SoFi Technologies (NASDAQ: SOFI) has been making incredible progress on its way to becoming a real player in U.S. banking. It has reported two straight quarters of positive net income, as expected, and revenue continues to increase at robust levels.

But with the business' many moving parts, not everything is being taken so well by investors, and SoFi stock is down 29% year to date. Is this a bargain buy or a value trap?

The digital answer to financial services

SoFi has done an impressive job working its way up from a student loan cooperative to a major U.S. bank competing with the biggest names in the business. It has nowhere near the assets and membership of the largest banks, but it's growing quickly, and it's on the radar of any digitally savvy young professionals in the U.S. making their first foray into managing their finances.

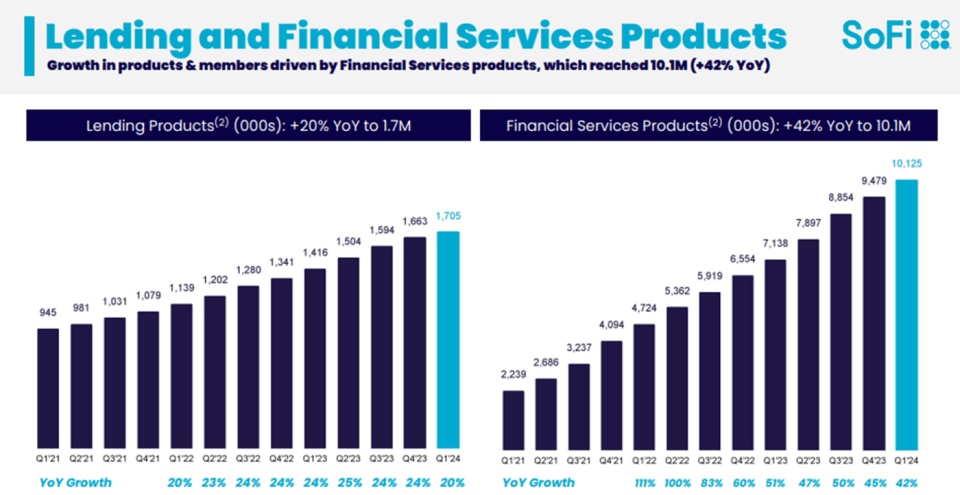

Membership is increasing at breakneck speed. SoFi added more than 600,000 new members in the first quarter for a total of more than 8 million, or a 44% increase year over year. The company is benefiting from growth in membership plus increased engagement, and products sold increased 38% over last year to nearly 12 million.

Satisfied customers are shelling out more money to buy more of its products, and that's leading to scale and profitability. Management reported its first quarter of positive net income as a public company in the 2023 fourth quarter, and it's expecting that to continue in 2024.

SoFi operates three segments: lending, which is its core business; its technology platform, a white-label fintech platform for business clients; and its personal financial services products outside of lending.

Product adoption increased for all of these segments in the first quarter, and it continues to grow steadily. But financial services have been the standout recently, increasing 42% year over year in the first quarter.

The pivot to an expanded business is bringing high growth and helping generate profits.

Investors are getting cold feet

So far, so good. But what's making investors nervous these days is the pressure in the lending segment. This is SoFi's main business, and revenue in the segment decreased 2% year over year in the first quarter.

Loan originations increased in all of its categories, but it was slower growth overall. Management says that it's taking a conservative approach to lending considering the high interest rates and risk of default.

But the market was looking for a more aggressive approach to this business and for SoFi to capitalize on its strengths. It has growing deposits and a strong balance sheet, with a record $3 billion increase in deposits for a total of $21.6 billion.

At the same time, its large loan book makes it susceptible to defaults, which is also a worry. Some other things that might have spooked investors in the most recent update were converting some debt into stock, which dilutes the shares, and a sale of late-stage delinquent loans, which could imply trouble with delinquencies.

In other words, there were several updates in the quarter that in and of themselves might not have been incredibly worrisome, but when taken all together create a picture with added risk.

Is SoFi stock a bargain or a value trap?

At its lower price, the stock trades at a forward price-to-earnings ratio of 34, which is cheap for a high growth stock. But it's only a bargain if SoFi shares can rebound.

I think the company's positive updates outweigh the negative ones. It has a great product that customers like, which is the most important feature of any business, and it's becoming profitable, which is arguably the second most-important feature. It's managing through a fairly difficult time while still demonstrating these attributes, even though it's not a smooth ride right now.

At this low price, SoFi stock looks like a bargain. It reports second-quarter earnings on July 30, and investors should pay attention to how its managing risk in its lending business.

Should you invest $1,000 in SoFi Technologies right now?

Before you buy stock in SoFi Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoFi Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $692,784!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 29, 2024

Jennifer Saibil has positions in SoFi Technologies. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Should You Buy SoFi Stock While It's Below $8? was originally published by The Motley Fool