In a technical analysis shared with his followers on X, crypto analyst Bobby A (@Bobby_1111888) provides a bullish prediction for XRP despite the US Securities and Exchange Commission’s decision to appeal the ruling in its case against Ripple Labs. Amid the regulatory turmoil, Bobby’s interpretation of the macro charts suggests a bullish outlook for XRP, contradicting the potential bearish sentiment stirred by the SEC’s latest legal maneuver.

Bobby contrasts the immediate market reactions typically triggered by high-profile legal news with the actual long-term trends observed in asset prices. “Many forget that, even amid news of the SEC lawsuit in 2020, the asset appreciated from $0.11 to $1.95,” he points out.

XRP Monthly Charts Still Look Bullish

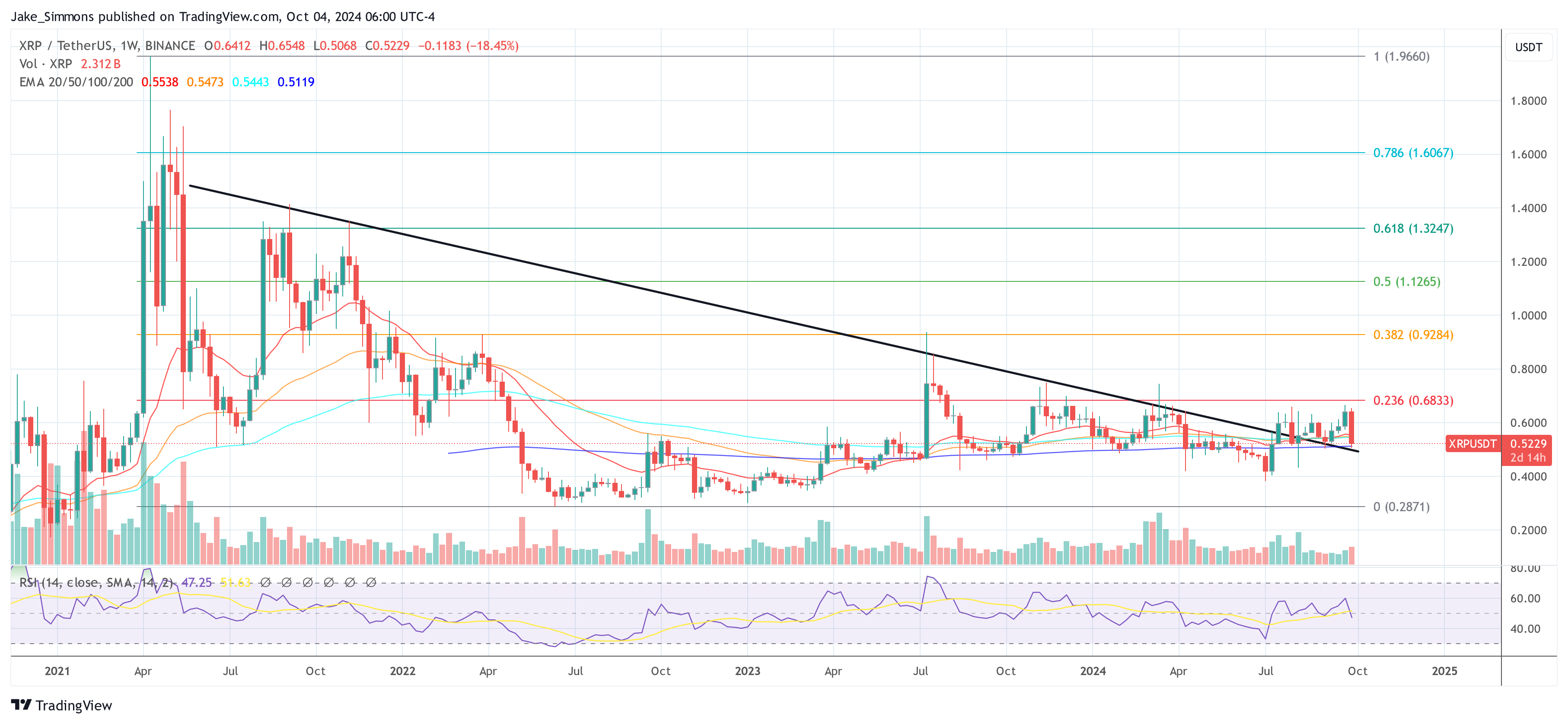

The analyst highlights that XRP has been trading for the past nearly seven years in a consistent sideways consolidation which he describes as a “macro base.” According to Bobby, this extended period of consolidation is crucial for understanding the potential for upward movement.

“The monthly timeframe shows that post the Bitcoin Halving, during every cyclical rotation of the momentum oscillators, the asset [XRP] experiences rapid price appreciation, which could initiate at any moment. This happened in 2017 and 2020,” Bobby further explains.

An argument of Bobby’s analysis focuses on the monthly Bollinger Bands of the XRP/USD chart, an indicator used to measure market volatility and identify potential price targets based on previous market behavior. “Much like during 2016, the price is tightly wound around all essential higher timeframe moving averages, including the median line of the monthly Bollinger Bands,” the analyst writes.

He adds, “While we are on the topic of the Bollinger Bands, they are the tightest they have ever been in the coin’s history,” he notes. This tightness suggests that XRP is at a pivotal point where any increase in volatility could lead to a substantial price movement.

Notably, Bobby’s take profit zone lies between the 1.618 Fibonacci extension level at $5.31 and 4.236 Fibonacci extension level at $13.72. Thus, Bobby’s expected return for this bull run is between a whopping 950% to 2,600%.

Bobby theorizes that the initial movements when volatility returns might be deceptive, potentially designed to mislead market participants about the true direction of the price. He draws parallels to Bitcoin’s unexpected rally in March 2020, suggesting that XRP could experience a similar deceptive yet ultimately bullish breakout.

“The XRPETH and XRPBTC charts do not look like this is the start of a long, drawn-out bear market but, instead, possible capitulation at deep value areas. Remember that the worst news comes at the bottom and the best news at the top,” Bobby added.

The upcoming US presidential election could also play a critical role in shaping the regulatory landscape affecting cryptocurrencies like XRP. Bobby speculates about the possible outcomes: “Should Donald Trump be re-elected as president, I cannot see any situation where Gary Gensler remains chair of the SEC.” He argues that a change in the SEC’s leadership could relax the regulatory scrutiny over Ripple and, by extension, XRP, fostering a more favorable market environment.

In his closing remarks, Bobby reiterates his strong conviction in the bullish thesis for XRP. “No one ever said this would be easy, and investing never is,” he reflects, encouraging his audience to adopt a strategic, long-term view of their investment in XRP.

At press time, XRP price stood at $0.52.

Featured image created with DALL.E, chart from TradingView.com