What makes the ultimate growth stock? Beyond high growth rates, I'd say it has to have long-term growth drivers, be on the cusp of or already demonstrating profitability, have some sort of hedging or resilience, and not be overvalued.

Sounds too good to be true? Check out Nu Holdings (NYSE: NU). Nu is a Brazil-based digital bank that offers a wide array of financial services in three Latin American countries, and it appeals to a broad base of customers through its low rates, easy-to-use platform, and modern technology. It has all this and more.

High growth rates

Quarterly growth rates have been incredibly high for Nu as it adds customers at a fast pace -- and these customers are engaging at high rates. Nu added more than 5 million customers in the second quarter, zooming past 100 million for the first time, for a total of 104.5 million. Customers in its headquarters and main market of Brazil are still joining at a healthy clip despite more than half the adult population -- 56% -- already using the platform, and engagement rates are increasing as well, reaching 83.4% in the quarter.

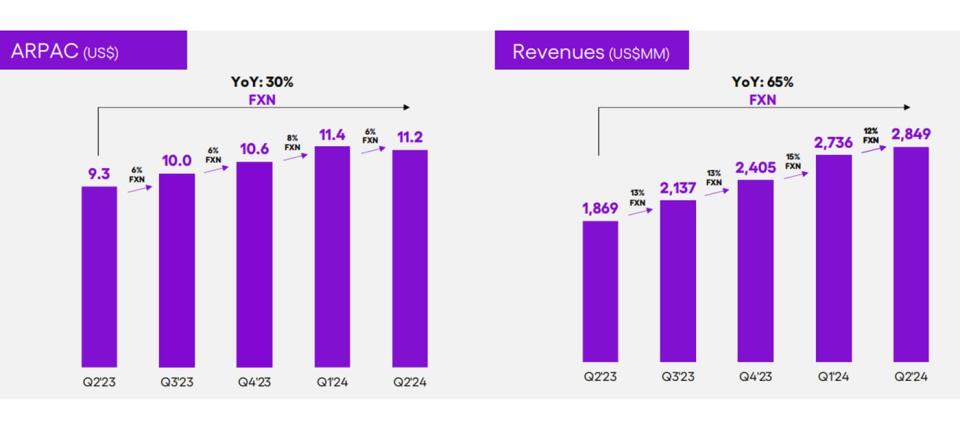

Average revenue per active user (ARPAC) increased 30% year over year, and it keeps growing sequentially as well on a currency-neutral basis.

Long-term growth drivers

The bank is still capturing market share in Brazil, and it's growing even faster in its newer markets of Mexico and Colombia. Mexico added 1.2 million customers in the second quarter for a total of 7.8 million, while Colombia surpassed 1 million in the quarter.

It still has limited services in the countries, and it only recently launched its high-interest savings account that's attracting new membership. Growth in the Mexico business was the main driver of deposit increases in the second quarter, with deposits there tripling over the past two quarters since launching the savings account. Management says these two markets are still in their "investment phases."

As Nu picks up more accounts and launches new services, it's leading to higher engagement and more cross-sells and upsells. That should keep growth rates robust for the foreseeable future.

Near or demonstrating profitability

All of that could still pose risk if Nu wasn't turning sales dollars into profits. But the company has been reporting strong profits for several consecutive quarters, driven by a stable cost to acquire and a low cost to serve that it says is 85% lower than incumbents. Increases in deposits are also driving higher net interest income (NII) and margin (NIM) in the credit business. NII increased 77% year over year in the second quarter, while NIM rose from 13% to 14%. Total net income increased 134% to $487 million currency neutral.

Nu is demonstrating this kind of profitability even though the Mexico and Colombia businesses remain in the red. It's important for a company that can grow long term to have that kind of capital available to grow without worrying about overall profitability, which is likely one of the reasons Warren Buffett likes this stock.

Hedging its bets

Buffett has talked about varied earnings streams as a feature he looks for in a stock, and Nu is expanding its platform to protect its business. It has diversified to cover bank accounts, lending products, and other financial services.

The high growth in deposits, which is what's driving growth in its newer markets, gives it cash to drive its lending business, and it has taken on some extra risk and defaults, given its swelling and healthy credit portfolio. The total portfolio increased 49% year over year in the second quarter, and loan originations increased 78%.

Reasonable valuation

Nu stock trades at a forward price-to-earnings ratio of 23, which looks like a bargain in relation to its performance and opportunities. It certainly looks reasonably valued compared with other high-growth stocks.

Too good to be true?

So is Nu a no-brainer buy? There's still some risk because it operates in a region where there's high economic volatility, and it's still a fairly young company. That's mitigated by its strong risk management and stability thus far.

It's also a Buffett stock. That's not proof of anything, but since Buffett generally avoids riskier stocks, it gives investors a flavor for the level of risk with Nu stock. I'd say it's minimal at this point.

If you have $500 to spend after paying down debt and saving for an emergency, you can get a fair amount of Nu stock while it's still below $15. You'll thank yourself later.

Should you invest $1,000 in Nu Holdings right now?

Before you buy stock in Nu Holdings, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nu Holdings wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Jennifer Saibil has positions in Nu Holdings. The Motley Fool recommends Nu Holdings. The Motley Fool has a disclosure policy.

The Ultimate Growth Stock to Buy With $500 Right Now was originally published by The Motley Fool