The price of Bitcoin has not had the most straightforward performance in 2024 despite a strong start to the year. The flagship cryptocurrency has spent most of the last two quarters in consolidation, fluctuating within the $50,000 and $70,000 range.

This uninspiring performance has sparked conversations about the current cycle, with several analysts and experts predicting whether the bull run is still on. Amongst the latest to comment is the CryptoQuant CEO, who offered an interesting on-chain insight into the cycle.

Why Are Whales Taking Less Profit This Cycle?

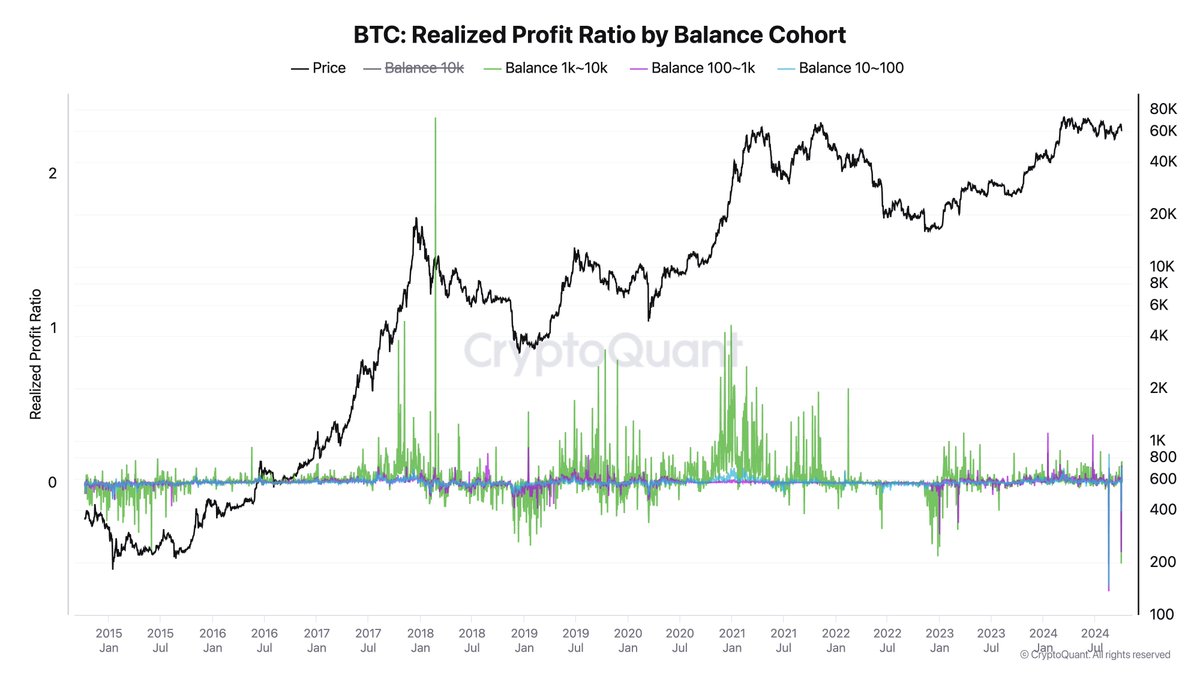

In a post on the X platform, CryptoQuant CEO Ki Young Ju revealed that the Bitcoin whales have held onto their assets this cycle. As a result, the large investors have set the record for the least profit-taking compared to other cycles if the current bull run ends now.

This on-chain revelation is based on the Realized Profit Ratio by Balance Cohort metric, which measures the ratio of coins sold at a profit by an investor class relative to the total coins sold at a given time. It basically evaluates the profitability of different cohorts of Bitcoin holders.

Typically, when the Realized Profit Ratio of whales is high, it implies that a sell-off is likely ongoing, with the large investors believing that prices have peaked. On the other hand, a low Realized Profit Ratio often indicates a low level of profit-taking, meaning that investors are not cutting their losses or expecting further price gains.

The current on-chain data points to a trend where the large holders have taken the least amount of profits across any bull cycle. This could mean that the Bitcoin whales still have faith in Bitcoin’s long-term potential. Ultimately, this suggests that the current bull run is far from the end, and there is the possibility of the Bitcoin price uptrend resuming.

Bitcoin ‘Dolphin’ Addresses On The Rise Again: Santiment

In a post on X, Santiment revealed that the Bitcoin’s “Dolphin” cohort, holding between 0.1 to 10 BTC, have been growing steadily over the past few months. The analytics reported that this tier of investors mostly sold for profit in the first half of the year.

However, addresses holding between 0.1 and 10 BTC have been on the rise since early July. Specifically, the 0.1 – 1 BTC wallets have increased by 25,671 more addresses, while the 1 – 10 BTC wallets have climbed by about 4,000 addresses.

This indicates that small-scale investors might be returning to the market, which could be positive for the Bitcoin price over the coming months. As of this, the premier cryptocurrency is valued at $61,94, reflecting a 1.7% increase in the past day.

Featured image created by Dall.E, chart from TradingView