Today, enjoy the Empire newsletter on Blockworks.co. Tomorrow, get the news delivered directly to your inbox. Subscribe to the Empire newsletter.

Happy Friday! To celebrate the impending weekend, we’ve put together a new Friday format for you.

This time around, we’re diving headfirst into a new Avalanche partnership for Franklin Templeton, and the crew at Delphi give us all a cycle update.

Carving up turf

A war is being fought over blockchain mindshare by two of Wall Street’s largest operators.

Some would say Franklin Templeton started it by rolling out a tokenized money market fund, FOBXX, on Stellar in 2021.

The fund, which buys government securities with customer cash that’s pooled via an official app, had $100 million in play at the start of last year.

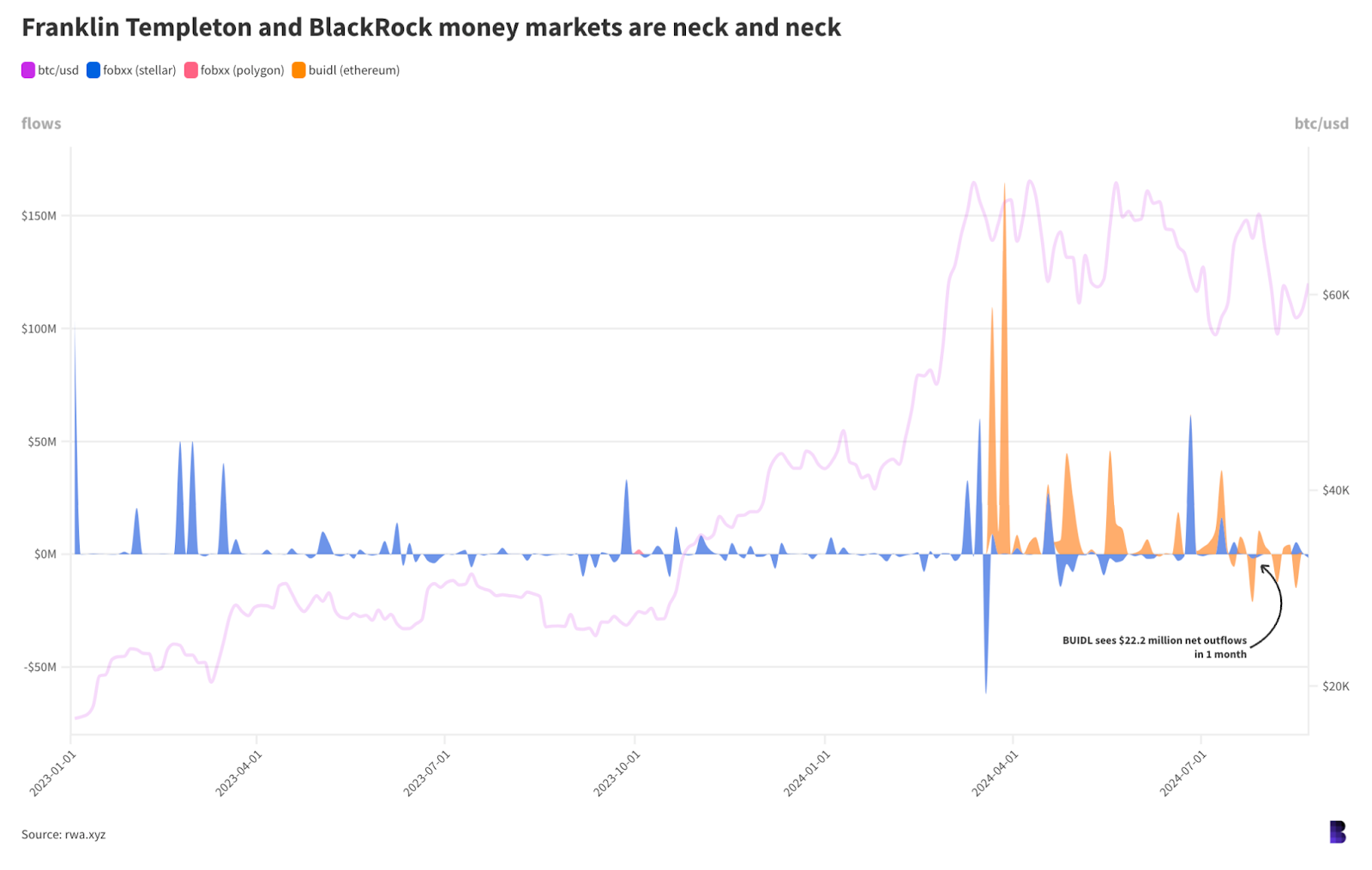

Now FOBXX has over $424 million with 462 token holders, second only to BlackRock’s newer offering on Ethereum, BUIDL, which has so far attracted $502.7 million from 17 token holders since it launched in March — just as bitcoin was at all-time high.

Both BUIDL and FOBXX are the largest tokenized money market funds right now.

Crypto native outfit Ondo follows with $282.3 million from a much larger userbase of 4,230 — which makes sense considering it’s available on both centralized and decentralized exchanges, unlike BUIDL and FOBXX.

With Franklin Templeton expanding FOBXX to also operate on Avalanche, it seems that traditional finance giants are really in the business of marking their tokenization territories, even if there’s no rights to exclusivity.

Franklin Templeton now has Stellar (as does WisdomTree), Polygon and more recently Arbitrum, although nobody has subscribed to the fund through the latter so far. And BlackRock has Ethereum.

“We think there’s an exciting array of digital nation-states, and we think they’re attacking and creating new solutions that exist because of the upgraded technology, and we want to partner across [that space],” Roger Bayston, head of digital assets at Franklin Templeton, told us.

“We think there’s going to be lots of winners, because there’s lots of business to do. If you’re in the business of selling block space, then there’s a lot of business to unfold. You have to have the right technology to optimize that.”

And OK, all those networks are permissionless and anyone can build anything they like on them, including Wall Street.

But if carving out available liquidity is the name of the game for crypto-forward finance shops, then exactly who is launching what and where would be top of mind for executives planning the next move.

