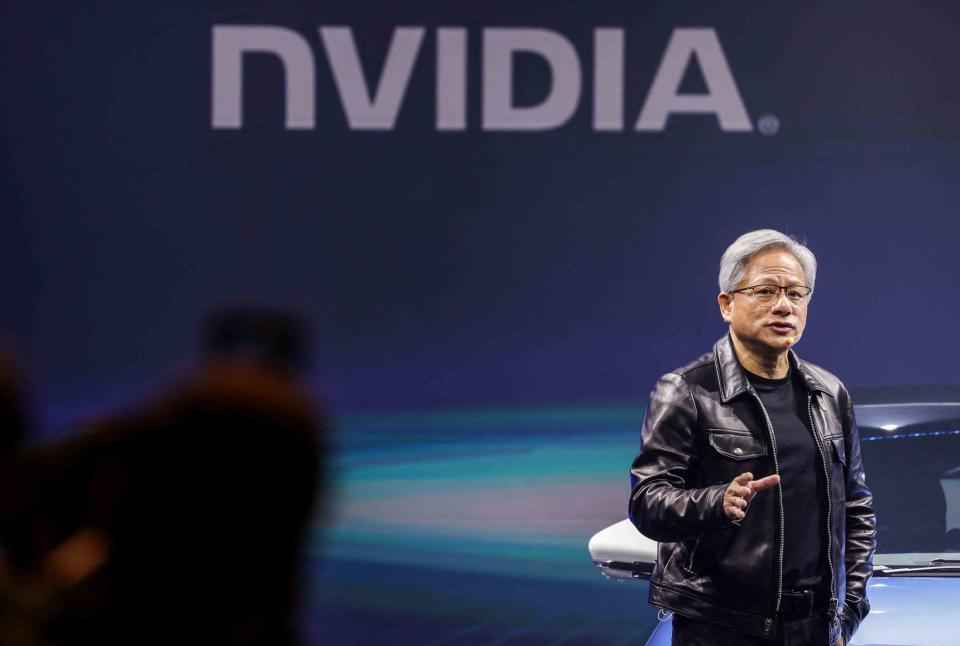

I-Hwa Cheng / AFP / Getty Images

Nvidia CEO Jensen Huang speaks at an event in Taipei last October.Key Takeaways

Chip stocks had their worst week since January 2022, as AI investor favorite Nvidia lost about 14% during the holiday-shortened trading week.

Broadcom shares fell 10% after the company disappointed investors with its earnings report, and the stock lost nearly 16% of its value this week.

Chip stocks’ rough week comes as concerns about the health of the economy mount.

Investor concerns about AI spending have also weighed on sentiment.

Chip stocks slumped this week, with the PHLX Semiconductor Index (SOX) tumbling 10%, its biggest weekly decline since January 2022.

Market darling Nvidia (NVDA) shed 4.1% on Friday to finish the holiday-shortened trading week down almost 14%. That’s about as much as lost by Intel (INTC), which on Tuesday was hit with reports that it could lose its coveted place in the Dow Jones Industrial Average.

Broadcom (AVGO) tumbled 10% on Friday after posting disappointing quarterly results on Thursday afternoon. The stock lost nearly 16% of its value this week.

Worries About AI Spending Weigh on Sentiment

Chip stocks’ rough week comes as concerns about the health of the economy mount. The U.S. added fewer jobs than expected in August, according to Labor Department data published Friday, adding to the growing body of evidence that the U.S. economy is slowing. It was a similar report on August 2 that capped off semiconductors' second-worst week of the year (-9.7%).

Economic concerns have coincided with a shift in investor sentiment around artificial intelligence (AI). Corporate spending on AI, once music to Wall Street’s ears, has come under scrutiny in recent months. Big tech’s ballooning capital expenditures have some investors worried about when—or if—the spending will pay off. That has dampened the mood of tech investors and weighed on shares of the semiconductor companies whose products are AI's vital organs.

The industry's second-quarter earnings—specifically their outlooks for the rest of the year—have also struggled to meet investors' exceedingly high expectations. Nvidia again topped earnings expectations last week, but growth has slowed. And after a year of blowout reports, its good sales guidance was simply not good enough.

Read the original article on Investopedia.