Several large-cap assets, including Bitcoin and Ethereum, struggled to make a mark in the past week, as the general market suffered a steep downturn in prices. According to various analyses, the market was negatively impacted by some recent macro developments in different countries.

This significant decline has had a widespread effect on the market sentiment, with most investors now treading cautiously. This can be seen with the recent drop in Ethereum open interest, which could hold serious implications for the price of ETH.

Ethereum Open Interest Declines By $6 Billion — Impact On Price?

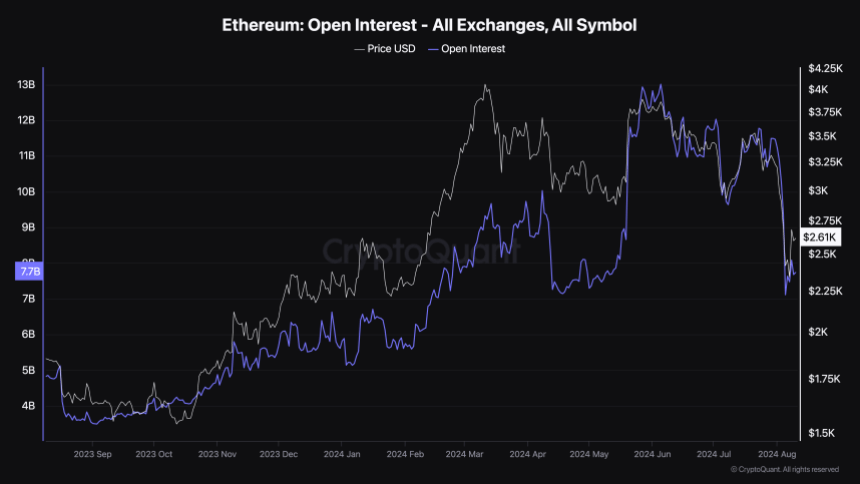

According to the latest report by blockchain analytics platform CryptoQuant, the Ethereum open interest has fallen by more than 40% (approximately $6 billion) in the month of August. The “open interest” metric refers to an indicator that measures the total number of derivatives positions of a cryptocurrency (ETH, in this case) currently open on all centralized exchanges.

An increase in this indicator’s value implies that investors are opening up new positions in the futures and options market at that given time. It basically indicates that investors are pouring money into ETH derivatives at the time. When the metric falls, on the other hand, it means that derivatives traders are closing their positions or getting liquidated in the market.

As shown in the chart above, the Ethereum open interest has been in a downward trend since the start of August, bottoming out on Monday following the general market downturn. According to data from CryptoQuant, the open interest of ETH stands at around $7.67 billion, as of this writing.

Although it has demonstrated some good signs of recovery in the past day, a low open interest does not look healthy for the Ethereum price — especially if viewed from a historical standpoint. Decreased positions in the derivatives markets could cause a fall in liquidity, which could lead to substantial price fluctuations due to market inefficiency.

At the same time, the falling open interest could dampen volatility in the Ethereum market in the short term, especially as fewer investors are betting on the ETH price. A low volatility suggests that the price of Ethereum might not witness any large movement any time soon.

ETH Price At A Glance

As of this writing, the price of Ethereum continues to hover around the $2,600 mark, reflecting an almost 4% decline in the past 24 hours. According to data from CoinGecko, the altcoin’s value is down by more than 13% in the last seven days.

Featured image from Unsplash, chart from TradingView

Disclaimer: The information found on NewsBTC is for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.