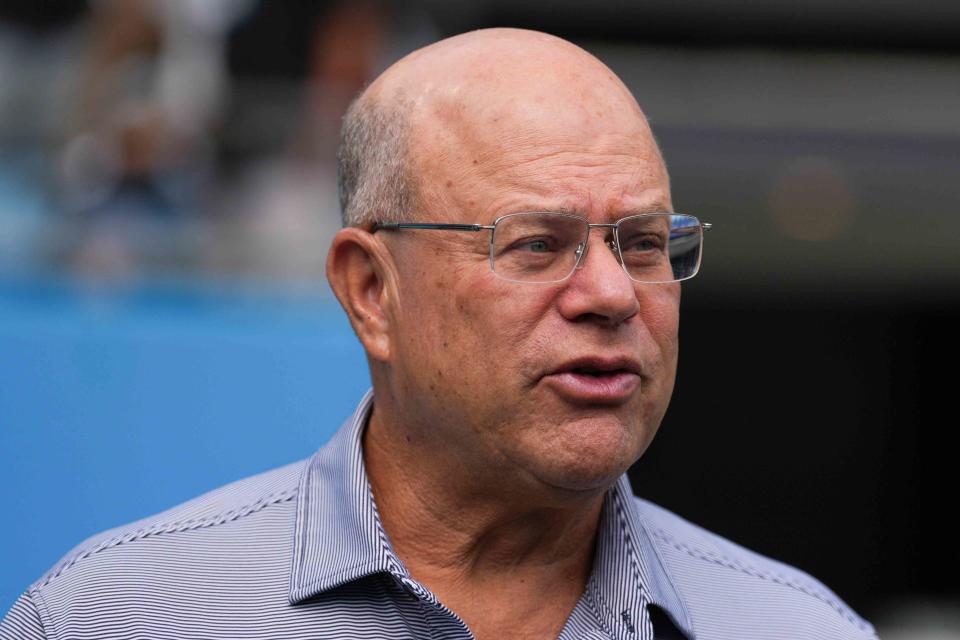

Grant Halverson / Stringer / Getty Images

David Tepper, founder of Appaloosa Management.Key Takeaways

Billionaire David Tepper, in an interview with CNBC Thursday, said that following China's massive stimulus effort announced Tuesday, it's time to invest in the country.

The Appaloosa Management founder said he would buy “everything” in China. “ETFs, I would do futures. Everything,” said Tepper, who also owns the Carolina Panthers.

Tepper said many Chinese companies were attractive because they had low price-to-earnings multiples and good growth prospects.

Billionaire hedge-fund manager David Tepper has an ambitious call: Go big on China.

In an interview with CNBC Thursday, the founder of Appaloosa Management said that following China's massive stimulus effort announced Tuesday, it's time to pile in. "It has implications in bonds, currencies, and stocks," said Tepper.

After Beijing's stimulus announcement, Tepper said, he would invest in “ETFs, I would do futures, Everything."

Tepper, who earlier this year doubled his stake in e-commerce giant Alibaba Group (BABA), Chinese ISP Baidu (BIDU), and online agriculture retailer PDD Holdings (PDD), also owns the Carolina Panthers.

The renowned investor said he favored many large Chinese companies because they had "single-digit [price-to-earnings] multiples with double-digit growth." Tepper added that Beijing's push to allow stock buybacks also made them attractive.

Tepper said he'd made a similar call in 2010, a period that followed huge growth in Chinese stocks before a crackdown by Beijing on its tech giants and the country's slowing economy started a downward spiral in shares.

Bank of America Sees Fiscal Measures Coming in Next Few Weeks

Still, most economists and analysts were disappointed with Tuesday's swath of measures, noting that a big fiscal push rather than monetary measures is what's needed to boost the country’s weak domestic demand levels.

In a note Wednesday, Bank of America analysts said they expect China to announce a fiscal package in the coming weeks, including "demand-boosting stimulus on consumption and investment, as well as further enhancement of social security, healthcare, and pro-birth measures."

Read the original article on Investopedia.