The automotive industry is evolving rapidly, and it's forcing companies like Ford Motor Company (NYSE: F) to adapt on the fly. Just six years ago former Ford CEO, Jim Hackett, made an announcement that Ford would cease all passenger car production in North America other than the prized Mustang. Six years ago it made sense for the folks at the Blue Oval to focus almost entirely on SUVs and trucks, which brought in majority of profits, and leave the low-margin passenger car business to competitors.

Fast forward to today. The fundamentals of operating in the electric vehicle industry have flipped that notion on its head, and they are opening the doors for perhaps a new Fiesta, Focus, and Puma.

Why the flip-flop?

Over the past century, the automotive industry has been relatively simple to understand for investors; the bigger the vehicle, the bigger the margins. Ford's F-150 is its bread and butter and has long hauled in the profits, along with SUVs, and that will continue for internal combustion engine options.

However, the complete opposite is true right now for electric vehicles. That's because a much larger SUV or truck requires a much larger electric battery. Ford's CEO, Jim Farley, said that batteries for massive EVs could reach as high as $50,000. Ford has previously said that the data shows, at least currently, that consumers aren't as willing to pay a premium for a larger battery, and that's forced the automaker to adapt.

Further, as many analysts predict, EV pricing will need to hit a range between $25,000 and $30,000 to take the next step toward mainstream consumers. It will be difficult for larger vehicles with larger batteries to hit that mark -- at least for now.

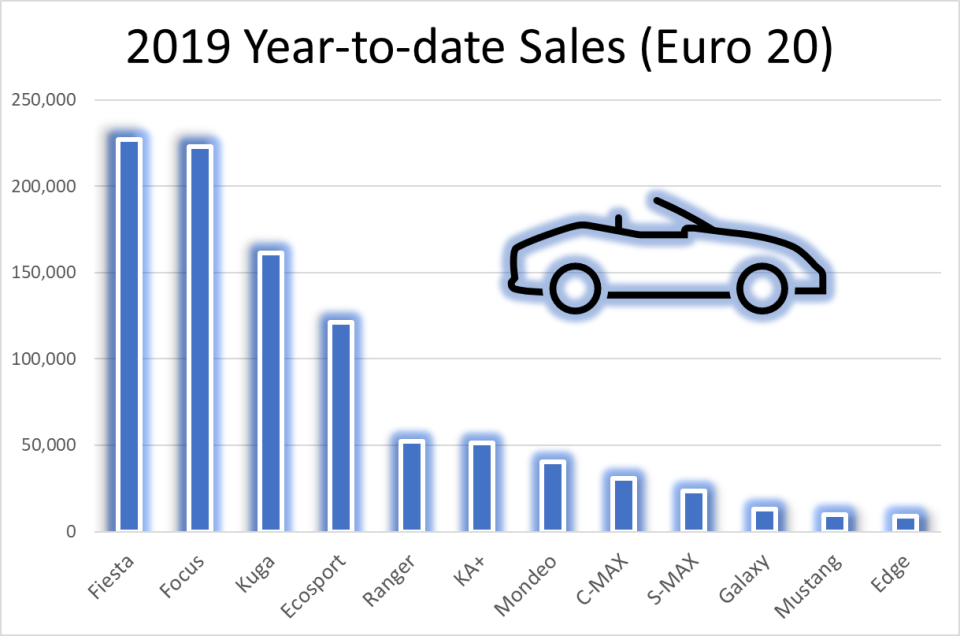

Now, management believes that the company's future with EVs will largely revolve around small vehicles with less expensive batteries at high volume. That sets the stage for Ford to potentially bring back some of its most popular global models, the Fiesta and/or Focus, which is something management hinted was possible even as the last Fiesta rolled out of production late last year in Europe. Those two models were crucial for Ford's expansion in Europe; just look at the last year of sales before COVID-19 disrupted the industry.

Enter skunkworks

A secret bet on affordable EV development was made by Ford years ago, and the "skunkworks" team was originally a small team operating independently of Ford's headquarters. But as it became more clear the gamble on developing small EVs was the right decision, the small team has grown to comprise at least 300 members, some from Tesla, Rivian, Apple, and even Formula 1 aerodynamicists.

According to a report from Autocar, the new platform could produce successors to the Fiesta and Focus, as well as a replacement for the current Puma crossover which was the best-selling car in the U.K. last year.

The good news is that if Ford develops these more affordable EVs based on previous highly popular passenger car models, it's likely to succeed because we've already seen that consumers in the U.S. take to the Chevrolet Bolt EV, Tesla's Model 3, Model Y, and even the Mustang Mach-e.

x

The potential revival of the Fiesta and/or Focus would likely roll out sometime in 2026, and it could be exactly what Ford needs to fend off the competition. 2026 is building up to be a massive year for more affordable EV options with launches of Rivian's R2, Kia's EV3, the next-generation Chevrolet Bolt EV, lower cost Lucid models, and we can only guess how far well-built and highly affordable Chinese EVs will expand globally by that time.

While reviving the Fiesta and/or Focus goes against conventional wisdom and is a flip-flop from Ford's previous strategy to axe just about anything that isn't an SUV, truck, or commercial van, the smaller, more affordable models could be key for the Dearborn automaker to turning around its EV division that could lose up to $5.5 billion in 2024 alone. Stay tuned; Ford's key to the future might just steal a page from its past.

Should you invest $1,000 in Ford Motor Company right now?

Before you buy stock in Ford Motor Company, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Ford Motor Company wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $606,079!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of August 6, 2024

Daniel Miller has positions in Ford Motor Company. The Motley Fool has positions in and recommends Apple and Tesla. The Motley Fool has a disclosure policy.

Why Ford Could Revive 2 High-Volume Vehicles, and Soon was originally published by The Motley Fool