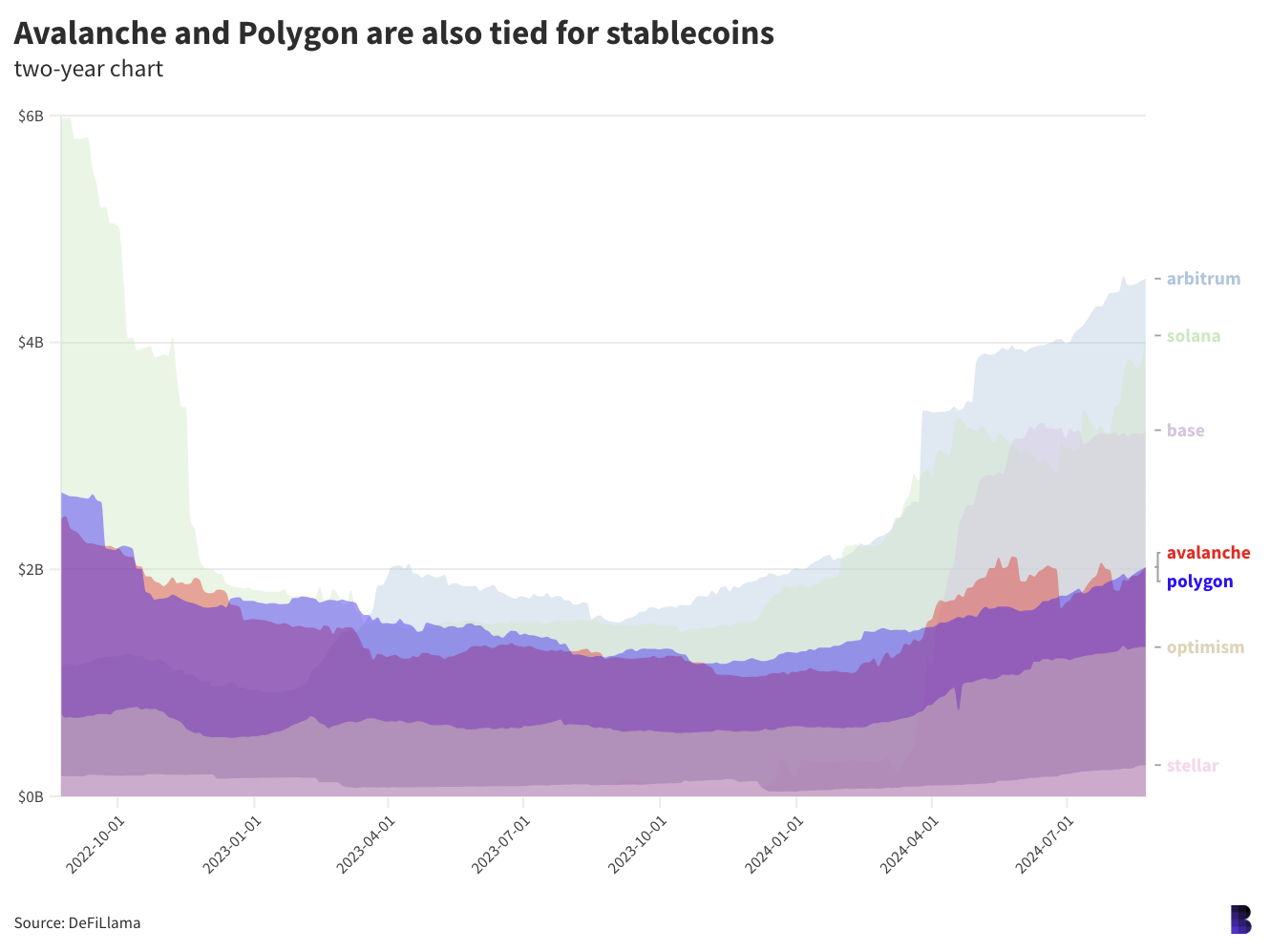

So, where to after Avalanche? If liquidity is truly a factor in those decisions, stablecoin supplies could offer some insight.

It turns out that Avalanche and Polygon have practically the same stablecoin supplies of around $2 billion.

Base and Solana otherwise have $3.2 billion and $4 billion, slightly trailing Arbitrum, and they’d be our bets for where to next.

— David Canellis

IYKYK

On today’s Empire episode, Jason (Yanowitz, though I’d really hope you knew that by now) sat down with Anil Lulla, Yan Liberman, and José Maria Macedo from Delphi to round out the week.

In crypto, Lulla said, don’t bother with a five or 10 year plan. If you need it, “you’re not going to make it.”

“The tricky thing relative to previous cycles was just the fact that not everything goes up now, whereas before… you just have to kind of be right and bet on the fastest horse,” Liberman said.

And things have changed for a couple of reasons. One is pretty clear: People have “wised up,” as Liberman put it. Folks can fall back on historical data in a way they haven’t previously been able to before, and “there’s an element of survivorship bias.”

There’s also less retail this time around, which certainly isn’t helping things.

https://open.spotify.com/episode/6G62868DoOeT91kV3tqlKr

But that’s not to rain on anyone’s parade: You can still be successful, you just can’t pull the same tactics as last cycle.

And now you know.

One other thing discussed on the pod was where we’re at in the cycle, with Delphi’s Liberman still calling it “fairly early.” This lines up with some of the reporting we’ve presented in other editions. I then always have to ask, “but where do we go then?” and it feels like there are a lot of unknowns at this point.

Maybe we’ll get some clarity next month and break out of the current sideways action we’re seeing at the moment. It seems a lot of bullishness stems from the potential for more TradFi adoption and regulatory clarity. It’s anecdotal, but other aspects of crypto appear to have taken the backseat for now.

Though I’m always curious, dear reader, if you have a different take. My inbox is open.

— Katherine Ross

Start your day with top crypto insights from David Canellis and Katherine Ross. Subscribe to the Empire newsletter.

Explore the growing intersection between crypto, macroeconomics, policy and finance with Ben Strack, Casey Wagner and Felix Jauvin. Subscribe to the On the Margin newsletter.

The Lightspeed newsletter is all things Solana, in your inbox, every day. Subscribe to daily Solana news from Jack Kubinec and Jeff Albus.

- BlackRock

- Delphi

- Empire Newsletter

- Franklin Templeton