Data analytics company Palantir Technologies (NYSE: PLTR) has experienced an increase in its growth rate as its customers look to use artificial intelligence (AI) to enhance their day-to-day operations. Palantir has held bootcamps to showcase its new AI platform, AIP, to demonstrate to customers how it can help their businesses. And it looks to be paying off with an improved growth rate.

While many companies may offer to provide AI solutions, it can often be difficult to implement them. That's where Palantir can provide some excellent value to its customers, and it could unlock a tremendous growth opportunity for the business.

Getting from prototype to production isn't easy for many companies

Designing new processes and testing out new AI products can seem easy, but actually implementing changes and putting them into production is a different ballgame, and that's where Palantir sees many companies struggling.

On its latest earnings call, Palantir's Chief Technology Officer Shyam Sankar said, "It is so easy to create an AI prototype, the equivalent effort of making a PowerPoint slide, but it's actually very, very hard to get that in production, probably 10 to 100 times harder than traditional software transitioning to production. And therein lies our entire opportunity in the market."

And not getting projects into production may be a potential source of frustration for companies as they try to justify costly AI initiatives. Research company Gartner estimates that 30% or more of generative AI projects may end up abandoned by the end of next year as businesses struggle to validate the payoff from their investments. This can result in managers feeling the pressure to move projects into production sooner rather than later, which can potentially lead to an increase in demand for Palantir's services, including its AIP.

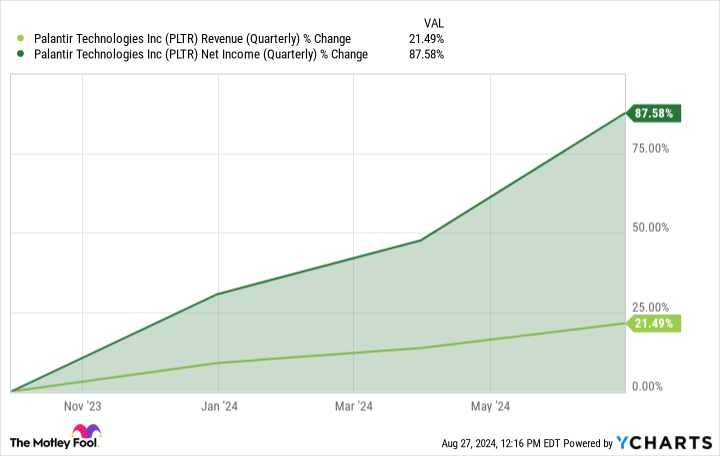

Palantir's sales have been rising, and profits have been accelerating even faster

Palantir's business has been moving in a positive trajectory in recent quarters as not only has it become consistently profitable, but its top and bottom lines have also been increasing. And a particularly positive sign is that profits have been rising at a faster rate than revenue.

PLTR Revenue (Quarterly) data by YCharts.

In its latest quarterly results, which ended on June 30, Palantir's revenue grew by 27% to $678 million, which is faster than the 13% growth it achieved a year earlier.

However, even amid all this revenue and even profit growth, Palantir's stock still doesn't look cheap. With Palantir at more than 180 times its trailing earnings and nearly 90 times next year's estimated future profits (based on analyst expectations), investors are still paying a hefty premium for the business. Even based on revenue, Palantir looks egregiously overvalued, trading at close to 30 times its sales.

Palantir's stock has potential, but it also comes with risks

Palantir has more than doubled in value this year as it has become a popular buy with AI investors. But there are challenges and headwinds looming, including a possible recession and a decline in AI-related spending.

While the business does appear to be moving in the right direction, it's Palantir's pricey valuation that would prevent me from buying shares of the company today. Without a more significant acceleration in its profits or more of a reduction in its stock price, there simply looks to be too much optimism and future growth already priced into its valuation to make it a good buy, and for this to be an investment with a high probability of generating a strong future return.

Investors may want to wait to see if the company can indeed build off its recent results and continue to accelerate its growth rate, because if it can't, the stock could be due for a correction. As of now, it may be a bit too risky to buy the stock given its high price tag.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool recommends Gartner. The Motley Fool has a disclosure policy.

The Big Problem Palantir Technologies Hopes to Solve for Its Customers was originally published by The Motley Fool