Bitcoin teases us at $60K, then dips to $58K.

It's like trying to nail jelly to a wall - frustrating, messy, and oddly captivating.

We're all here, fingers hovering over buy and sell buttons, waiting for that bull run.

While we ponder these crypto conundrums, let's dive into today's top stories:

TLDR:

Franklin Templeton's launching a crypto index ETF called EZPZ. When is it launching? And will this fund have enough demand?

Bitcoin's market dominance might not hit previous peaks. Are alts stealing the spotlight? Which alts should we look out for?

Trump's crypto portfolio revealed. What bags is he holding?

Coinbase wants AI to have its own crypto wallet that will reward AI users. But how is it exactly gonna work? 🤖

Dogwifhat (WIF) is having a rough month. Is it going to experience another dip?

And fresh market analysis coming up.📈

Before you we begin, take a sec to sign up for our newsletter below, and become the first ones to receive alphas straight to your inbox!

Let’s dive in!

Franklin Templeton's New Crypto Product

Franklin Templeton is diving deeper into the crypto pool with its latest SEC filing.

The asset management giant is eyeing a new crypto index ETF, dubbed EZPZ.

So what sets it apart from regular crypto ETFs?

EZPZ aims to track the CF Institutional Digital Asset Index, starting with the dynamic duo of crypto: Bitcoin and Ethereum.

Coinbase is set to play the role of custodian.

When is it launching? And will this fund have enough demand? Read the full story!

Bitcoin Might Not Reach Past Glories

Remember when Bitcoin was the undisputed king of crypto?

Well, times might be changing.

A top analyst thinks Bitcoin's market dominance won't hit its previous highs. Why? The crypto landscape is evolving.

Benjamin Cowen, a big name in crypto analysis, has some intriguing predictions. He's eyeing a 60% dominance target for Bitcoin.

What does it mean?

It could signal big opportunities in alts.

Which alts should we look out for? Read the full story!

Trump's Portfolio Is Out!

A jaw-dropping financial disclosure just pulled back the curtain on Donald Trump's crypto holdings.

Clearly, the former president isn't just talking the crypto talk – he's walking the walk with a gigantic crypto portfolio.

We’re talking about millions in Ethereum, tucked away in a cold wallet. But that's just the tip of the blockchain iceberg.

What other crypto tokens is he holding right now? Is he a HODLer or a trader? Read the full story!

AI Gets a Bank Account

Imagine ChatGPT with its own bank.

Well, Coinbase's CEO Brian Armstrong thinks it's the next big thing.

Armstrong's latest idea? Giving AI language models like ChatGPT and Google's Gemini their very own crypto wallets.

But here's where it gets interesting. Coinbase has already launched a grant program, offering $3,000 to five lucky projects that can successfully marry AI with crypto wallets.

But how is it exactly gonna work? It is all just talks or has Coinbase already created the foundation of such programs? Read the full story!

Dogwifhat's Not in Good Shape

This Solana-based memecoin darling is having a rough time. After pulling off a V-shaped recovery, WIF is now dipping.

We're talking about a 30% dip since August 9.

But WIF isn't the only memecoin feeling the burn. The whole pack is hurting, with Dogecoin, Shiba Inu, and Pepe all seeing red.

But WIF is taking it on the chin harder than other memecoins. It's down 42% in the last month.

The future?

The charts show a head-and-shoulders pattern.

What does that mean? Is an upside coming or is the token going to face another major dip? Read the full story!

And a Quick Analysis…

Bitcoin's been continuously flirting with the $60,000 mark lately (and it just went down to $58K at the time of writing).

But the on-chain data is painting a unique picture.

75% of all Bitcoin hasn't budged in over 6 months. That's right, three-quarters of BTC is sitting pretty in wallets, unmoved since early 2024.

This level of hodling is unprecedented, especially considering Bitcoin has dropped 21% from its all-time high.

