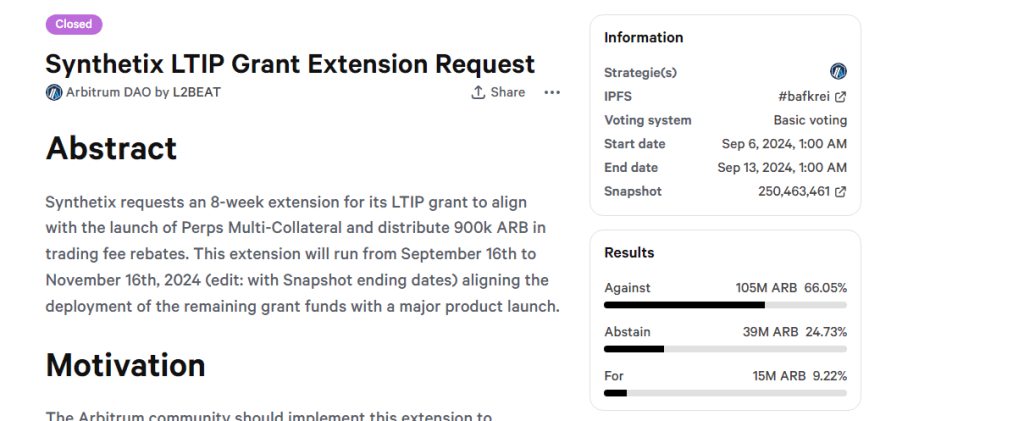

Synthetix, a popular DeFi protocol, is facing challenges regarding its plans for Arbitrum, a layer-2 platform for Ethereum. According to the recent voting results, the community voted against its plans to extend its Long-Term Incentive Program (LTIP) grant.

Arbitrum Holders Vote Against Synthetix Proposal

The goal was to support the launch of Multi-Collateral Perps. The feature would have permitted traders to trade using margin with ETH, BTC, and USDx acting as collateral when initiating perpetual futures on Arbitrum via Synthetix perpetuals.

If the Arbitrum community had agreed, it would have allowed Synthetix to distribute 900,000 ARB as trading fee rebates. According to the Synthetix proposal, they intended to incentivize users and, thus, boost the active trading volume of Synthetix on the layer-2 platform.

While novel and a net positive for Synthetix, the ARB community deemed the extension, which would have started from September 16 through November 16, unnecessary. Subsequently, 66% of all ARB votes were against this extension, and 9% supported this proposal.

Now that ARB holders have rejected the extension, the launch of the Multi-Collateral Perps feature will face delays. For this reason, Synthetix users on Arbitrum would have to wait longer to trade trustless perpetual with the freedom to use various margin assets.

At the same time, there are now reduced incentives to engage. Fewer users will be willing to trade on Arbitrum using Synthetix perpetual without the extension. Accordingly, this would negatively impact the DeFi trading portal.

Combining the above, engagement on Arbitrum would be impacted as Synthetix traders, angling for the fee rebates sent from the 900,000 ARB, would withdraw.

What’s Next? Will ARB Recover From Record Lows?

In the future, it remains to be seen how Synthetix will proceed on Arbitrum, the largest Ethereum layer-2 by trading volume. As it is, the protocol might now have to explore other strategies to incentivize traders and launch the crucial Multi-Collateral Perps feature.

Though SNX prices might suffer, ARB might find support now that supply will be lowered. Looking at the daily chart of the ARBUSDT, sellers are in control.

After peaking in January 2024, ARB has been plunging lower, sliding by as much as 80% to spot rates. The token finds itself in critical support. If bears take over, ARB will fall, printing fresh all-time lows.

Feature image from iStock, chart from TradingView