Fidelity's FBTC sees second-largest withdrawal amid ETF downturn.

Key Takeaways

- Fidelity's FBTC faced a significant withdrawal, marking its second-largest since inception.

- Grayscale's GBTC approaches $20 billion in cumulative outflows amid market challenges.

ETF investors hit the sell button after returning from the Labor Day holiday weekend.

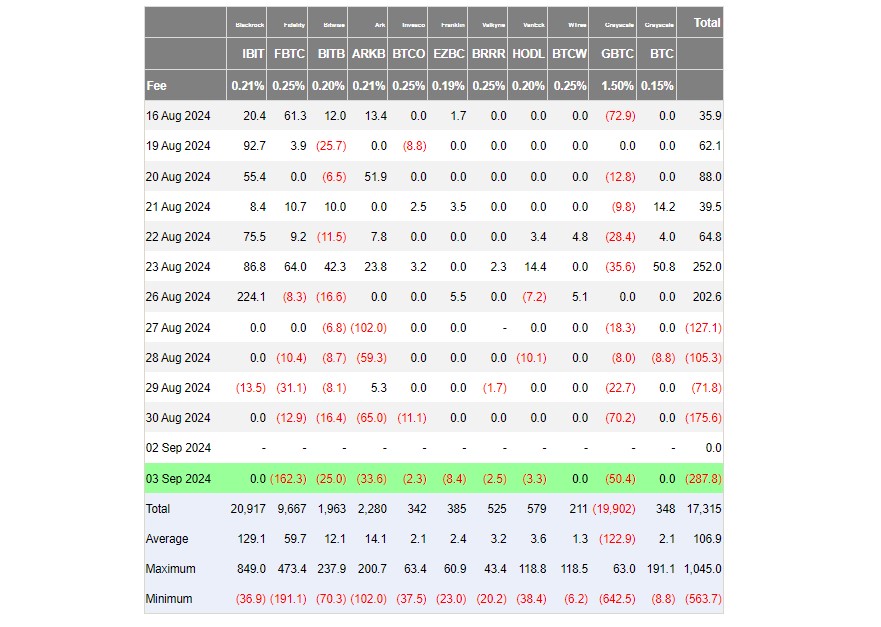

US spot Bitcoin exchange-traded funds (ETFs) kicked off September trading with approximately $288 million in net outflows on Tuesday, data from Farside Investors shows. These funds have seen their fifth consecutive day of net outflows, collectively shedding over $750 million since last Tuesday.

The post-Labor Day ETF market saw a wave of selling pressure, with 8 out of 11 Bitcoin funds reporting negative performance.

Outflow king, Grayscale’s GBTC, ended Tuesday with over $50 million in net outflows, but the spotlight was on Fidelity’s FBTC as the fund saw around $162 million withdrawn, its second-largest outflow since launch.

Competing Bitcoin ETFs managed by ARK Invest/21Shares, Bitwise, Franklin Templeton, VanEck, Valkyrie, and Invesco, also contributed net outflows.

The rest, including BlackRock’s IBIT, WisdomTree’s BTCW, and Grayscale’s BTC, reported zero flows.

Grayscale’s GBTC approaches $20 billion in net outflows

Total outflows from GBTC may soon surpass $20 billion, according to data from Farside Investors. Despite recent signs of a slowdown following months of massive selling, the fund still sees capital bleeding.

The recent drop in Bitcoin’s value has reduced Grayscale’s assets under management to approximately $13 billion.

Some of the GBTC outflows were driven by the selling of many crypto companies that went bankrupt in 2022 and 2023 and held Grayscale’s Trust shares on their balance sheets.

Once the Trust converted to an ETF, these companies sought to sell their shares to repay creditors, Michael Sonnenshein, CEO of Grayscale, said previously.

Grayscale has lost its lead in the Bitcoin ETF market to BlackRock. BlackRock’s IBIT ETF has attracted nearly $21 billion since its launch, making it the world’s largest Bitcoin ETF.”