Crypto analyst Astronomer (@astronomer_zero) posits a strong bullish outlook for Bitcoin in the fourth quarter of 2024. Leveraging historical data, Astronomer provides an analysis via X, suggesting an 82% probability of an ultra bullish trend based on the performance of Bitcoin in September.

The crypto analyst opens his analysis with an emphasis on the unexpected positive performance of Bitcoin in September. “September is about to close and to the general public’s surprise, it’s looking like it’s going to be green (by a long shot), with the chance of setting the greenest September in 2024, supporting our breakout thesis we have been on for a while now,” he writes.

Delving into thesentiment of the market, Astronomer notes a significant disconnect between public perception and actual market positions. “And although we’re not the only ones anymore that are on the full bull thesis, data is and remains data. And after thorough inspection, despite the talking/analysis posts, most are not positioned yet, took profit too early or will cheer for dips and say they are a gift for the reason of wanting one,” he explained.

He further elaborates on the sentiment within closed circles: “This observation is not just coming from public posts or Twitter, but also from the array of paid groups partaken in to conduct these analyses. Not allowed to share names or details, but most groups indeed are long and took profit early, are looking for an entry, or are short. So the market’s hand seems to be working.”

82% Chance Bitcoin Will Be Bullish

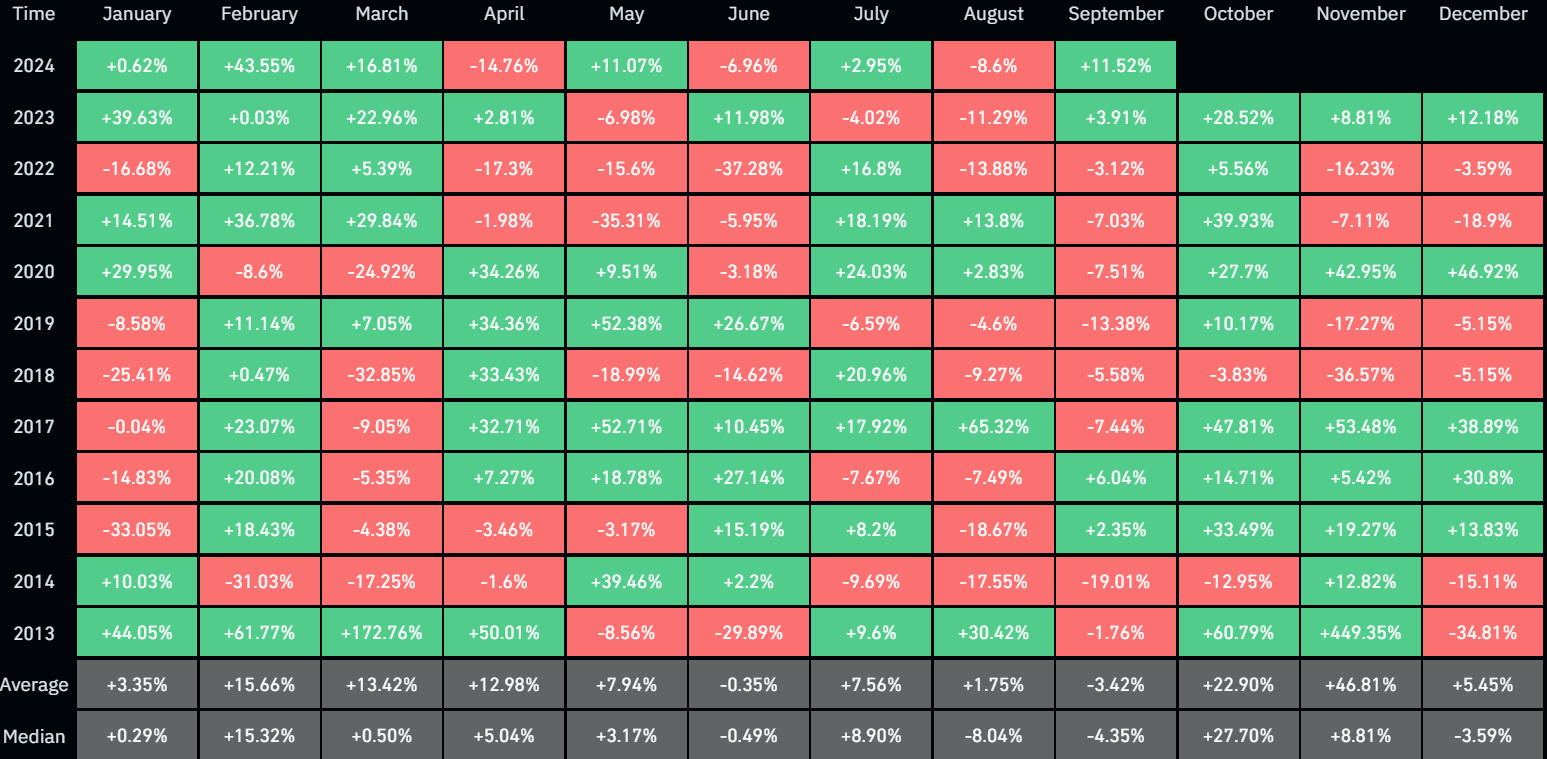

Astronomer’s bullish thesis leans on historical data, particularly the cyclical nature of the Bitcoin price. “The data analysis is fairly simple here: each time BTC had a green September, it was followed by no less than three green months after, i.e., a green October, November, and December. And this has happened 3/3 times since BTC inception,” he asserts, signifying a strong seasonal pattern.

However, he is quick to temper this with a critique of his methodology, admitting to the potential pitfalls of low data samples: “Now like I said, I am not the biggest fan of seasonality and our analysis only has 3 data points, which gives us only a 67% confidence to make the claim that the next three months will indeed be green (low data fallacy). But to add significance, by the binary nature of bullish/bearish, there is also exclusivity to the data: if September is not green, 6 out of 8 times, Q4 has not been green each month.”

He refines his thesis further, “So, by including the exclusivity, a more general and easier to interpret claim, using more data points is that: ‘The direction of September has determined the general direction of Q4 and if September is green and not red, a bullish (not bearish) Q4 has followed 9 out of 11 times. So if September closes above $59k, there is an 82% chance Q4 will be bullish’.”

The prediction stirred dialogue within the community. A user @pieceofsheet99 commented skeptically, suggesting the potential for an unexpected downturn: “If September turned out to be green to everyone’s surprise, October can also turn out to be red to everyone’s surprise as well.” Astronomer responded, reaffirming his reliance on historical trends, “Indeed, but that’s not what we have seen typically. So, I personally, as always, stick to the data.”

Astronomer’s analysis concludes on a note of strategic optimism, emphasizing the importance of aligning with market dynamics and historical patterns rather than speculative impulses. “How bullish? We will see (time is more important than price), but it’s not about planning for retirement and making fast money. It’s about being on the right side of the trade, time after time after time, enjoying the market stress-free and not having too many regrets through losing money or being sidelined (enjoying the process). And this way, eventually (rather soon), you hit your goals.”

At press time, BTC traded at $64,622.

Featured image created with DALL.E, chart from TradingView.com