Bitcoin surges as US economic indicators show improvement.

Key Takeaways

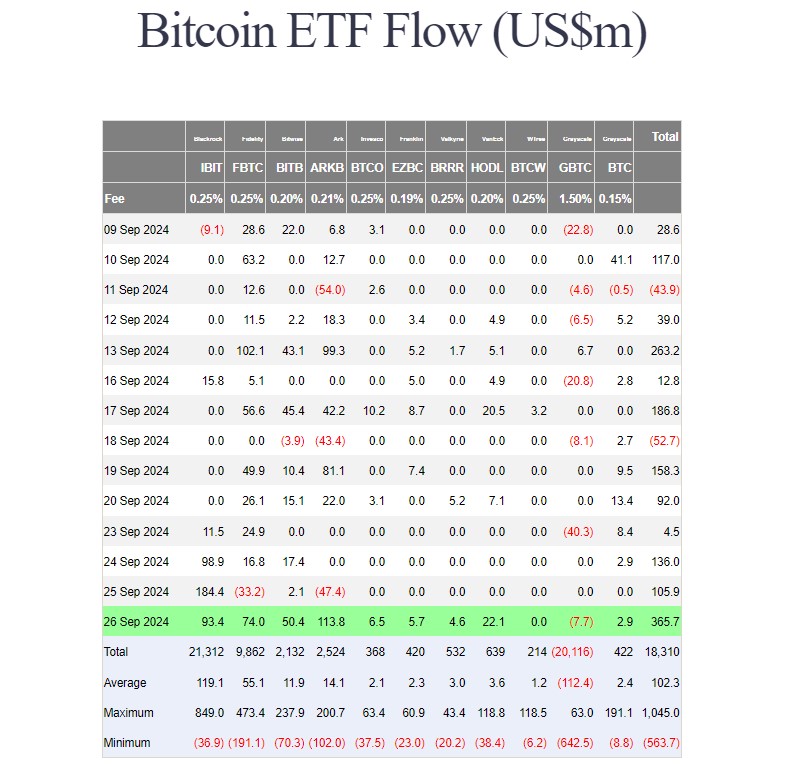

- US spot Bitcoin ETFs have garnered over $600 million so far this week.

- ARK Invest's ARKB led with $114 million in new capital on Thursday.

US investors poured around $365 million into the group of spot Bitcoin ETFs on Thursday, bringing the total net buying to over $600 million so far this week, according to Farside Investors data. The strong inflows came amid Bitcoin’s surge to $65,000, hitting a monthly high.

After losing on Wednesday, ARK Invest’s ARKB was back strongly yesterday, leading the pack with approximately $114 million in new capital.

BlackRock’s IBIT extended its winning streak, logging around $93 million on Thursday while Fidelity’s FBTC and Bitwise’s BITB collectively drew in about $124 million.

Other gains were also seen in funds managed by VanEck, Invesco, Valkyrie, and Franklin Templeton. WisdomTree’s BTCW was the only ETF with zero flows.

Grayscale’s Bitcoin Mini Trust captured nearly $3 million on Thursday. In contrast, its high-cost product, the GBTC fund, lost around $7 million, the lowest outflow in the last two weeks.

Renewed interest in spot Bitcoin ETFs coincides with Bitcoin’s recent price increase.

Bitcoin surged past the $65,000 level on Thursday after US GDP growth rose to 3% and weekly jobless claims unexpectedly decreased.

Positive economic indicators, coupled with the Fed’s recent interest rate cut and potential stimulus measures in China, have likely contributed to Bitcoin’s price rally.

More rate cuts?

The Fed’s inflation gauge, the Personal Consumption Expenditure (PCE) index, is scheduled to be published at 8:30 AM ET on Friday.

Analysts expect the headline PCE to decline to 2.3% year-over-year in August, which would be the lowest level for four years. The core PCE is forecast to rise by 2.7% annually.

Morningstar’s Preston Caldwell forecasts that overall PCE increased by 0.15%, and core PCE increased by 2.4%. If his predictions are correct, he anticipates the Fed will cut interest rates by 25 basis points in November and December.

A potential rate cut could have a positive impact on Bitcoin’s price. Lower interest rates make riskier assets like Bitcoin more attractive to investors, potentially pushing prices higher.