Global markets had an acute panic attack this week — a sudden bout of chaos in what has been otherwise a rather placid and predictable year.

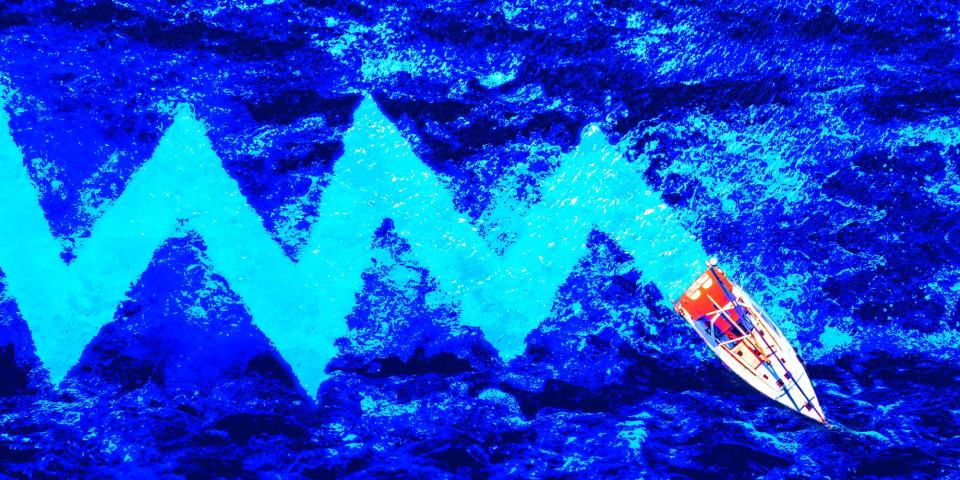

The dizziness started in Asia: Markets crashed in Japan early Monday, with the headline Nikkei index falling by as much as 12.4%. The trembling then spread across the globe as cryptocurrencies — supposedly an uncorrelated store of value — experienced a temporary loss of control, plummeting along with everything else. By the end of the day it was clear that US stock markets could not catch their breath. Fully untethered from reality, hearts palpitating wildly up and down Wall Street, the Dow Jones Industrial Average closed down more than 1,000 points, a 2.6% drop, while the tech stock-heavy Nasdaq tanked by 3.4% and the S&P 500 sank 3%. In the days that followed, the market jumped or fell with each new piece of information, leading to a distinct tightness in every investor's chest.

As with any panic attack, the reasons for its sudden onset are myriad — a compounding of long-known anxieties both in and out of our control. After the Bank of Japan hiked interest rates, the Japanese yen appreciated suddenly, scrambling the carry trade, a popular Wall Street strategy that had been paying off for years but requires placid markets to sustain itself. Added on top were concerns about Big Tech, the backbone of 2024's roaring market. After wrapping up earnings season with little profit to show for investments in AI, worries that companies wasted $1 trillion on this nifty but unproven tech went from whispers to open debate.

Most important, though, was the market's painful processing of the July jobs report, which showed that the US added just 114,000 new jobs last month, well below economists' expectations. The main reason for the market's tranquility this year was the strong conviction that America's battle with inflation would end with a soft landing, an ideal scenario where prices come back under control without a surge of job losses. The recent uptick in unemployment — which rose to 4.3% in July — forced Wall Street to accept that its perfect economic scenario is at risk and that the Federal Reserve, which has been focused on getting inflation under control, may be behind the curve on cutting interest rates to support the labor market. It was enough to send the market into a full-on tantrum.

A soft landing remains Wall Street's base case. Fed Chairman Jerome Powell is likely to step in to boost the economy in September. And it is probable that the recent weakness in the job market is just a level setting back to a more sustainable existence. But even a little doubt can be pernicious for finance, a world ruled by probabilities. After a rather long absence, fears that the US economy could tip into recession came back into view, which caused the people of markets — from the macro traders to the stock jockeys — to panic.

All this bedlam is a warning that a new era is approaching. The inflationary post-pandemic economy is fading, and something new will soon replace it. We do not know if that regime will reward growth or value stocks, whether it will send money flows back to Japan or to Mexico. We do not know this new economy's structure — only that it will be slower than what we're experiencing now and perhaps more "normal" than anything we've seen since the 2008 financial crisis. The plan is to return to a 2% inflation rate and a 2% benchmark interest rate. Exactly how we get there — through a soft landing or after a recession — is the question that will have markets convulsing between fresh data prints and central-bank announcements until we reach our destination. It may be a turbulent ending, but at least it's in sight.

There are levels to this, man

The signs that the economy is slowing are neither unexpected nor unintended. They are part of our recovery from the pandemic. In the face of an economy so hot that both wages and prices shot up uncomfortably, the Fed jacked up interest rates from 0% to 5.25%. The explicit intention was to tap the brakes, slow consumer spending, and get businesses to ease up on some of their hiring. This put Wall Street in "bad news is good news" mode — so-so economic data was proof that higher rates were actually slowing things down, and over the past year, investors got plenty of proof. The consumer price index continued its downward trend in June, coming in at 3%, just above the Fed's 2% target. Fewer and fewer Americans quit their jobs as they became less confident that they'd immediately find new ones. Wages kept rising, but more slowly, which means prices could stabilize.

