Taiwan Semiconductor Manufacturing Co (NYSE:TSM) is ramping up its 2nm technology development at home and beyond despite odds ranging from geopolitical tensions to supply chain constraints to natural calamities like earthquakes and hurricanes.

The contract chipmaker’s 2nm technology commercialization at the new Baoshan plant in Hsinchu is still on track for 2025.

According to the supply chain, the price for Huguoshengshan 2nm wafers will be double that of the 4nm and 5nm wafers, exceeding $30,000, highlighting its moat translating into the pricing power, the Commercial Times reports.

Also Read: What’s Going On With Nvidia Stock On Thursday?

The contract chipmaker’s advanced manufacturing remains in high demand for artificial intelligence and smartphones, but it faces pressure from industry selloffs and supply issues.

Investments in foundries are substantial; research institutions estimate that 3nm process R&D costs $4 billion to $5 billion, while building a 3nm factory costs at least $15 billion to $20 billion.

Taiwan Semiconductor eyes 2nm chip production in at least 2 US fabs it is constructing. It committed over $65 billion toward the Arizona facility. The company’s critical clients at its Arizona plant include Nvidia Corp (NASDAQ:NVDA), Advanced Micro Devices, Inc (NASDAQ:AMD), and Apple Inc (NASDAQ:AAPL), the Nikkei Asia reports.

The contract chipmaker recently expanded its collaboration with chip packaging and testing service provider Amkor Technology, Inc (NASDAQ:AMKR) to migrate advanced packaging and test capabilities to Arizona to tap the AI frenzy. Amkor told Nikkei Asia it would invest in a $2 billion chip packaging and testing facility in Peoria, Arizona.

Taiwan Semiconductor and Amkor will jointly develop CoWoS (Chip on Wafer on Substrate) and Integrated Fan-Out (InFO).

Nvidia leverages Taiwan Semiconductor’s CoWoS chip packaging technology to boost computing power for its high-performance graphics processors. Apple employed InFO chip packaging tech for processors in its iPhone and Macbook core chips.

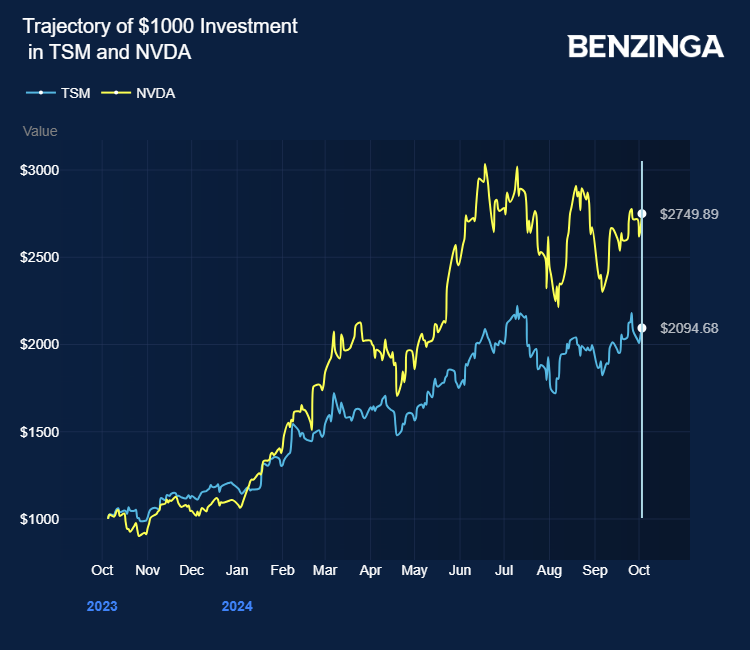

Taiwan Semiconductor stock is up over 107% in the last 12 months.

Investors can gain exposure to the semiconductor ETFs through EA Series Trust Strive US Semiconductor ETF (NYSE:SHOC) and Columbia Semiconductor and Technology ETF (NYSE:SEMI).

Price Action: TSM stock is down 0.21% at $179.10 premarket at last check Friday.

Also Read:

Photo by wakamatsu.h via Shutterstock

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article What's Going On With Taiwan Semiconductor Stock On Friday? originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.