You don't have to be a rocket scientist to make money in the stock market. There are intelligent moves everyday investors can make to become wealthier.

If you have $1,000 or so that you don't need for living expenses or to pay down debt, and you want to invest, here are two exchange-traded funds (ETFs) that are particularly smart buys today.

A core index fund with a clever approach to stock weightings

Large-cap stocks serve as excellent foundational investments for many investors' portfolios. An index fund that tracks the S&P 500, which is comprised of 500 of the largest and best businesses in America, can be a great way to gain exposure to this wealth-building asset class.

The Invesco S&P 500 Equal Weight ETF (NYSEMKT: RSP) goes one step further. Unlike most S&P 500 index funds, which are weighted by market capitalization, Invesco's ETF, as its name suggests, weights the stocks that it buys equally.

For investors who want to own large-cap stocks but are concerned that megacap stocks like Nvidia, Apple, and Microsoft have grown too big and account for too large a portion of many index funds, the Invesco S&P 500 Equal Weight ETF could be an excellent choice.

By equally weighting its holdings, Invesco's fund reduces concentration risk. In this way, the ETF provides a greater level of diversification for its shareholders, which it maintains by rebalancing its holdings quarterly.

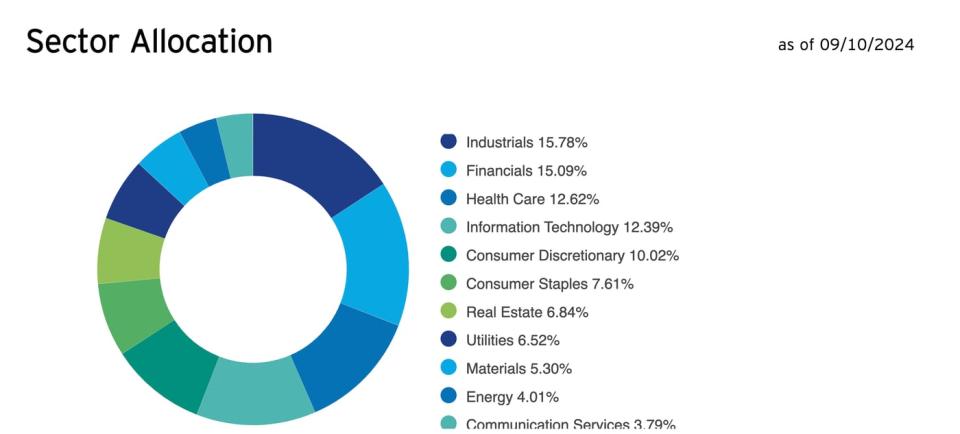

Instead of being overloaded with tech stocks like many large-cap index funds, the result is that Invesco's ETF holdings are more broadly allocated across sectors. Information technology was actually its fourth-largest sector as of Sep. 10, behind industrials, financials, and healthcare.

Finally, Invesco's fees are reasonable. The Invesco S&P 500 Equal Weight ETF has an expense ratio of 0.20%. That amounts to just $2 per $1,000 invested per year.

Smaller companies, bigger potential rewards

If you'd like to add even more growth potential and diversification to your investment portfolio, take a look at the Vanguard Russell 2000 ETF (NASDAQ: VTWO). Vanguard's ETF offers you a low-cost way to invest in a broad collection of small-cap and mid-cap stocks. These smaller businesses tend to have vast expansion potential.

The Vanguard Russell 2000 ETF holds stakes in over 2,000 stocks with a median-market value of $3 billion. That's quite different from the median-market cap of the stocks held by the Invesco S&P 500 Equal Weight ETF, which stood at nearly $100 billion as of June 30. The two funds are thus complementary. Together, they can add both ballast and high-powered growth to your portfolio.

Notably, small businesses tend to be highly sensitive to interest rates. In the current economic environment, that could be a very good thing. With inflation slowing, the Federal Reserve has indicated that it might start cutting rates as soon as this month. That could be a boon for owners of small-cap stocks. Small businesses often rely on loans to scale their operations, so they tend to become more profitable when interest rates fall.

With its annual expense ratio of just 0.1%, the Vanguard Russell 2000 ETF could provide you with a simple, low-cost way to profit from a rate-cut-fueled rally in small-cap stock prices.

Should you invest $1,000 in Vanguard Russell 2000 ETF right now?

Before you buy stock in Vanguard Russell 2000 ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Russell 2000 ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Joe Tenebruso has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The Smartest ETFs to Buy With $1,000 Right Now was originally published by The Motley Fool