever).

The main error is ignoring the cost of yourself. Although arguably your time is worth $1000/hr, let’s just say you need to pay yourself “enough.” Which means what?

An easy definition is: You are taking out of the business the same amount of money you were making at the job you quit. (Oh, you haven’t quit yet, because you need the money?) The market has already decided your time and skills are worth at least that; if the startup replaces it, it’s fair (in my book) to call it profitable.

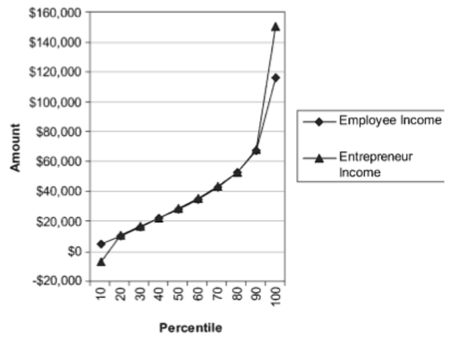

Indeed, the majority of small business owners make about the same money as they were making when they were an employee, without all the stress and extra hours:

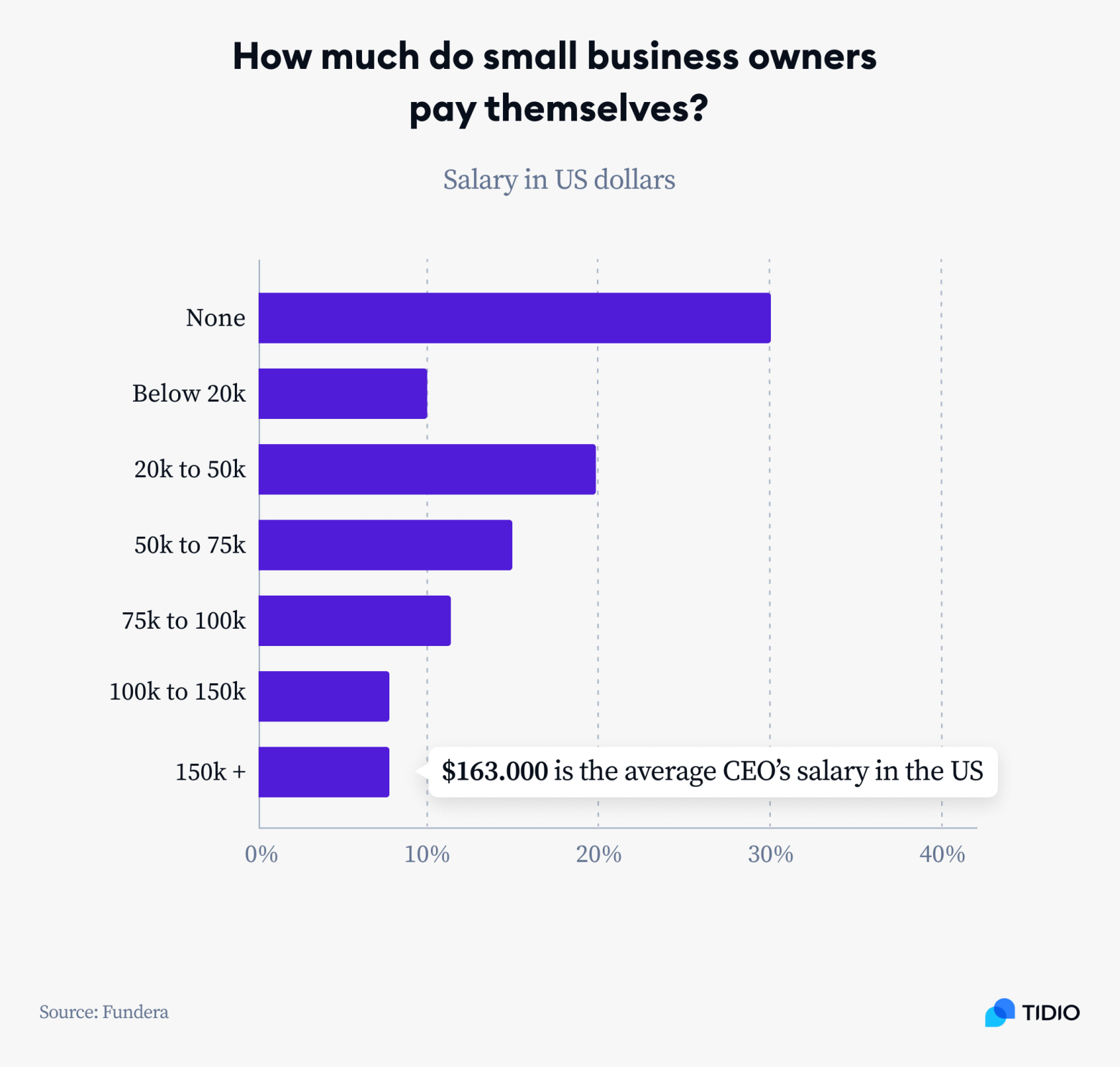

And most small business owners make less than the average CEO salary:

At minimum, you need to be ramen-profitable, i.e. enough for you to eat as cheaply as possible and not be malnourished, and also not be burning savings. You can dramatically change that income requirement through lifestyle and location; this is why it can be easier to start a company when you’re young and unattached and childless, when you have few material needs and might like living in another country for a while.

The strongest definition of profitability is to imagine that you’ve sold your business to a high-quality operator who is hiring people to do the work. You likely “wear a lot of hats,” so some of those roles are part-time. You might be excellent at some—the new owner will have to hire great talent at market rates—and poor at others—the new owner can skimp on those. The company is profitable when it would also be profitable in that scenario. In short, when it is profitable on its own power, not “it + a founder pouring their heart and soul into every waking hour to the limit of their endurance and ability, for free.”

Don’t despair

So now that I’ve perhaps unfairly ridiculed you, let’s take a step back and recognize what’s really going on, because it’s wonderful and amazing and fantastic and exciting:

You’re building a business! Sure it’s just begun, sure it might need a kick in the ass, sure it might be struggling, sure sure sure, so what? You and every other little new business. You and everyone else who doesn’t explode out of the blocks. Almost no company explodes out of the blocks, including all the successful ones in all industries. This is exactly what you’d expect it would do, even if you’re actually the next 37signals or Smart Bear or WP Engine.

Indeed, that’s exactly what my company WP Engine looked like for the first 9 months. And then it was chaos for two years, like it always is.

Same with my previous company Smart Bear—it took 2.5 years before I could even hire one employee, and even then it was 1/4 of the salary he deserved (and later ended up making). Eventually we, too, made millions of dollars a year—in profit!—but not for years.

In other words, there’s nothing strange or bad here. It’s just that it’s not “profitable from day one.” Stop saying that.

Dispense with the feather-fluffing and get to what is—the strengths you have, the challenges you want to overcome, the resources at your disposal.

And then set your mind and goals on making that sucker profitable for real!

☞ If you're enjoying this, please subscribe and share this article! ☜