Tether's USDT approaches $120b market cap, while PayPal's PYUSD surpasses $620m within its first year.

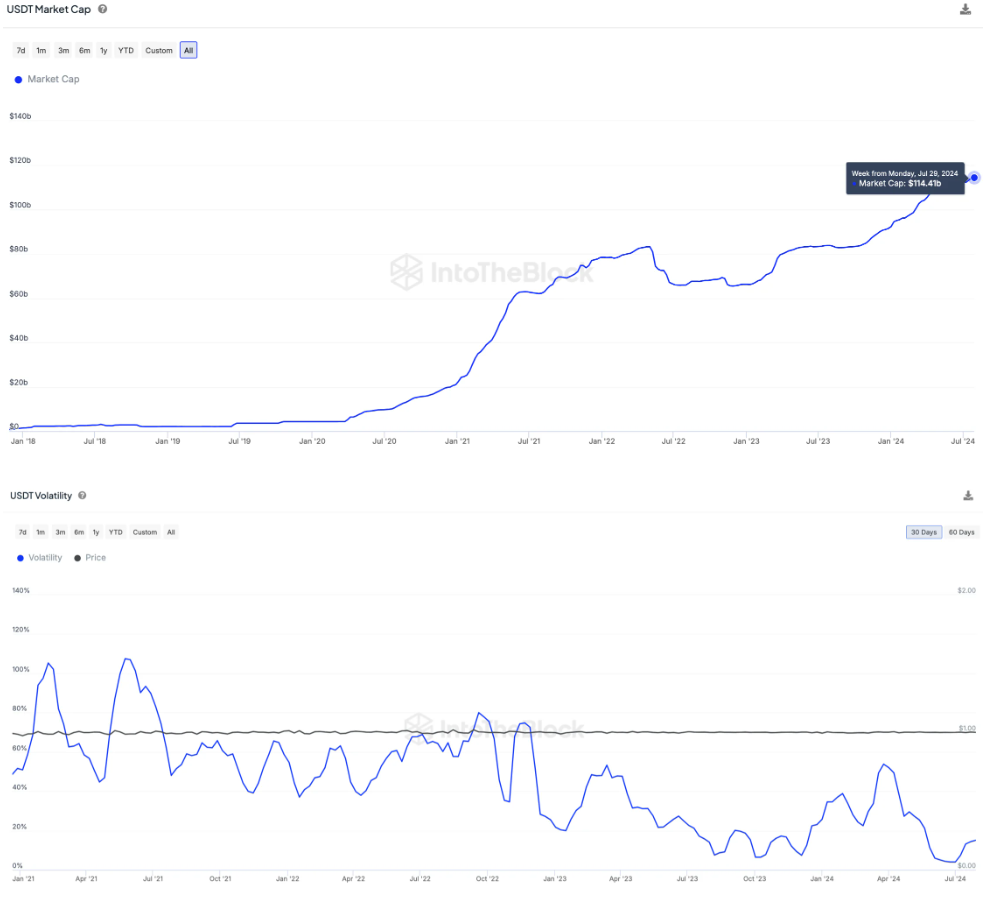

Tether’s USDT has propelled the stablecoin market to over $160 billion in value, its highest point since the collapse of Terra’s UST. According to IntoTheBlock, USDT now comprises over 70% of the stablecoin market, maintaining this dominance throughout 2024. The stablecoin has also recorded all-time low volatility in July, despite broader market retractions.

USDT’s on-chain metrics show significant growth, with over 18 million weekly transactions on Ethereum Virtual Machine-compatible chains alone. The Tron network handles 78% of these transactions, becoming the preferred platform for USDT transfers.

Notably, USDT surpassed Circle’s USD Coin (USDC) in monthly transfer volume for the first time in 2024, according to data from Artemis. In July, Tether’s stablecoin reached $721.5 billion in volume, surpassing USDC by 17.7%.

PayPal’s PYUSD has surpassed $620 million in market cap within its first year, contributing to the overall stablecoin market growth. This expansion indicates increased liquidity flowing into the crypto-economy.

Tether has expanded access to US dollars, with 48 million addresses holding USDT. Of these, 84% are on the Tron network, further cementing its position as the dominant platform for USDT transactions.

Moreover, Tether reported a record $5.2 billion profit in the first half of 2024, as USDT approaches a $120 billion market cap.

Despite past controversies, USDT has demonstrated resilience and continues to lead in real-world crypto adoption.