Although Bitcoin (BTC) on-chain health remains net positive, from a price perspective two crucial support levels must be maintained for a continued bullish uptrend, notes ARK Invest in its latest monthly report.

Bitcoin’s Healthy On-Chain Metrics, What Does It Mean?

In its report, ARK Invest posits that Bitcoin requires some upside if its market structure is to be maintained. The report notes that in August 2024, BTC’s price slid by 8.7% to $58,972. The leading digital asset was also unable to overcome its 200-day moving average, making two key support areas at $52,000 and $46,000 critical for its bullish momentum.

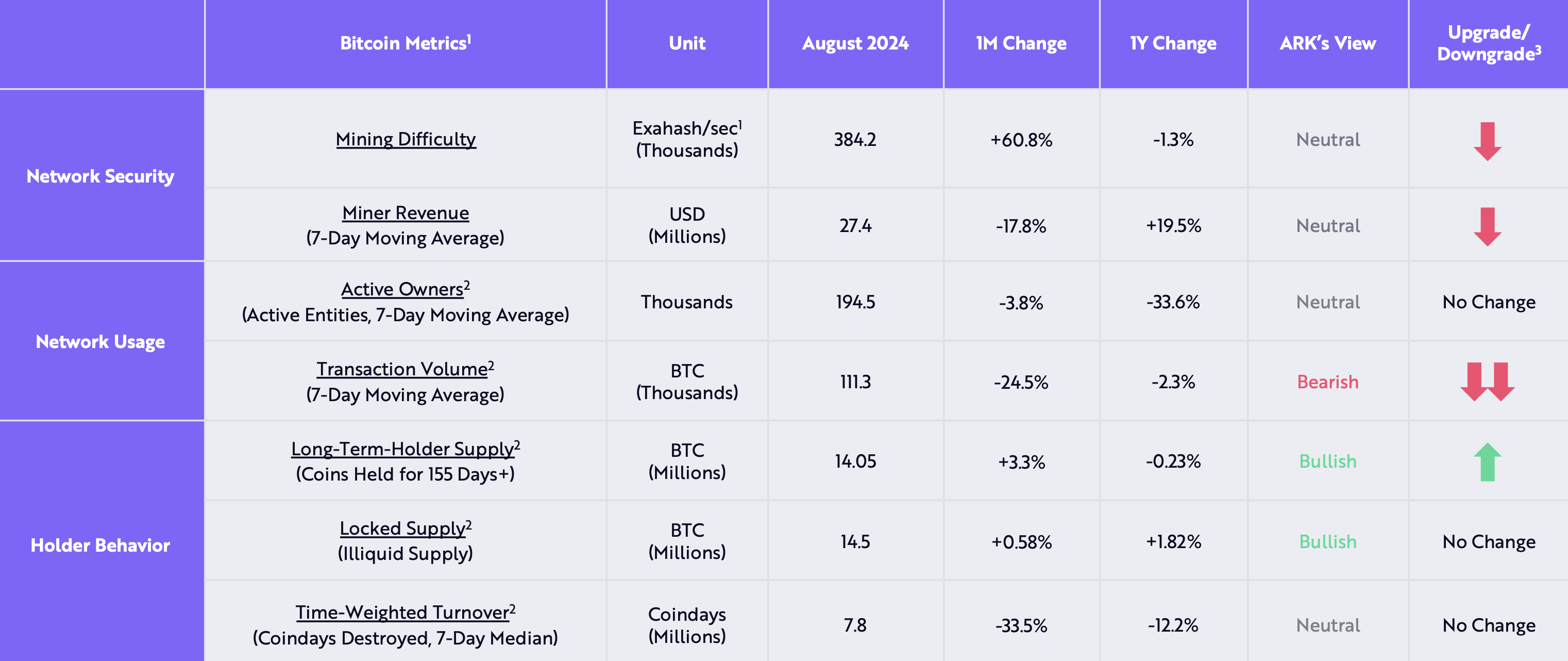

The report states that despite the temporary headwinds faced by Bitcoin, its on-chain health remains ‘net positive.’ Essentially, the Bitcoin network is net bullish across different on-chain metrics such as network security, network usage, and holder behavior.

Bitcoin’s long-term holder supply, or BTC held for more than 155 days by holders, is up 3.3% month-over-month (MoM) and down a marginal 0.23% year-over-year (YoY). In addition, Bitcoin’s locked supply has increased in both MoM and YoY terms by 0.58% and 1.82%, respectively.

Bitcoin’s transaction volume has tumbled by 24.5% MoM and 2.3% YoY, a bearish on-chain indicator. However, Bitcoin’s bullish on-chain metrics overshadow the one bearish indicator, allowing its on-chain health to remain net positive.

Another key performance indicator strengthening ARK Invest’s bullish stance on Bitcoin is its short-to-long liquidation dominance. Essentially, this metric measures short-term liquidations relative to long-term liquidations over the last 90 days, and found that it’s at its lowest since Q2 2023.

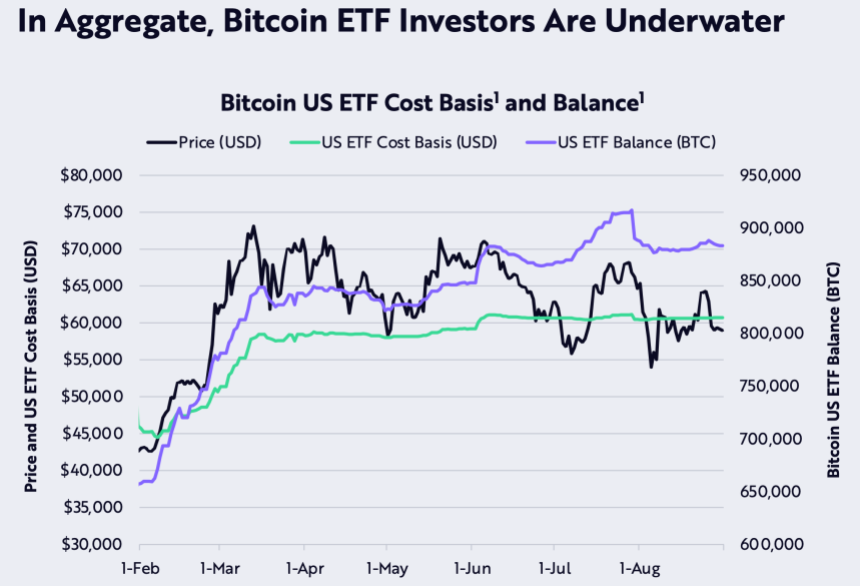

Bitcoin ETF Investors Underwater At Large

The report highlights that at the end of August 2024, the estimated cost basis of US spot exchange-traded-fund (ETF) participants was higher than BTC’s price, hinting that the average ETF investor may be at a loss. The higher estimated cost basis of US spot ETF participants compared to its price can be confirmed from the chart below.

The US Securities and Exchange Commission (SEC) approved spot Bitcoin ETF earlier this year, which made it easier for institutional and retail investors to gain exposure to the world’s largest cryptocurrency through a compliant investment product.

Bitcoin ETFs are witnessing unprecedented interest from institutional investors. Specifically, Wall Street titans such as Goldman Sachs and Morgan Stanley have poured millions of dollars into Bitcoin ETFs. Conversely, Ethereum ETFs haven’t yet piqued institutional interest at comparable levels.

At press time, Bitcoin trades at $57,836, up a minimal 0.2% in the past 24 hours. BTC’s total market cap stands at $1.14 trillion.

Featured image from Unsplash, Charts from ARK Invest and Tradingview.com