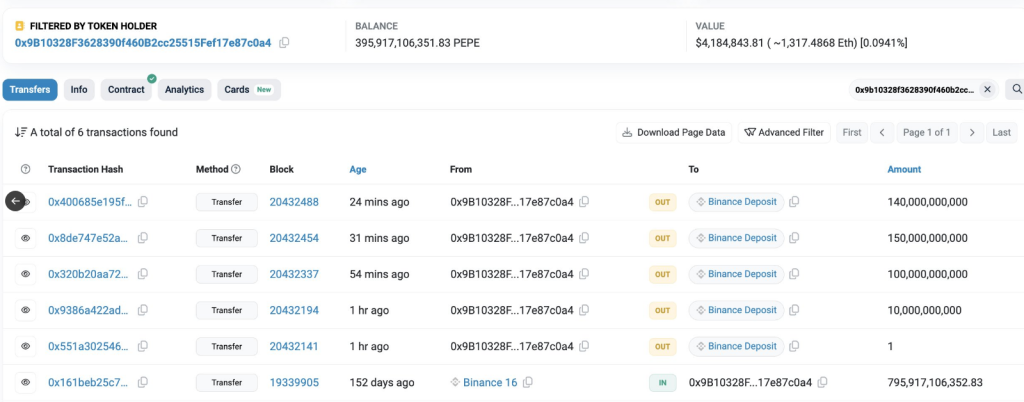

Recently, a massive transaction shook the digital currency ecosystem. A prominent whale transferred 400 billionPEPE tokens—worth about $4.22 million—to Binance.

Strategically timed among the general negative market mood, this move seems to be a deliberate one for partial profit booking. The whale’s behavior corresponds to the breach of a critical support level around $0.00001075, a key threshold that has lately increased the downward pressure on PEPE’s price.

A whale deposited 400B $PEPE($4.22M) to #Binance to take profits in the past hour.

The whale withdrew 795.92B $PEPE($2.55M at the time) from #Binance on Mar 1 and currently has 395.93B $PEPE($4.18M) left.

His total profit on $PEPE is $5.85M, the ROI is 230%!… pic.twitter.com/o7T1ihjoq9

— Lookonchain (@lookonchain) August 1, 2024

Previously active on March 1st, the whale pulled out 795 billion PEPE tokens from Binance, worth $2.55 million. Even with this big withdrawal, the whale still has a decent 396 billion PEPE, which means it has an unrealized profit of $5.85 million, or a 230% return on investment. This amazing financial dance shows how smart the whale is and how dangerous it is to trade PEPE in a market that is always changing.

Pepe Technical Study: Negative

PEPE is trading at about $0.00001051 as of the most recent report, a 7.5% decline in price over the last 24 hours. Concurrently, trade volume has jumped by 14%, indicating a change in market involvement and investor participation.

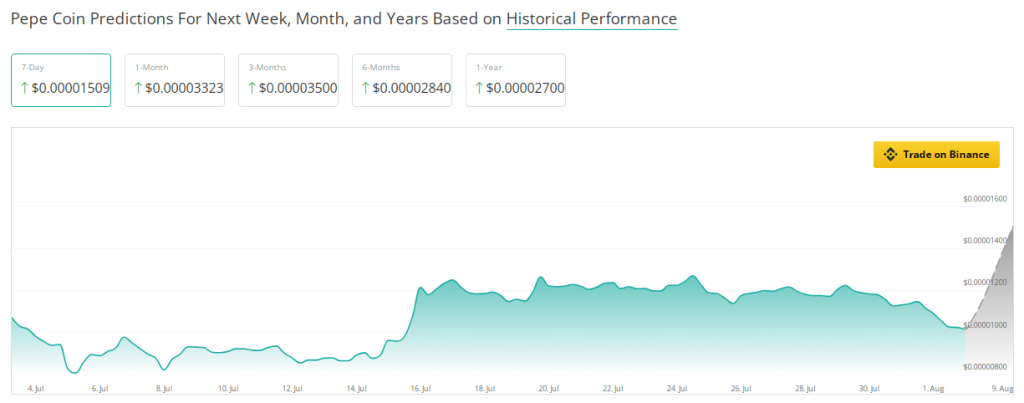

Technical study shows a pessimistic view of the cryptocurrency despite this higher activity. With forecasts showing a possible 20% collapse in the short future, the recent violation of the important support level of $0.00001075 is expected to propel further drops.

The 200 Exponential Moving Average (EMA) suggests PEPE may find support around $0.0000852. Despite the gloomy market, this technical indicator suggests price stabilization. Technical indicators and market dynamics challenge PEPE’s prospects.

Liquidation Levels And Possible Rebound

The latest development also puts into perspective PEPE’s main liquidation thresholds, which lie on the lower end at $0.000010 and on the upper end at $0.0000118. Should the bearish mood persists, the meme coin may experience a downward motion below $0.000010, forcing the liquidation of around $2.04 million in long bets.

Conversely, a shift in market sentiment could result in PEPE falling below $0.0000118, which would result in the liquidation of approximately $13.4 million in short positions.

Beyond the current volatility, PEPE projections remain somewhat positive, though short-term forecasts show a significant comeback with an expected 249.99% gain over the following three months.

Related Reading: Can Bitcoin Cash (BCH) Go Up 680% This Week? This Analyst Believes So

With expected rates of 183.50% over six months and 169.42% over one year, the longer horizon seems as bright. These scenarios could be good news for the popular meme coin as it maneuvers its way into the volatile crypto market, but all things considered PEPE could be headed in the right direction.

In essence, the larger projection stays robust even if PEPE has major short-term difficulties and liquidation hazards. The direction of the token will be greatly shaped by the combination of whale movements, technical indicators, and market emotion.

Featured image from , chart from TradingView