Violent weather events are driving down real estate values in Texas, Florida, and Louisiana, according to Capital Economics.

Property-insurance costs have grown at the fastest rate in 20-years due to billion-dollar storm damages, the firm said.

Multifamily real estate values in the coastal regions of these states have dropped 7% since 2019, double the national average.

The rise in violent weather events over the past few years are driving a decline in real estate values in Texas, Florida, and Louisiana, according to a recent note from Capital Economics.

Much of that is due to surging property-insurance costs in the wake of severe storms and hurricanes. Premium growth recently reached a 20-year high, the research firm said.

"Last year the US saw 28 extreme weather events where damage exceeded $1 billion, over three times the usual number in the past half-century," economist Imogen Pattison of Capital Economics said.

Already this year, there have been 15 storm events that each caused more than $1 billion in damage. Just a few weeks ago, Hurricane Beryl — which was the earliest-formed Category 5 hurricane in Atlantic history — caused an estimated $2.7 billion in damages, according to Karen Clark & Co.

That nearly $3 billion in damages from just one hurricane is ultimately what insurance companies will lose, and to make up for that and many other storm-related losses, they're jacking up insurance premiums in a big way.

"The steady rise in the frequency and intensity of natural disasters has had a dramatic impact on insurance premia for US real estate as insurers have scrambled to price-in physical risks," Pattison explained. "Others have withdrawn from particular markets altogether, causing a further climb in prices amongst those left behind."

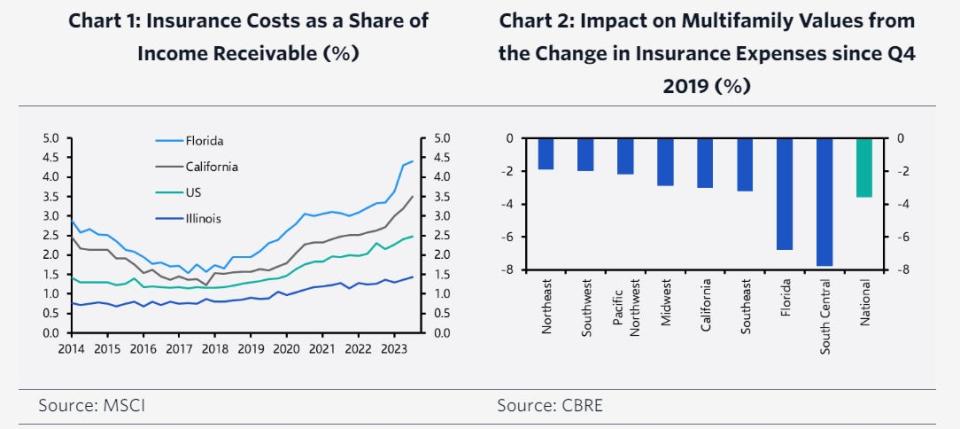

According to data from MSCI, insurance costs in Florida have more than doubled from less than 2% of income receivable in 2017 to 4.5% at the end of 2023.

And those higher costs have ultimately helped drag down property values in impacted regions, especially in the multifamily sector.

An analysis from CBRE found that the most impacted coastal regions of Florida, Texas, and Louisiana saw a real-estate-value drop of 7% since the end of 2019 for multifamily buildings, which is about double the national average of -3.6%.

But there has been a sign of hope in that the rate of growth in insurance costs appears to have peaked, according to Pattison. But she says the ongoing trend of violent weather could still exacerbate the issue in the future, further driving real estate values down in the most impacted regions.

"We suspect many of the most at-risk regions will see a worsening of weather conditions over the next 30 years. While the immediate impact of the rise in extreme events on insurance costs seems to be cooling, future climate-related risk will likely leave premium growth above its historic average," Pattison said.

Read the original article on Business Insider