10xResearch analysts who had correctly predicted the Bitcoin price run-up to a new all-time high earlier in the year have turned bullish once again. In a recent report by 10xResearch Head of Research, Markus Thielen, the analysts point out a number of factors that have seen the BTC price turn bullish. Just like before, this is a development that could lead to a run-up to a new all-time high for the Bitcoin price, something that could mark the beginning of another bull market.

Fed’s Rate Cut Triggers Bitcoin Uprising

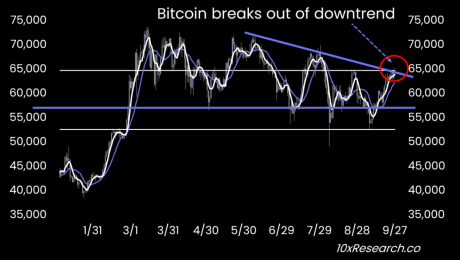

Following the Federal Reserve’s decision to cut interest rates by 0.5 bps earlier in the month, the Bitcoin price has been on a positive uptrend. It rose from trending around $53,000 to rising above $66,000 in a matter of weeks. However, the uptrend may be far from done as the analysts see further upside.

In the report, the 10xResearch analysts point to the rise in stablecoin minting and billions in inflows from Chinese over-the-counter brokers as reasons why the rally could continue. Since the Fed rate cuts, approximately $10 billion in new stablecoins have been minted. Naturally, this is positive for the Bitcoin market as it means new inflow is coming in. The report explains that year-to-date stablecoin inflows have now topped $35 billion.

Another positive development with this is the rise in the decentralized finance (DeFi) activity across the space. There has been increased fee revenue, signaling more participation. “While activity has slowed in September, activity and fees could rebound following the Fed’s recent rate cut,” the report read.

The analysts believe that the Bitcoin price is now targeting new all-time highs after breaking the downtrend that has plagued it for months. “With Bitcoin breaking above $65,000, we anticipate a swift move toward $70,000, followed by new all-time highs in the near term,” the analyst said.

Altcoin Season Is On The Way

The Fed rate cuts has not be positive for the Bitcoin price only as the altcoin market has also followed suit. There has been an over 20% jump in the altcoin market cap this month alone, showing that they’re also following the bullish trend being set by Bitcoin.

There has been a notable decline in the BTC dominance since the Fed announcement. This suggests that altcoins are gaining ground, and if the Bitcoin dominance continues to fall, it could signal the start of another altcoin season.

“A notable shift occurred following last week’s FOMC meeting: Bitcoin’s dominance has waned, while Ethereum gas fees have spiked, fueled by a surge in altcoin activity across the ecosystem,” the analysts stated. “If the Federal Reserve remains open to cutting rates, pursuing high-beta altcoins will likely gather further momentum.”

Featured image created with Dall.E, chart from Tradingview.com

Disclaimer: The information found on NewsBTC is for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.