The more leisurely pace of growth kept the stock market rolling along merrily. Consumers still had money to spend, and after hiking prices during the pandemic, corporates enjoyed record profits. On August 1, the day before the jobs report dropped, the S&P 500 was up 11.8% for the year, while the Nasdaq and the Dow had gained 9.1% and 7%. While there was some demand for protection against the prospect of volatility reemerging, overall sentiment across Wall Street had gotten more bullish.

"We're not seeing a ton of demand for downside protection," Mandy Xu, Cboe's head of derivatives-market intelligence, told me at the end of last month. She added that, for the most part, Wall Streeters were making a lot of bets that the market would go up. When everyone starts betting in the same direction, it gets lopsided.

The sudden reassessment after the jobs report not only caught many investors on Wall Street offside but changed the entire market's tenor — bad news is now bad news. A slowing economy is what policymakers and investors wanted to see, but not one so slow that it could hurt the jobs market or, in the worst case, tip the economy into a full-on recession. The question is whether we are in the former kind of slowdown and not the latter.

If you dig deeper into recent economic data, there's a strong case for the US being in a kinder, more forgiving slowdown. The July jobs report showed wage growth at 3.6% year over year, meaning people are still getting raises even when adjusting for inflation. Over at Apollo Global Management, Torsten Slok, the chief economist, argued to clients that the "source of the rise in the unemployment rate is not job cuts but a rise in labor supply because of rising immigration." In other words, there is no sudden surge in layoffs, just more demand for jobs. In another note to clients on Tuesday, Slok noted that the rate of borrowers defaulting on risky loans has declined over the past year — not what you would expect to see ahead of a recession.

Until Americans lose their jobs, consumers will keep spending. As long as consumers keep spending, the US economy can stay on track. The problem is uncertainty. Until Wall Street can be sure that the consumer will hold on (or not), conviction is easily shaken. And when conviction is easily shaken, there is a heightened risk of stampedes. It takes a lot of data points to get to clarity, and the process of sifting through them to see the new shape of the market is in its early innings.

Not all companies will come out on top in this new environment. Corporations were able to jack up prices over the past three years to pad record profits, but consumers are getting choosier about what they spend their money on, sometimes shifting to cheaper products. This is causing trouble for some brands that pushed their prices too far. Starbucks, which raised prices over the pandemic, missed earnings in the second quarter. McDonald's, which has raised prices by a whopping 40% since 2019, also whiffed. Meanwhile, Shake Shack, which raised prices by only about 8% through the pandemic, beat earnings estimates over the same period. This dispersion in winners and losers means that (gasp!) investors will need to be choosier about the stocks they pick, Kevin Gordon, a director and senior investment strategist at Charles Schwab, told me. Riding an index is not going to cut it anymore.

"The ones that are doing well on pricing power are doing well. The ones who are not are getting crushed for missing estimates," he told me. "Companies that benefited from the inflation wave are no longer benefiting."

Over the past few years, some of Wall Street's most prominent investors have complained that the art of fundamental financial analysis has been lost. Digging for cheap stocks, reading balance sheets, listening to investor calls — some of that has been replaced with quant trading and index hugging. Perhaps it will find its place in the market to come, or maybe it's just a stop on the way to the next trend. Part of the chaos of this moment is that no one knows.

Known knowns and unknown knowns

Investors have spent most of the past four years trying to get their heads around one unknown after another. Since 2020 they've gone from pandemic-driven emergency interest-rate cuts to historically fast, inflation-fighting interest-rate hikes. The economy was essentially put into sleep mode, scarcity pushed prices up, and corporations laid off workers only to bring them back. If this felt like a wild ride, that's because it was. After all that weirdness and uncertainty, returning to a normal state of affairs can feel like its own kind of shock. If all goes to plan, that is the kind of market we'll be entering: normality. A "normal" economy with inflation near 2%, steady job gains dispersed across industries, and a Fed that can maybe fade into the background for a while. Be boring.

The Fed is likely to cut rates in September, but if the economy's deterioration accelerates, the probability of a recession increases, and those cuts may not be enough to stop it. A recession is a "normal" event, too, just not a particularly fun one. After years of weird times and outsize gains, Wall Street is dancing on a knife's edge. Trades that worked in our strange post-pandemic market will not work under a more standard economic regime of low inflation and lower interest rates. As we saw with the carry-trade blowup, changing those positions generally means violence. What happened on Monday was a sudden realization that the new structure may assert itself before Wall Street imagined it would. Expect more mayhem as the market parses every new piece of information, grasping for something solid, moving with whatever data eases or engenders recession fears. This is the tune the market is dancing to now. It's a kind of chaos, but consider it positive chaos.

Linette Lopez is a senior correspondent at Business Insider.

Read the original article on Business Insider