This week's stock market movement features a lot of fear. Tech stocks sold off heavily, while safe-haven stocks like utilities and pharmaceuticals saw increased interest. The Nasdaq entered correction territory, falling more than 10% off its recent highs. A relatively weak jobs report (114,000 created vs. 185,000 estimates) has some thinking about a recession again and selling stocks. Many investors get understandably jittery during these events. However, market pullbacks are entirely normal.

I look forward to these opportunities. Finally, investors can purchase stocks at reasonable prices rather than at all-time highs.

Even the "Magnificent Seven" stocks are not immune to a correction. Amazon (NASDAQ: AMZN) is trading 20% below its recent high, as shown below.

The downturn looks like an excellent opportunity for investors to pick up shares at a great price.

Here's why.

Were Amazon's earnings actually "bad"?

The market wasn't pleased with Amazon's second-quarter earnings, but I think some are having trouble seeing the forest for the trees. Net sales increased 10% to $148 billion in Q2, a slowdown from the 13% growth in Q1. This should not be a surprise, given the economy-wide slowing of consumer spending. Amazon's operating income jumped 91%, from $7.7 billion in Q2 last year to $14.7 billion this year. While this looks terrific compared to 2023, it is 4% less sequentially. The slight slowdown in growth from Q1 to Q2 and new recession fears are worrying Wall Street. But Amazon's results were stellar where it matters most: AWS.

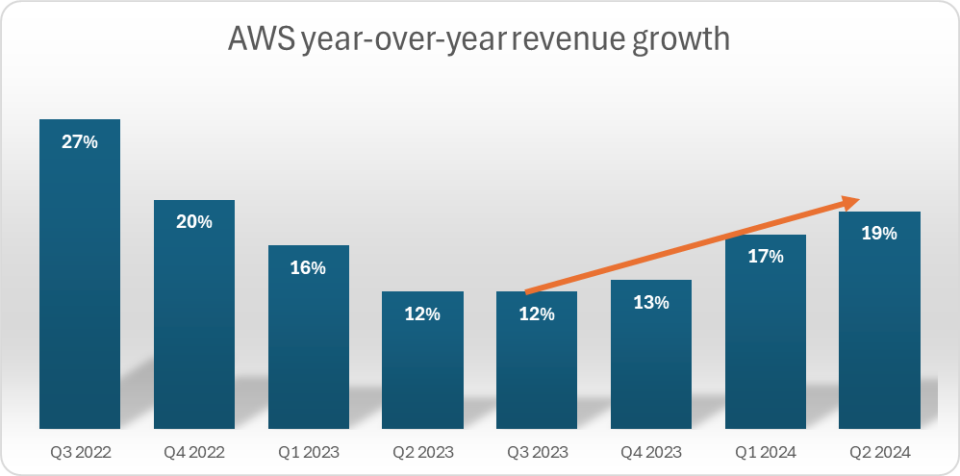

AWS is Amazon's cash cow. The cloud segment accounted for $66 billion in operating profits for 2021-2023 combined, a whopping 89% of the company's total operating profit. This is despite a rough 2023 when companies cut data budgets in anticipation of a recession that never came. But artificial intelligence (AI) is now a massive tailwind for cloud service providers. Generative AI programs require incredible data and processing power, and AWS will be a major beneficiary.

As shown below, AWS revenue growth accelerated in each of the last three quarters.

This trend is encouraging and bodes well for Amazon's results and stock over the long haul.

Is Amazon stock a buy now?

When valuing Amazon, I like to look at its price-to-sales (P/S) ratio and its price-to-cash from operations (CFO). Cash from operations, often called operating cash flow, is important because it tells us how much money a company's primary business generates.

As depicted below, Amazon is undervalued by 13% based on sales and 75% based on cash flow compared to its 10-year averages.

This is the lowest it has traded based on cash flow in over 10 years.

Valuing Amazon requires looking past a simple price-to-earnings (P/E) ratio, but the current P/E ratio of 38 is also the lowest in more than 10 years.

Amazon's overall sales growth could continue hovering near 10%. Management guided for 8% to 11% growth next quarter. However, AWS is the profit center; it has AI tailwinds and accelerating growth. At times like these, I like to remember two things that Warren Buffett says: "Be greedy when others are fearful" and "the stock market is a device for transferring money from the impatient to the patient." This advice could work well for Amazon investors.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $641,864!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 6, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Bradley Guichard has positions in Amazon. The Motley Fool has positions in and recommends Amazon. The Motley Fool has a disclosure policy.

This "Magnificent Seven" Stock Looks Like a Steal Amid the Sell-Off was originally published by The Motley Fool