The retailing giant offers low-cost options and household necessities, meaning it’s a top option even as shoppers pull back on nonessential items. Also, booming demand for curbside pickup and delivery services fueled a 21% jump in Walmart’s quarterly e-commerce revenue. And its expanding network of third-party merchants and resulting advertising sales (up 26%) indicate blossoming growth areas for the company.

WMT already owns a sizeable advantage in terms of retail footprint among its competitors. Its growing e-commerce and third-party ecosystems could help it thrive more. That’s especially true if the company’s substantial AI investments pay off in the efficiencies they seek. All in all, this is what led to WMT announcing a stock split in February.

It’s no wonder WMT shares are up 47% this year – and they could rise more. MAPsignals data shows how Big Money investors are betting heavily on the forward picture of the stock.

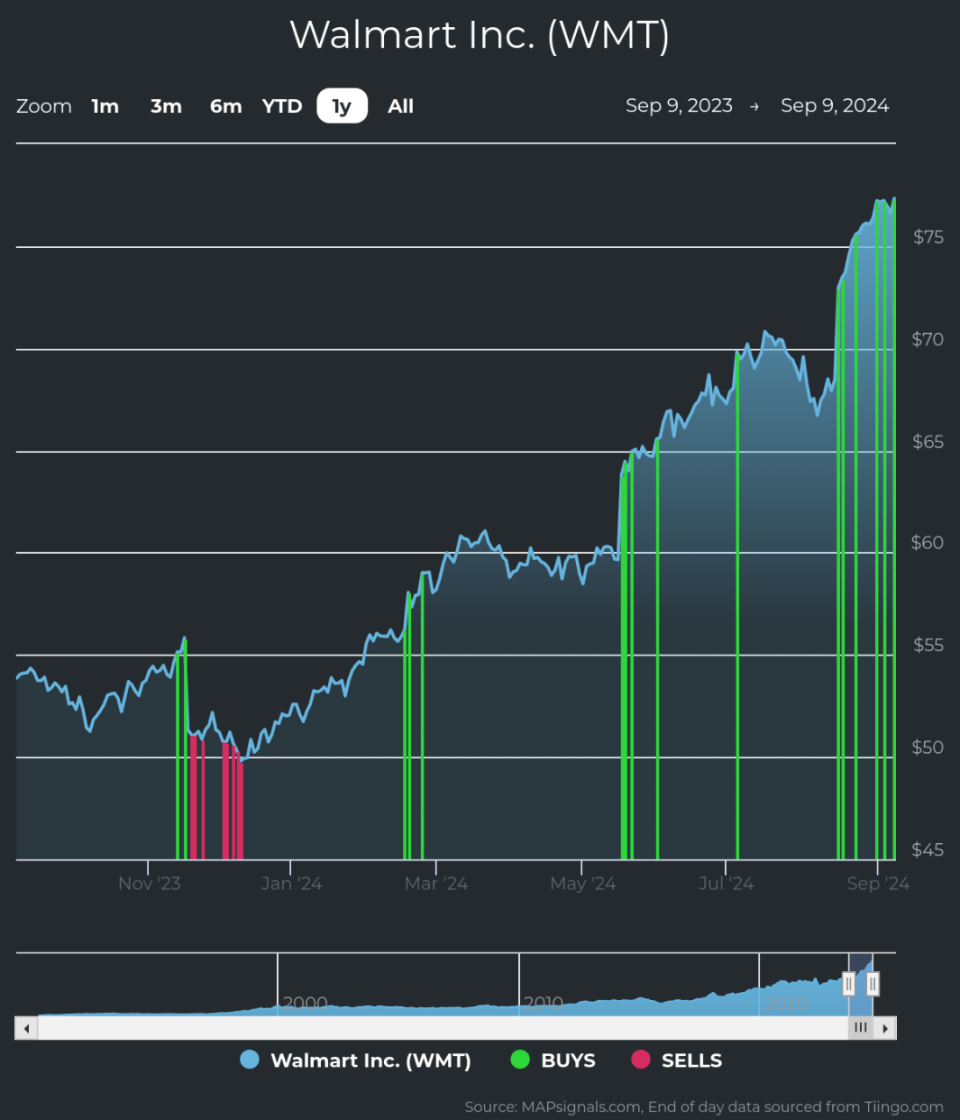

Walmart Shares Under Accumulation

Institutional volumes reveal plenty. In the last year, WMT has enjoyed strong investor demand, which we believe to be institutional support.

Each green bar signals unusually large volumes in WMT shares. They reflect our proprietary inflow signal, pushing the stock higher:

Plenty of staples names are under accumulation right now. But there’s a powerful fundamental story happening with Walmart.

