A widely followed cryptocurrency analyst and trader is leaning bearish on Bitcoin (BTC) while offering his opinion on two altcoins.

Starting with Bitcoin, the analyst pseudonymously known as Sherpa tells his 222,600 followers on the social media platform X that Bitcoin is headed to a price of $45,000, around 20% below the current level.

From the widely followed analyst’s chart, it appears that Sherpa is suggesting that the level around $45,000 is a pivotal support zone on the weekly time frame. It also appears that the support area falls at the 0.5 Fibonacci retracement level when the start and end points under consideration are the beginning of the bull cycle in late 2023 and the all-time high of around $73,800, respectively.

Bitcoin is trading at $56,207 at time of writing.

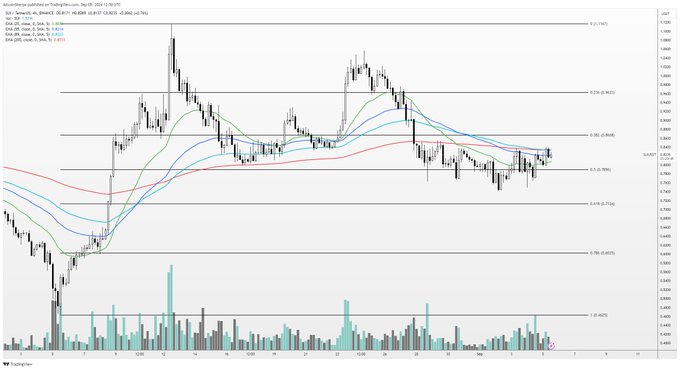

Next up is the Solana (SOL) competitor Sui (SUI). Sherpa says that the price action of the layer-1 blockchain “still looks good” in the four-hour time frame. The pseudonymous analyst says he is going to load up on the altcoin for a short-term time horizon.

“NOT a long-term hold at all. [Token] unlocks are going to destroy this thing long-term. As a trade, looks interesting.”

SUI is trading at $0.849 at time of writing.

Next up is the decentralized machine learning and artificial intelligence platform Bittensor (TAO).

According to Sherpa, TAO is likely to trade in a range for a while before breaking out to the upside. Based on the pseudonymous analyst’s chart of TAO on the daily time frame, it appears that he is suggesting that Bittensor could revisit a support zone lying slightly below the $200 price before embarking on an uptrend move.

TAO is trading at $238 at time of writing.

Generated Image: Midjourney