The stock market is filled with mystery. One stock that consistently piques my curiosity is financial services and banking platform SoFi (NASDAQ: SOFI).

Over the last few years SoFi has managed to disrupt the financial services industry by aggressively acquiring customers -- particularly in the desirable Gen Z and millennial demographics.

The company's second-quarter earnings demonstrated that management's growth plan continues to take shape. And yet despite this growth, it seems like investors are souring on the stock -- sending shares down roughly 3% as of the time of this article. Although this might not seem like much, it adds to the 28% decline so far in 2024.

Let's take a look at SoFi's business and assess if now is an opportunity to buy the dip, and determine if the negative investor sentiment is warranted.

Another great performance

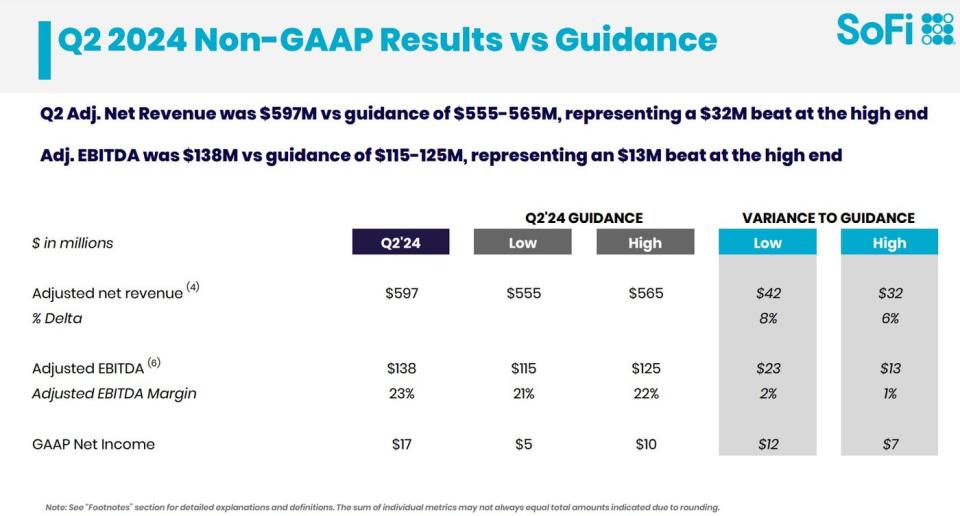

SoFi recently reported earnings for its second quarter ended June 30. As the figures in the table below indicate, SoFi outperformed its guidance across several important financial metrics.

On the surface, beating the high end of your guidance across both revenue and profits should be celebrated.

However, a closer look at SoFi's detailed financial breakdown indicates where the company is currently generating its growth. By examining the individual segments of SoFi's entire business, investors can get a better idea of what may be concerning to Wall Street and has influenced a sell-off in the stock.

A closer look at the financials

SoFi breaks down its business into three core segments: lending, technology, and financial services.

For the quarter ended June 30, SoFi's technology group generated $95 million in revenue -- an increase of 9% year over year. Furthermore, the financial services segment rose 80% year over year to $176 million.

All good, right? Well, as the figures above indicate, financial services and technology operations only account for about 45% of SoFi's entire business. This implies that the bulk of SoFi's revenue stems from lending, and that deserves a close look as well.

During the second quarter, SoFi's lending revenue increased by 5% year over year to $339 million. While this was a modest improvement over the lending segment's first +iquarter performance, it doesn't exactly inspire a lot of confidence.

Clearly, SoFi's growth is protracted as the moment, and most of the deceleration stems from its core operation. Although this may imply that SoFi is a business in decline, I'd encourage investors to keep the long-term picture intact.

Think about the long term

There are two sides to SoFi. First, the company is very much a bank that offers traditional lending products such as student and business loans as well as mortgages. But at a deeper level, the company is disrupting financial services by building a tech-enabled product as opposed to opening brick-and-mortar bank locations.

This is an important dynamic to understand, because there are a lot of factors that can impact SoFi's growth prospects today and in the future.

For example, the current state of the macroeconomy is somewhat of an enigma. Inflation is showing signs of cooling down, which in theory should encourage consumers to go out and spend. But yet interest rates remain elevated.

The combination of lingering inflation and higher-than-usual borrowing costs can take a hefty toll on purchasing power for businesses and consumers. When you account for all of these factors, it's not entirely surprising to see SoFi's lending unit experience a deceleration.

However, smart investors understand that at some point the Federal Reserve will begin to taper rates and the economy will continue to improve. I think investors are massively discounting the bellwether this could be for SoFi's lending services.

The way I see it, SoFi's current performance is more reflective of the broader macro environment and less so of a broken business. As the entire operation becomes more balanced between technology, financial services, and lending, I think the tech-enabled aspect of the business will continue contributing margin expansion and consistent profitability.

For these reasons, I think SoFi is a no-brainer buying opportunity right now. Investors with a long-term horizon should consider taking advantage of the current sell-off and scoop up some shares.

Should you invest $1,000 in SoFi Technologies right now?

Before you buy stock in SoFi Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoFi Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $657,306!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 29, 2024

Adam Spatacco has positions in SoFi Technologies. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

SoFi Just Crushed Earnings. So Why Is the Stock Down? was originally published by The Motley Fool