American depositary shares of Chinese electric-vehicle (EV) maker Nio (NYSE: NIO) plunged Thursday after the company announced its July monthly delivery results. Those results weren't bad, but investors wanted more.

Nio delivered about 20,500 EVs last month, marking the third straight month the company has surpassed the 20,000 unit delivery threshold. But it was still only about 2% higher than the year-ago period. Nio closed today's trading session with a drop of 8.3%.

Investors want more from Nio

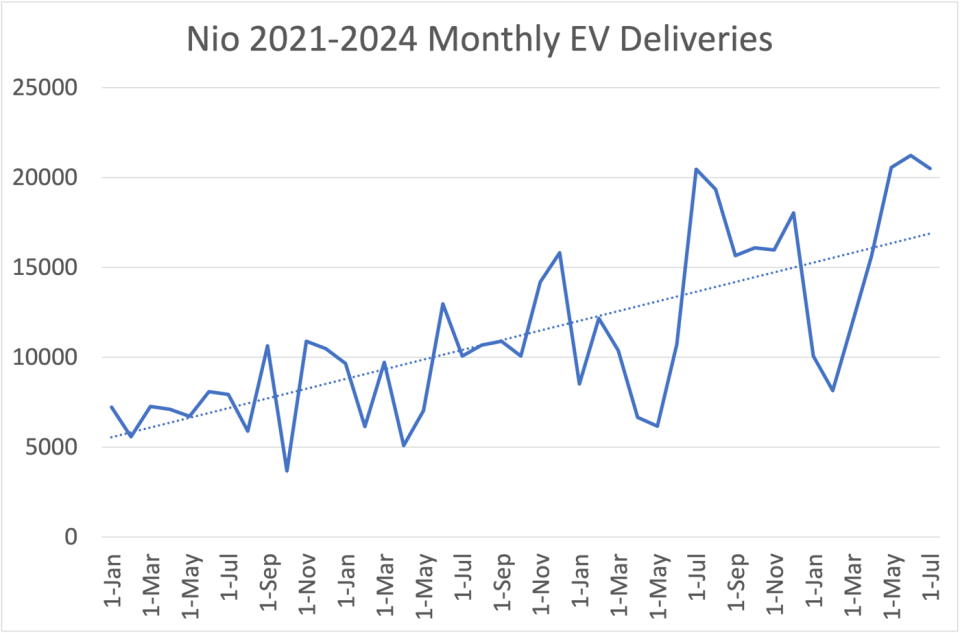

The July delivery results also represented a slight drop from the 21,209 vehicles shipped in June. Investors are getting impatient waiting for Nio to achieve profitability. They expected to see a continued ramp-up of vehicle sales, but as can be seen in the chart below, results have leveled off over the past several months.

Nio still has delivered about 44% more EVs in 2024 year to date, compared to 2023. But investors expected 2024 to be a year of sharp increases in production and sales. After all, that's what will be required to achieve profitability. This helps explain why the stock is down by 55% so far this year.

The other thing investors likely noticed was that Chinese EV peer Li Auto reported July deliveries that soared by about 50%, compared to July 2023. It also showed an increase month over month from June.

Nio stock likely won't gain any traction without a catalyst that pushes it meaningfully toward profitability. While July delivery results weren't bad, they didn't provide a noticeable boost toward that goal.

Should you invest $1,000 in Nio right now?

Before you buy stock in Nio, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nio wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $717,050!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 29, 2024

Howard Smith has positions in Nio. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Why Nio Shares Tumbled Today was originally published by The Motley Fool