Grayscale's Ethereum Trust dominates with $458 million in trades.

Photo by Tokenstreet on Unsplash

Key Takeaways

- Grayscale’s Ethereum Trust accounted for nearly half of the Ether ETFs' $1 billion trading volume.

- Ether ETFs reached 20% of the trading volume compared to bitcoin ETFs on launch day.

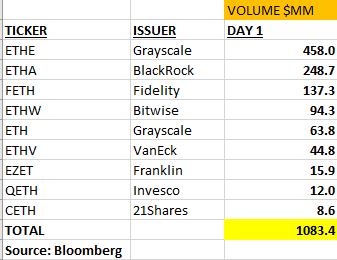

The nine Ethereum ETFs that began trading saw a combined volume of approximately $1.08 billion on their inaugural day. This figure represents about 23% of the $4.5 billion in trading volume observed when spot Bitcoin ETFs launched earlier this year, indicating significant but comparatively tempered interest in the Ethereum offerings.

Grayscale’s Ethereum Trust (ETHE) led the pack with $458 million in volume, accounting for nearly half of the total trading activity. This dominance likely stems from ETHE’s conversion from an existing trust structure, potentially resulting in outflows as some investors rebalance their positions.

BlackRock’s iShares Ethereum Trust (ETHA) followed with $248.7 million in volume, while Fidelity’s offering (FETH) saw $137.3 million traded. The remaining funds each saw less than $100 million in volume, with 21Shares’ product (CETH) recording the lowest at $8.6 million.

It’s crucial to note that trading volume alone does not indicate net inflows or outflows. The figure represents the total value of shares exchanged, encompassing both buying and selling activity. For context, of the $4.5 billion in first-day volume for Bitcoin ETFs, only around $600 million represented actual inflows.

The nature of these trades, whether they reflect long-term investment strategies or short-term arbitrage opportunities, remains unclear at this early stage. Market observers will need more time and data to discern meaningful trends in investor behavior and fund performance.

The launch of Ethereum ETFs marks another significant milestone in the integration of crypto into mainstream financial markets. These products offer investors exposure to Ethereum’s price movements without the complexities of direct crypto ownership and storage.

However, the long-term impact and adoption of these ETFs remain to be seen. Factors such as Ethereum’s technological developments, regulatory environment, and overall market conditions will likely influence their performance and popularity among investors.

As the market matures, it will be interesting to observe how trading volumes and inflows for Ethereum ETFs compare to their Bitcoin counterparts over time. This data will provide valuable insights into investor preferences and the evolving landscape of cryptocurrency-based financial products.