The highly anticipated spot Ethereum (ETH) exchange-traded funds (ETFs) have officially gone live for trading after months of delays.

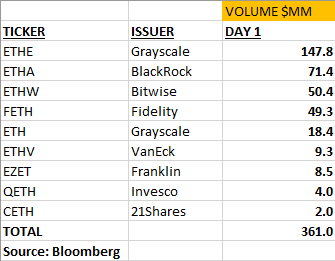

On Tuesday morning, ETFs from BlackRock, Fidelity, 21Shares, Invesco, Franklin Templeton, VanEck, Grayscale and BItwise hit the market, so far exceeding expectations according to some experts.

According to Bloomberg’s ETF analyst Eric Balchunas, all of the Ethereum ETFs have done much more in volume than a “normal” ETF launch after the first 90 minutes.

“Here’s where we’re at after 90 minutes. $361m total. As a group that number would rank them about 15th overall in ETF volume (about what TLT and EEM trade), which is Top 1%. But again compared to a normal ETF launch, which rarely see more than $1m on Day One, all of them have cleared that number and then some.”

By “half time,” Balchunas said the ETFs reached nearly $600 million in flows, which would put them on track to bring in about 20% the volume that the Bitcoin ETFs attracted on their day one.

According to economist Alex Krüger, there will likely be diminished sell pressure on Ethereum compared to Bitcoin during the launch of the BTC ETFs due to the much smaller discount on Grayscale’s ETH trust (ETHE) prior to Tuesday.

And while the ETFs are launching during a typical summer lull in markets, Krüger says today still isn’t a “sell-the-news” event.

“A lackluster launch makes sense, but it is not a sell the news [event].”

At time of writing, Ethereum is trading at $3,425, down 1% in the last 24 hours.

Generated Image: Midjourney