Long-term holders slow profit-taking as accumulated supply matures, historically signaling bear market transition.

Key Takeaways

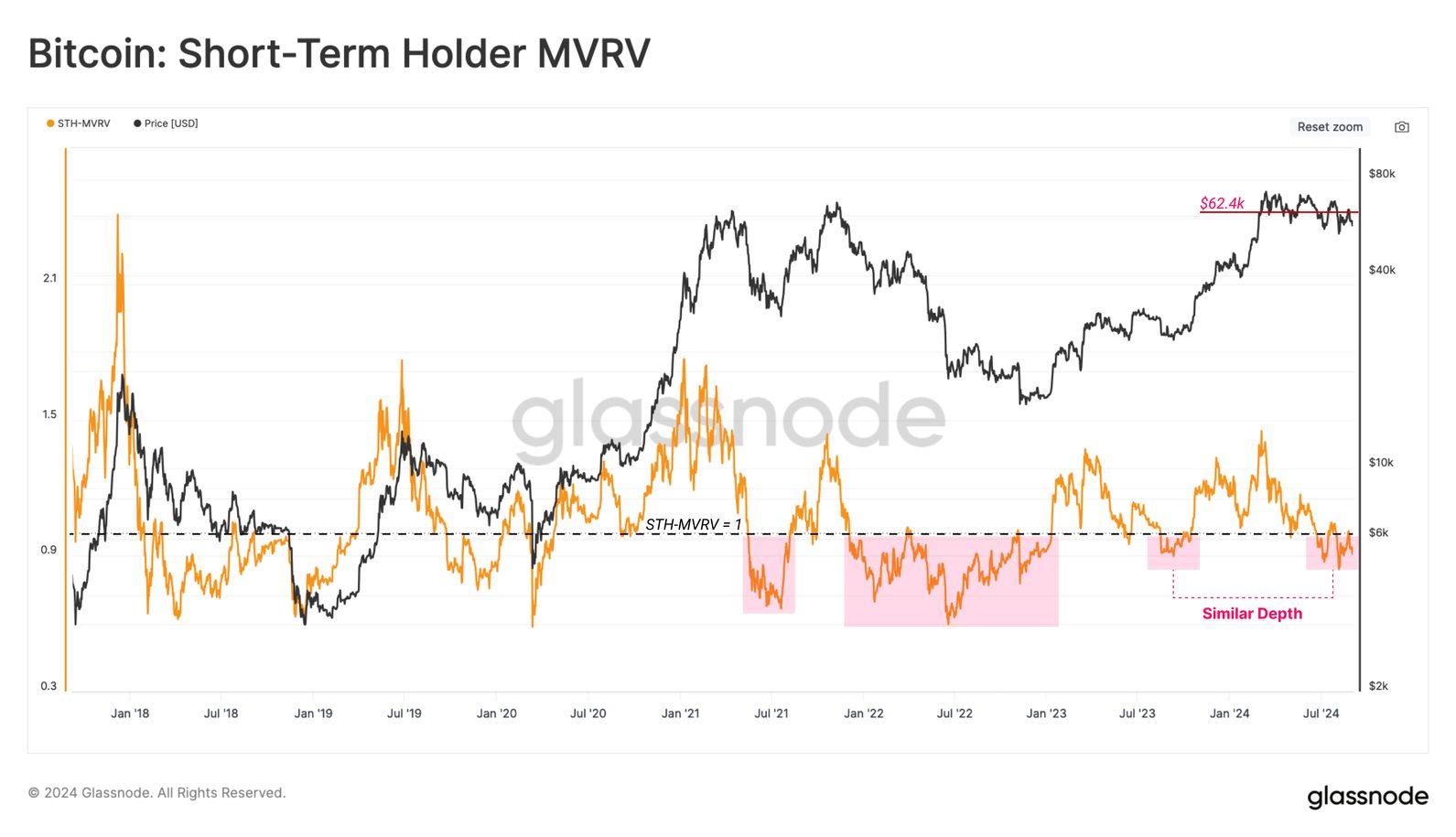

- Bitcoin short-term holders are experiencing significant unrealized losses amid market pressure.

- The Sell-Side Risk Ratio suggests a saturation of profit and loss-taking activities in the current price range.

Bitcoin (BTC) short-term holders are bearing the brunt of market pressure as prices stay underwater, as reported by Glassnode.

The Short-Term Holder cohort, representing new demand in the market, is experiencing significant unrealized losses. The magnitude of these losses has consistently increased over the last few months, though it has not yet reached full-scale bear market territory.

The Short-Term Holder MVRV Ratio has fallen below the breakeven value of 1.0, trading at levels similar to August 2023 during the recovery rally after the FTX failure.

“This tells us that the average new investor is holding an unrealized loss. Generally speaking, until the spot price reclaims the STH cost basis of $62.4k, there is an expectation for further market weakness,” added Glassnode analysts.

All age bands within the Short-Term Holder cohort are currently holding unrealized losses. Realized profit has drastically declined following Bitcoin’s all-time high at $73,000 while loss-taking events are elevated and trending higher as the market downtrend progresses.

Moreover, the Sell-Side Risk Ratio has declined into the lower band, suggesting most coins transacted on-chain are doing so close to their original acquisition price.

This indicates a saturation of profit and loss-taking activities within the current price range and historically suggests potential for increased volatility.

Robust position

On the other hand, Long-Term Holders have slowed their profit-taking, with supply accumulated during the all-time high run-up gradually maturing into Long-Term Holder status. However, this pattern has historically occurred during transitions toward bear markets.

Nevertheless, Glassnode analysts highlight that unrealized profits are still six times larger than the amount of unrealized losses observing the broader market.

“Around 20% of trading days have seen this ratio above the current value, underscoring the surprisingly robust financial position of the average investor,” they added.

Despite these challenges, Bitcoin remains only 22% below its all-time high, a shallower drawdown than in previous cycles. Meanwhile, the average Bitcoin investor remains relatively healthy compared to previous market moments.