Walmart Fundamental Analysis

Institutional support and a healthy fundamental backdrop make this company worth investigating. As you can see, WMT has had strong sales and earnings growth:

3-year sales growth rate (+5.1%)

3-year EPS growth rate (+8.2%)

Source: FactSet

Also, EPS is estimated to ramp higher this year by +11.3%.

Now it makes sense why the stock has been powering to new heights. WMT has a track record of strong financial performance.

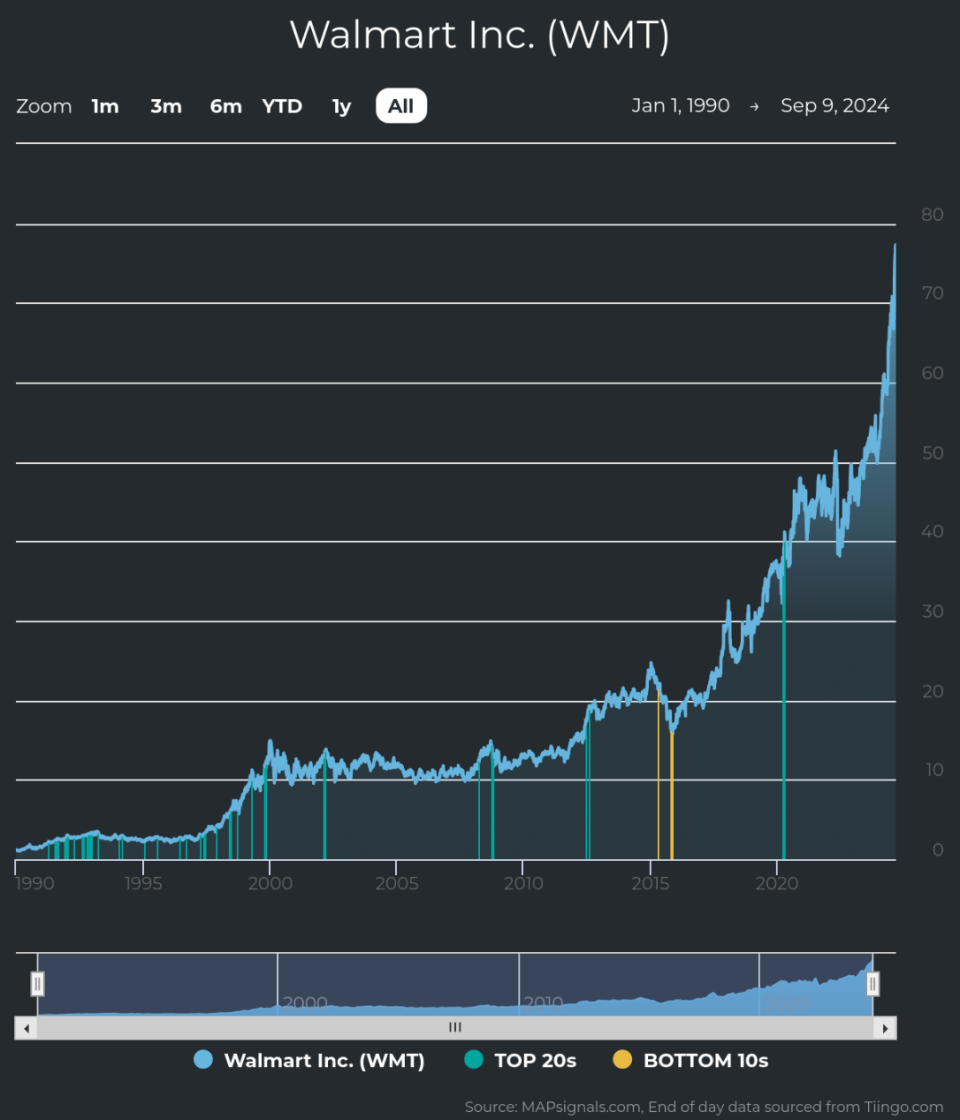

Marrying great fundamentals with our proprietary software has found some big winning stocks over the long term.

Walmart has been a top-rated stock at MAPsignals. That means the stock has unusual buy pressure and growing fundamentals. We have a ranking process that showcases stocks like this on a weekly basis.

It’s made the rare Top 20 report multiple times since 1990. The blue bars below show when WMT was a top pick…making the share price rise:

Tracking unusual volumes reveals the power of money flows.

This is a trait that most outlier stocks exhibit…the best of the best. Big Money demand drives stocks upward.

Walmart Price Prediction

The WMT rally isn’t new at all. Big Money buying in the shares is signaling to take notice. Given the historical gains in share price and strong fundamentals, this stock could be worth a spot in a diversified portfolio.

Disclosure: the author owns WMT in personal and managed accounts at the time of publication.

If you are a Registered Investment Advisor (RIA) or are a serious investor, take your investing to the next level, learn more about the MAPsignals process here.

This article was originally posted on FX Empire