Ethereum (ETH) is currently facing significant selling pressure and fear after a 23% decline, bringing its price down to yearly lows at $2,200. One major concern for investors is the ongoing underperformance of ETH compared to Bitcoin, a trend that has persisted since September 2022. Since then, Ethereum has fallen 44% against Bitcoin.

This dramatic drop has left investors and traders questioning the reasons behind Ethereum’s struggle. A recent report from CryptoQuant offers some clarity, pointing to several factors that may be affecting ETH performance. As market participants continue to monitor ETH’s movements, many are left wondering whether the asset can regain momentum or if further downside is to be expected in the coming weeks.

Ethereum Exposed: CryptoQuant Report Sheds Light

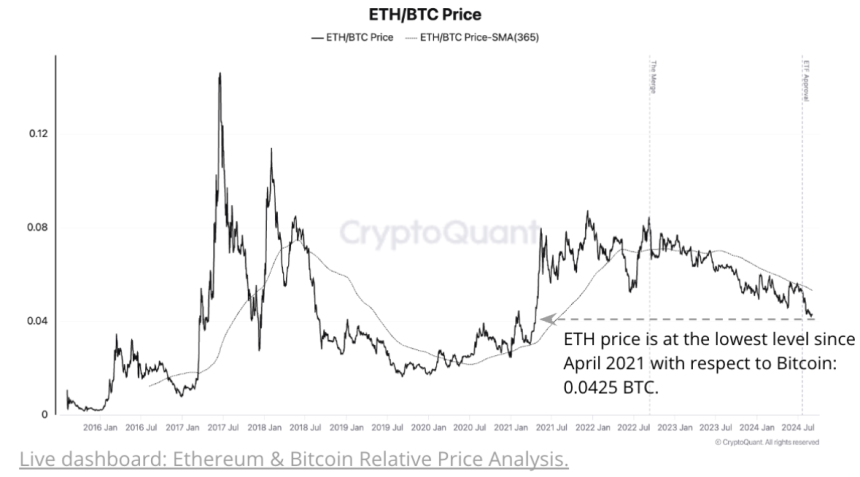

The recent report from CryptoQuant offers clarity on factors currently affecting Ethereum (ETH). Declining on-chain activity, shrinking institutional interest, and the underwhelming performance of Ethereum ETFs compared to Bitcoin are among the key contributors to Ethereum’s struggles, with the ETH/BTC pair now sitting at 0.0425, its lowest level since April 2021.

Ethereum’s underperformance seems to be tied to weaker network activity dynamics compared to Bitcoin. For instance, Ethereum’s total transaction fees have continued to decline, mostly attributed to the lower fees after the Dencun upgrade. The relative transaction count has also fallen dramatically, dropping from a record high of 27 in June 2021 to 11, one of the lowest levels since July 2020.

Moreover, Ethereum’s supply dynamics are not supportive of a price increase. Since early April, the total supply of ETH has steadily grown following the Dencun upgrade. The current supply is at 120.323 million ETH, the highest level since May 2023.

Additionally, traders and investors have shown a clear preference for Bitcoin over Ethereum, as the relative spot trading volume of ETH to Bitcoin has dropped from 1.6 to 0.76 in the past week. Ethereum’s price has historically risen relative to Bitcoin when its trading volume outperforms Bitcoin’s.

Given these factors, Ethereum may continue to underperform compared to Bitcoin in the near future.

ETH Price Action

Ethereum (ETH) is currently trading at $2,262 after a significant 23% drop from its local highs. Volatility and uncertainty continue to drive the market as ETH tests local demand near its yearly lows of around $2,200.

The cryptocurrency remains far below its 4-hour 200 moving average (MA) at $2,565, a critical indicator that typically signals market strength. For bulls to regain control, it is essential for the price to break above this moving average and challenge the local highs at $2,600.

However, if Ethereum fails to hold support at its yearly low of $2,200, the price will likely enter a deeper correction phase, potentially signaling the start of a bear market. This level is crucial for ETH’s short-term recovery, as losing it could trigger further selling pressure. Bulls need to retake these key levels to prevent ETH from slipping into prolonged bearish territory.

Featured image from Dall-E, chart from TradingView