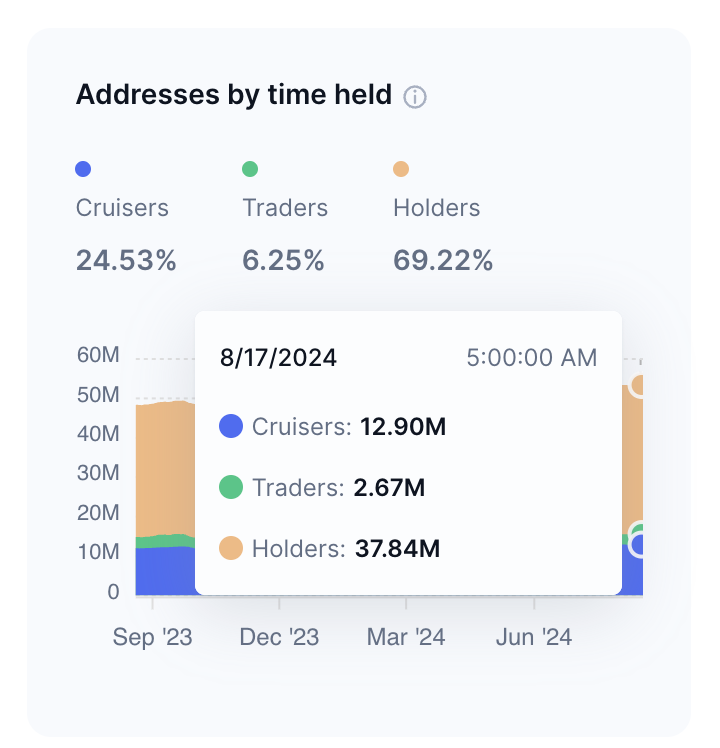

Moreover, according to data from CoinMarketCap, Bitcoin hodlers – defined as addresses that have been holding for longer than one year – currently account for 69.22% of all addresses (here’s how you can check this data).

This aligns closely with the Glassnode data and further reinforces the narrative of strong hands dominating the market.

What does this mean?

Well, historically, such strong hands often precede significant price movements. It's like a coiled spring – the longer it's compressed, the more explosive the release could be.

The interesting part? This holding trend is significantly reducing the supply of Bitcoin available for trading.

Basic economics tells us that when supply shrinks and demand stays steady (or increases), prices tend to go up.

We could be looking at a potential supply squeeze that might send prices soaring (NFA).

Short-Term Holders Underwater

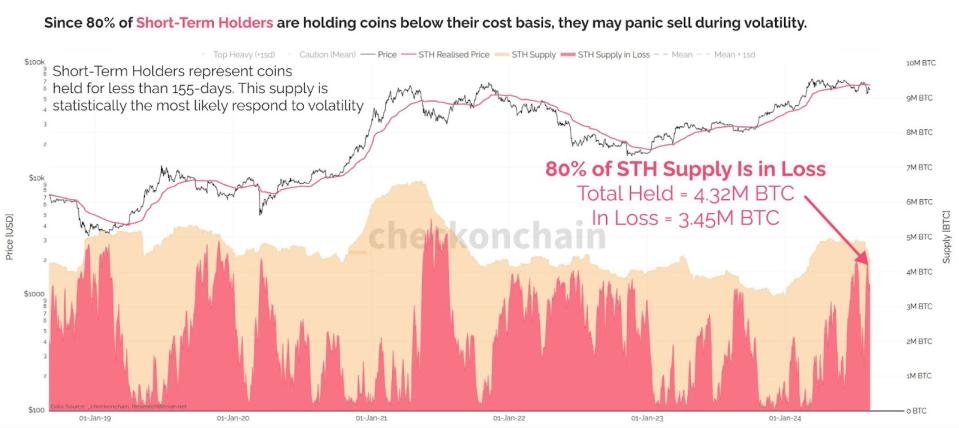

Now, let's flip the coin. While long-term holders are sitting pretty, short-term holders are feeling the heat.

According to on-chain analyst James Check, over 80% of Bitcoin short-term holders (those who've held for less than 155 days) are underwater. Their holdings were acquired at higher than current spot prices.

According to him, this situation is eerily similar to what we saw in 2018, 2019, and mid-2021. Each of those periods signaled an increased risk of panic selling.

If these short-term holders start dumping their bags, we could see some downward pressure on prices.

The Magic Number: $60,600

While Bitcoin has been flirting with $60,000, popular analyst Rekt Capital points out that $60,600 is the real level to watch.

According to him, if BTC can close a weekly candle above this price, it would reclaim its post-halving "reaccumulation range" that was lost during the recent dip to six-month lows.