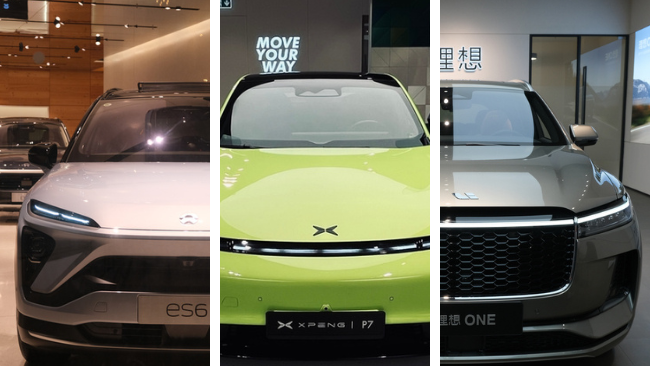

Chinese EV stocks Nio Inc (NYSE:NIO), XPeng Inc (NYSE:XPEV), and Li Auto Inc (NASDAQ:LI) are trading lower Monday after reports indicated the U.S. Commerce Department’s plans to ban Chinese software in autonomous and connected vehicles. Tesla Inc (NASDAQ:TSLA) is also trading lower by over 8% Monday.

The U.S. government is weighing a prohibition on Chinese software in U.S. vehicles with Level 3 automation and above, banning the testing of autonomous vehicles produced by Chinese companies on U.S. roads.

The Biden Government is also eying an embargo on vehicles equipped with Chinese-developed advanced wireless communications modules from U.S. roads.

Separate reports indicated a delay in Nvidia Corp’s (NASDAQ:NVDA) artificial intelligence chip delivery, which could extend for three months or more due to design issues. AI chips are also an integral component for EV stocks, from Tesla to its Chinese counterparts.

Recently, the Chinese EV companies received a boost from reports indicating that China plans to increase its stimulus program by 300 billion yuan ($41.5 billion) to subsidize passenger vehicle purchases.

Nio delivered 20,498 vehicles in July, up by 0.2% year-on-year. Li Auto delivered 51,000 vehicles in July, marking a 49.4% jump year-on-year. XPeng delivered 11,145 vehicles last month, up by 1% year-over-year.

The EV companies are battling a weakness in demand and are doling out discounts to spur demand.

Nio stock plunged 73% in the last 12 months. XPeng lost 60%, and Li Auto lost 59%.

Price Actions: NIO shares were trading lower by 7.41% to $3.75 at last check Monday. XPEV is down 5.49 at $7.14, and LI is down 3.59% to $18.51.

Photos via Shutterstock

"ACTIVE INVESTORS' SECRET WEAPON" Supercharge Your Stock Market Game with the #1 "news & everything else" trading tool: Benzinga Pro - Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article What's Going On With Chinese EV Stocks Nio, XPeng And Li Auto On Monday? originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.